Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following spot exchange rates are being quoted in the foreign exchange markets by the Nigerian branch of Barclays bank, involving the Ghanaian Cedi

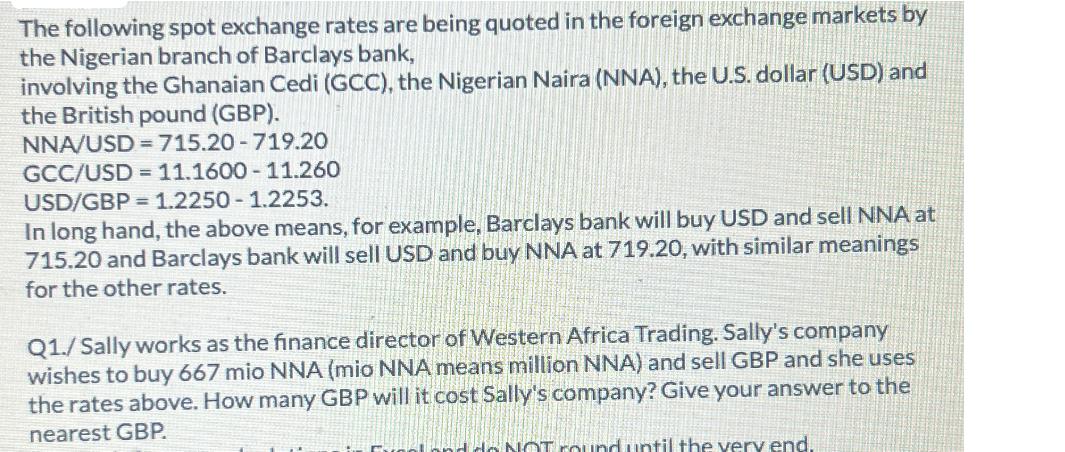

The following spot exchange rates are being quoted in the foreign exchange markets by the Nigerian branch of Barclays bank, involving the Ghanaian Cedi (GCC), the Nigerian Naira (NNA), the U.S. dollar (USD) and the British pound (GBP). NNA/USD = 715.20-719.20 GCC/USD = 11.1600 - 11.260 USD/GBP = 1.2250-1.2253. In long hand, the above means, for example, Barclays bank will buy USD and sell NNA at 715.20 and Barclays bank will sell USD and buy NNA at 719.20, with similar meanings for the other rates. Q1./Sally works as the finance director of Western Africa Trading. Sally's company wishes to buy 667 mio NNA (mio NNA means million NNA) and sell GBP and she uses the rates above. How many GBP will it cost Sally's company? Give your answer to the nearest GBP. land do NOT round until the very end.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started