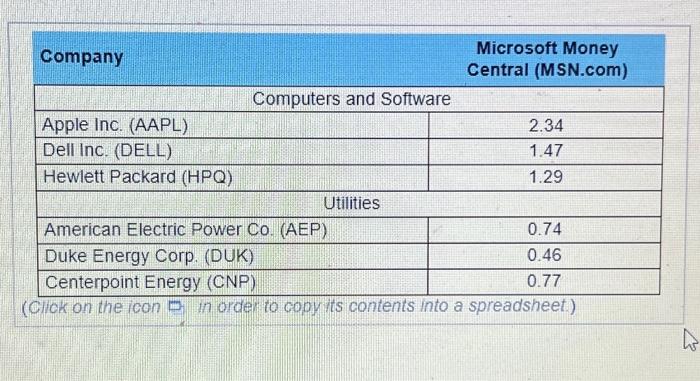

The following table contains beta coefficient estimates for six firms. Calculate the expected increase in the value of each firm's shares if the market

The following table contains beta coefficient estimates for six firms. Calculate the expected increase in the value of each firm's shares if the market portfolio were to increase by 10 percent. Perform the same calculation where the market drops by 10 percent. Which set of firms has the most variable or volatile stock returns? Company Apple Inc. (AAPL) Dell Inc. (DELL) Hewlett Packard (HPQ) Computers and Software Utilities Microsoft Money Central (MSN.com) 2.34 1.47 1.29 American Electric Power Co. (AEP) Duke Energy Corp. (DUK) Centerpoint Energy (CNP) (Click on the icon in order to copy its contents into a spreadsheet.) 0.74 0.46 0.77

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the expected increase and decrease in the value of each firms shares if the market port...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started