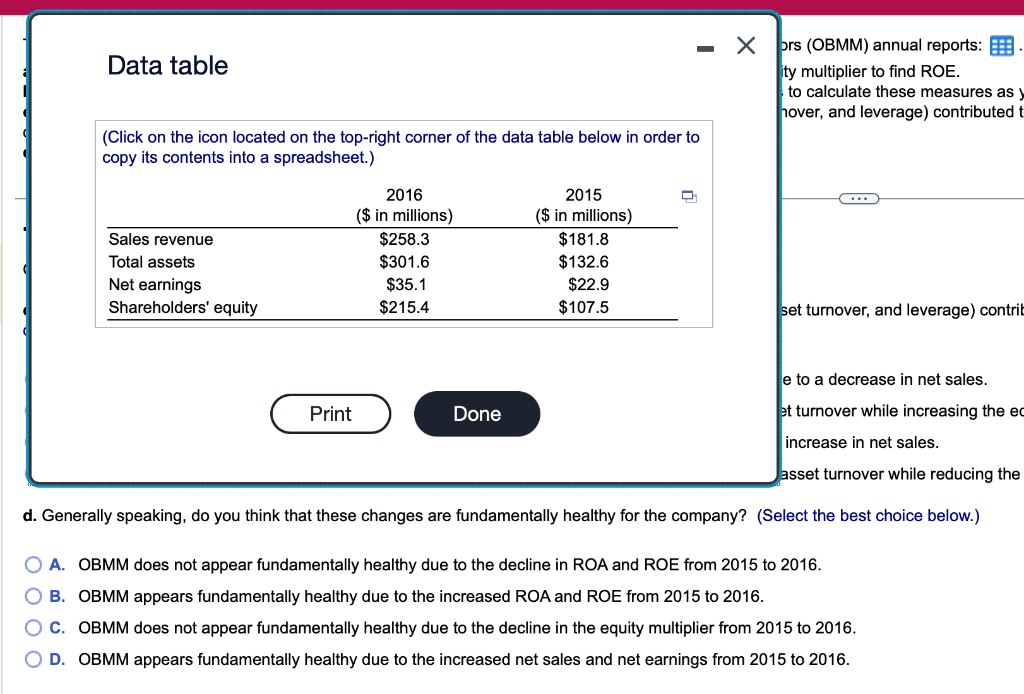

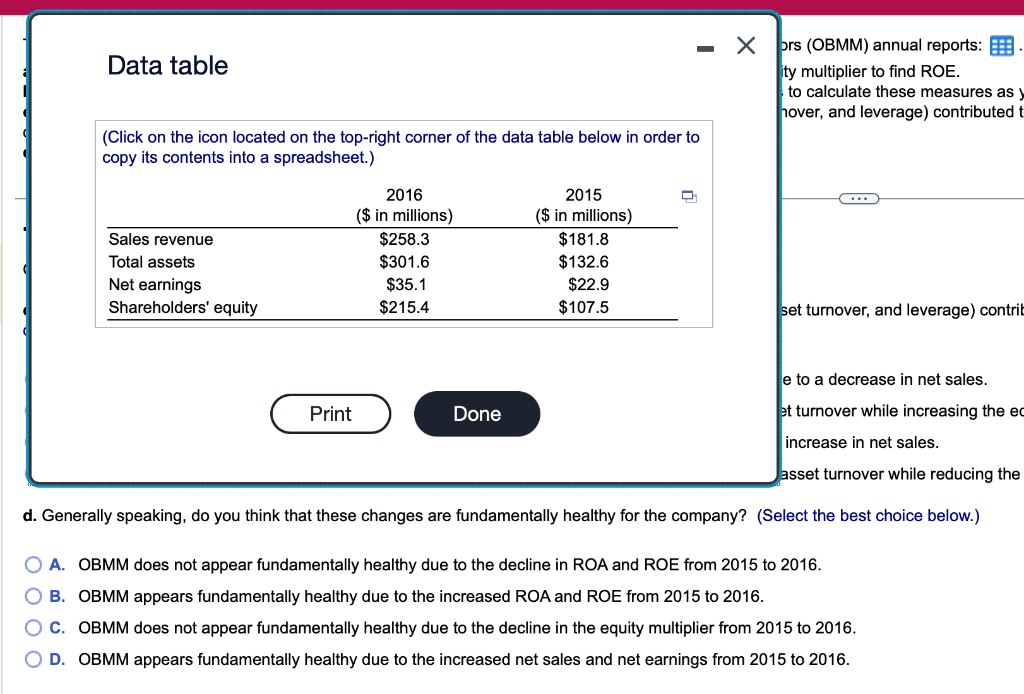

The following summary financial statistics were obtained from the 2015 and 2016 Otago Bay Marine Motors (OBMM) annual reports: a. Use the profit margin and asset turnover to compute the 2015ROA for OBMM. Now introduce the equity multiplier to find ROE. b. Use the summary financial information to compute the 2016ROA and ROE. Use the same procedures to calculate these measures as you did in part a. contributed the most to the change in ROA? Which contributed the most to the change in ROE? d. Generally speaking, do you think that these changes are fundamentally healthy for the company? a. OBMM's 2015 ROA is 1%. (Round to two decimal places.) OBMM's 2015 ROE is [ (Round to two decimal places.) b. OBMM's 2016ROA is %. (Round to two decimal places.) OBMM's 2016 ROE is %. (Round to two decimal places.) choice below.) A. The ROA declined through an increase in shareholders' equity, while the ROE declined mainly due to a decrease in net sales. B. Both ROA and ROE declined due to a sharp increase in total assets, which reduced the total asset turnover while increasing the C. The ROA declined through an increase in total assets, while the ROE increased mainly due to an increase in net sales. D. Both ROA and ROE increased due to a sharp decrease in total assets, which increased the total asset turnover while reducing the equity multiplier. d. Generally speaking, do you think that these changes are fundamentally healthy for the company? (Select the best choice below.) Data table ors (OBMM) annual reports: ty multiplier to find ROE. to calculate these measures as hover, and leverage) contributed t (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) e to a decrease in net sales. to turnover while increasing the ec increase in net sales. asset turnover while reducing the d. Generally speaking, do you think that these changes are fundamentally healthy for the company? (Select the best choice below.) A. OBMM does not appear fundamentally healthy due to the decline in ROA and ROE from 2015 to 2016. B. OBMM appears fundamentally healthy due to the increased ROA and ROE from 2015 to 2016. C. OBMM does not appear fundamentally healthy due to the decline in the equity multiplier from 2015 to 2016 . D. OBMM appears fundamentally healthy due to the increased net sales and net earnings from 2015 to 2016