Answered step by step

Verified Expert Solution

Question

1 Approved Answer

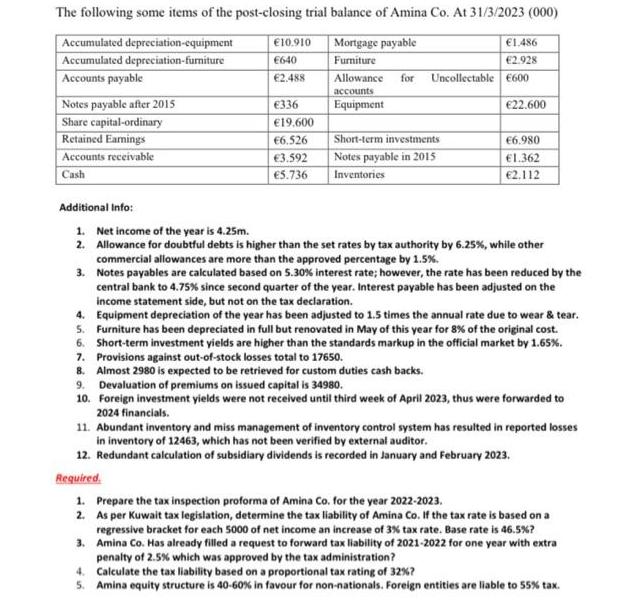

The following some items of the post-closing trial balance of Amina Co. At 31/3/2023 (000) 10.910 Mortgage payable 1.486 Accumulated depreciation-equipment Accumulated depreciation-furniture 640

The following some items of the post-closing trial balance of Amina Co. At 31/3/2023 (000) 10.910 Mortgage payable 1.486 Accumulated depreciation-equipment Accumulated depreciation-furniture 640 Furniture 2.928 Accounts payable 2.488 Allowance for Uncollectable 600 accounts Equipment Notes payable after 2015 Share capital-ordinary Retained Earnings Accounts receivable Cash 336 19.600 6.526 3.592 5.736 Short-term investments Notes payable in 2015 Inventories 22.600 6.980 1.362 2.112 Additional Info: 1. Net income of the year is 4.25m. 2. Allowance for doubtful debts is higher than the set rates by tax authority by 6.25%, while other commercial allowances are more than the approved percentage by 1.5%. 3. Notes payables are calculated based on 5.30% interest rate; however, the rate has been reduced by the central bank to 4.75% since second quarter of the year. Interest payable has been adjusted on the income statement side, but not on the tax declaration. 4. Equipment depreciation of the year has been adjusted to 1.5 times the annual rate due to wear & tear. 5. Furniture has been depreciated in full but renovated in May of this year for 8% of the original cost. Short-term investment yields are higher than the standards markup in the official market by 1.65%. Provisions against out-of-stock losses total to 17650. 6. 7. 8. Almost 2980 is expected to be retrieved for custom duties cash backs. 9. Devaluation of premiums on issued capital is 34980. 10. Foreign investment yields were not received until third week of April 2023, thus were forwarded to 2024 financials. 11. Abundant inventory and miss management of inventory control system has resulted in reported losses in inventory of 12463, which has not been verified by external auditor. 12. Redundant calculation of subsidiary dividends is recorded in January and February 2023. Required. 1. Prepare the tax inspection proforma of Amina Co. for the year 2022-2023. 2. As per Kuwait tax legislation, determine the tax liability of Amina Co. If the tax rate is based on a regressive bracket for each 5000 of net income an increase of 3% tax rate. Base rate is 46.5 % ? 3. Amina Co. Has already filled a request to forward tax liability of 2021-2022 for one year with extra penalty of 2.5% which was approved by the tax administration? 4. Calculate the tax liability based on a proportional tax rating of 32%? 5. Amina equity structure is 40-60% in favour for non-nationals. Foreign entities are liable to 55% tax.

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 Tax Inspection Proforma of Amina Co for the year 20222023 Item Amount Adjusted Amount Net Income 4250000 Depreciation Equipment 16950 Depreciation F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started