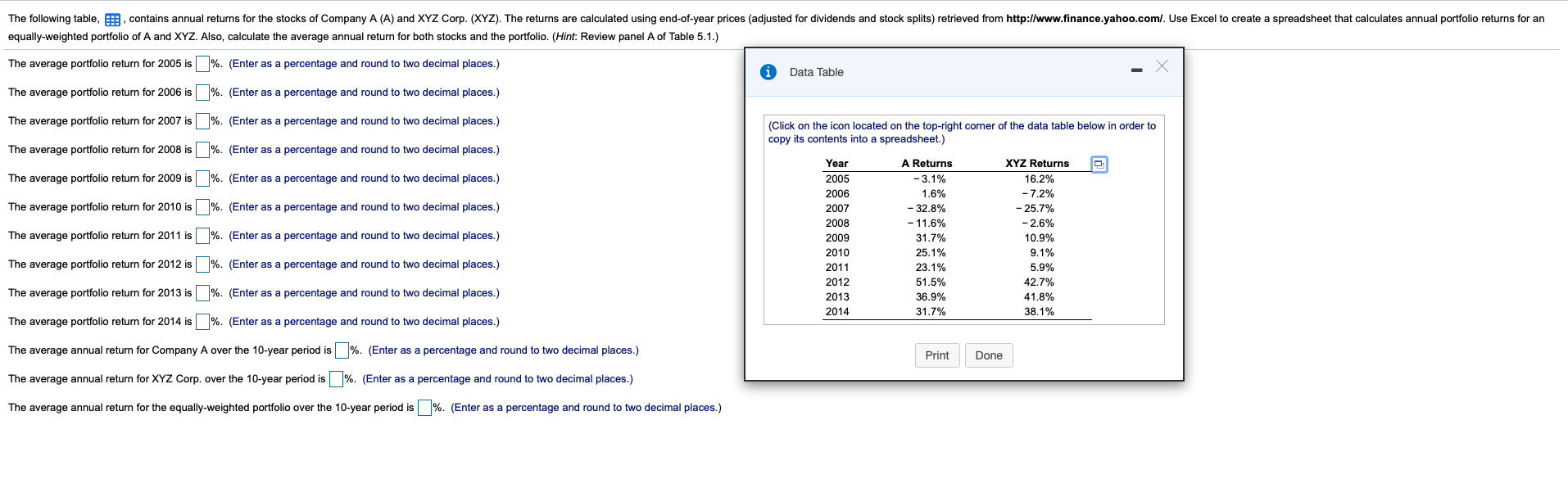

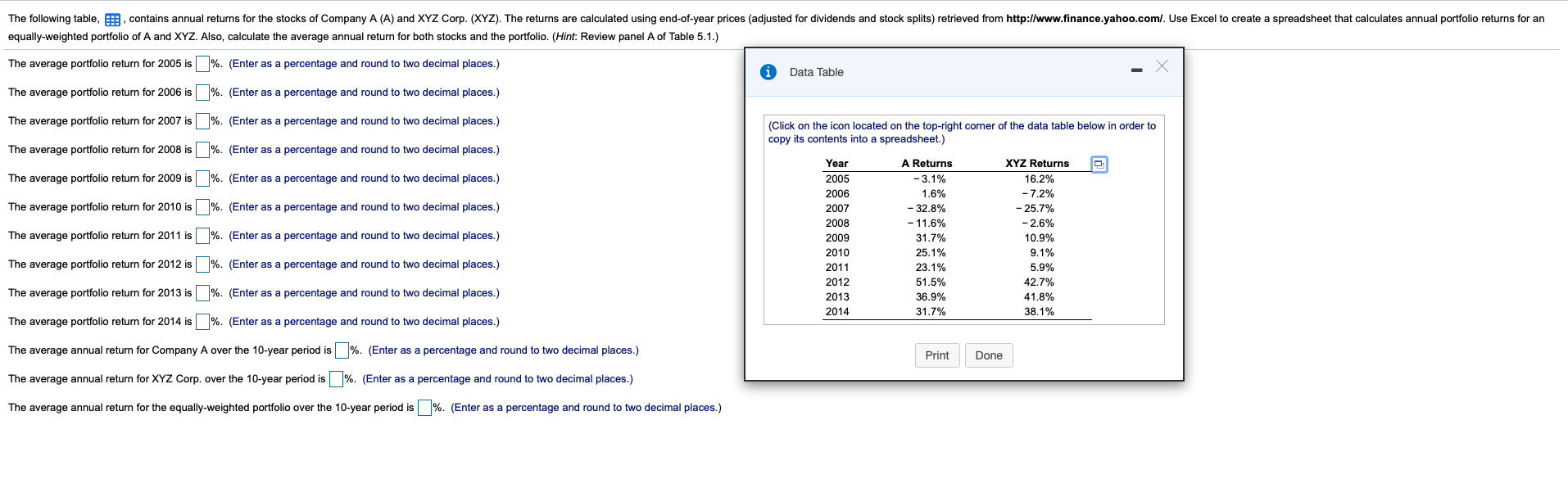

The following table, contains annual returns for the stocks of Company A (A) and XYZ Corp. (XYZ). The returns are calculated using end-of-year prices (adjusted for dividends and stock splits) retrieved from http://www.finance.yahoo.com/. Use Excel to create a spreadsheet that calculates annual portfolio returns for an equally-weighted portfolio of A and XYZ. Also, calculate the average annual return for both stocks and the portfolio. (Hint: Review panel A of Table 5.1.) The average portfolio return for 2005 is %. (Enter as a percentage and round to two decimal places.) Data Table The average portfolio return for 2006 is %. (Enter as a percentage and round to two decimal places.) The average portfolio return for 2007 is %. (Enter as a percentage and round to two decimal places.) (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) The average portfolio return for 2008 is %. (Enter as a percentage and round to two decimal places.) The average portfolio return for 2009 is%. (Enter as a percentage and round to two decimal places.) The average portfolio return for 2010 is %. (Enter as a percentage and round to two decimal places.) The average portfolio return for 2011 is %. (Enter as a percentage and round to two decimal places.) Year 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 A Returns -3.1% 1.6% - 32.8% - 11.6% 31.7% 25.1% 23.1% 51.5% 36.9% 31.7% XYZ Returns 16.2% - 7.2% - 25.7% - 2.6% 10.9% 9.1% 5.9% 42.7% 41.8% 38.1% The average portfolio return for 2012 is %. (Enter as a percentage and round to two decimal places.) The average portfolio return for 2013 is %. (Enter as a percentage and round to two decimal places.) The average portfolio return for 2014 is %. (Enter as a percentage and round to two decimal places.) The average annual return for Company A over the 10-year period is %. (Enter as a percentage and round to two decimal places.) Print Done average annual retu XYZ Corp. over 10-year period is %. (Enter as a percentage round decimal places.) The average annual return for the equally-weighted portfolio over the 10-year period is %. (Enter as a percentage and round to two decimal places.)