Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following summary transactions occurred during 2024 for Bluebonnet Bakers: Cash Received from: Collections from customers $ 380,000 Interest on notes receivable 6,000 Collection of

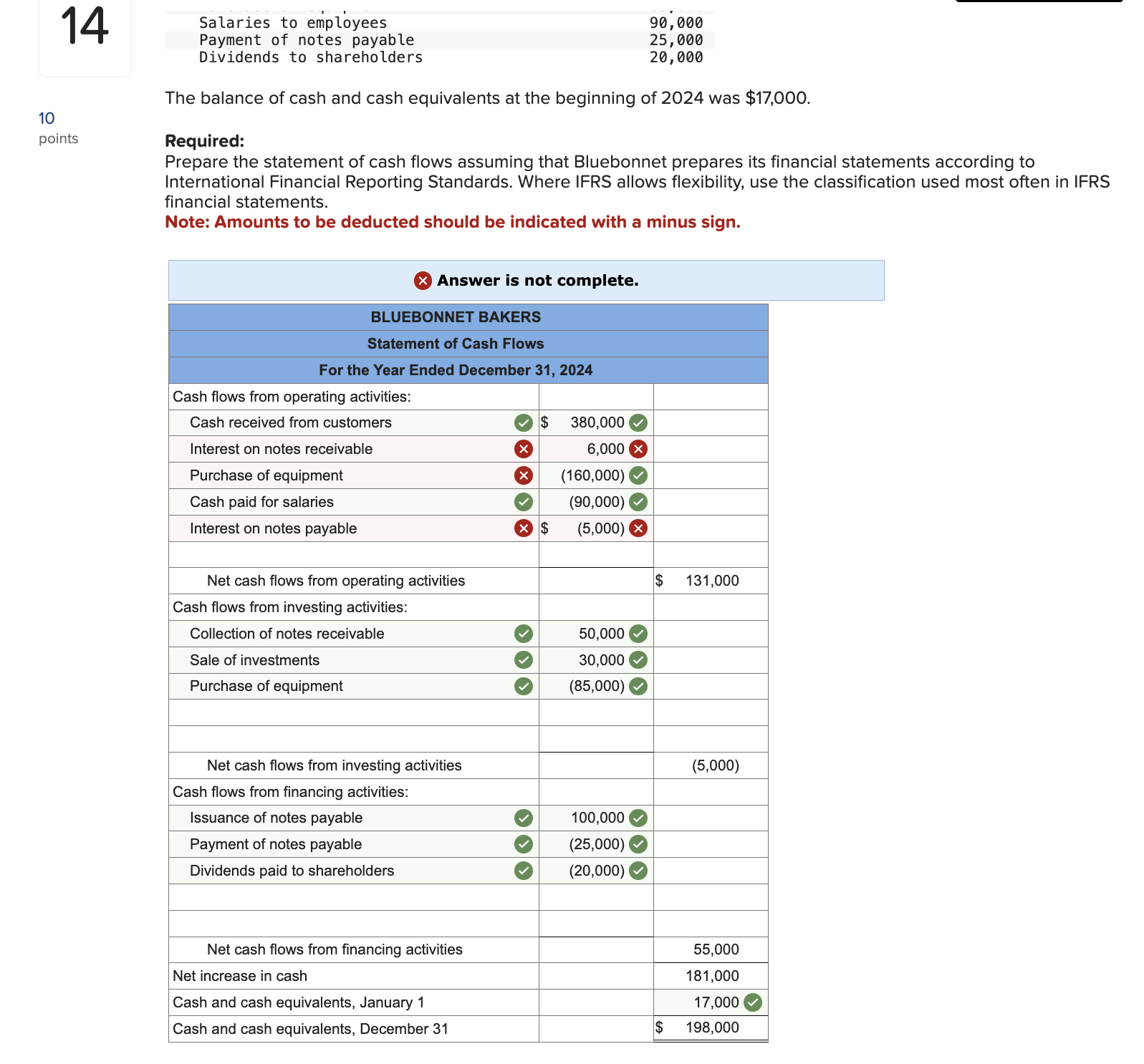

The following summary transactions occurred during 2024 for Bluebonnet Bakers:

| Cash Received from: | |

|---|---|

| Collections from customers | $ 380,000 |

| Interest on notes receivable | 6,000 |

| Collection of notes receivable | 50,000 |

| Sale of investments | 30,000 |

| Issuance of notes payable | 100,000 |

| Cash Paid for: | |

| Purchase of inventory | 160,000 |

| Interest on notes payable | 5,000 |

| Purchase of equipment | 85,000 |

| Salaries to employees | 90,000 |

| Payment of notes payable | 25,000 |

| Dividends to shareholders | 20,000 |

The balance of cash and cash equivalents at the beginning of 2024 was $17,000.

Required:

Prepare the statement of cash flows assuming that Bluebonnet prepares its financial statements according to International Financial Reporting Standards. Where IFRS allows flexibility, use the classification used most often in IFRS financial statements.

Note: Amounts to be deducted should be indicated with a minus sign.

The balance of cash and cash equivalents at the beginning of 2024 was $17,000. Required: Prepare the statement of cash flows assuming that Bluebonnet prepares its financial statements according to International Financial Reporting Standards. Where IFRS allows flexibility, use the classification used most often in IFRS financial statements. Note: Amounts to be deducted should be indicated with a minus sign. The balance of cash and cash equivalents at the beginning of 2024 was $17,000. Required: Prepare the statement of cash flows assuming that Bluebonnet prepares its financial statements according to International Financial Reporting Standards. Where IFRS allows flexibility, use the classification used most often in IFRS financial statements. Note: Amounts to be deducted should be indicated with a minus sign

The balance of cash and cash equivalents at the beginning of 2024 was $17,000. Required: Prepare the statement of cash flows assuming that Bluebonnet prepares its financial statements according to International Financial Reporting Standards. Where IFRS allows flexibility, use the classification used most often in IFRS financial statements. Note: Amounts to be deducted should be indicated with a minus sign. The balance of cash and cash equivalents at the beginning of 2024 was $17,000. Required: Prepare the statement of cash flows assuming that Bluebonnet prepares its financial statements according to International Financial Reporting Standards. Where IFRS allows flexibility, use the classification used most often in IFRS financial statements. Note: Amounts to be deducted should be indicated with a minus sign Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started