Answered step by step

Verified Expert Solution

Question

1 Approved Answer

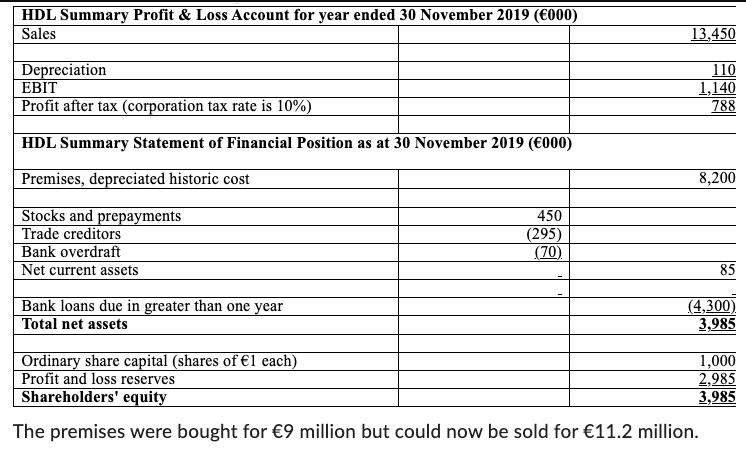

Calculate a per share valuation of HDL based on book values (insert your answer in the format X.XXX per share). HDL Summary Profit &

Calculate a per share valuation of HDL based on book values (insert your answer in the format X.XXX per share). HDL Summary Profit & Loss Account for year ended 30 November 2019 (000) Sales Depreciation EBIT Profit after tax (corporation tax rate is 10%) HDL Summary Statement of Financial Position as at 30 November 2019 (000) Premises, depreciated historic cost Stocks and prepayments Trade creditors Bank overdraft Net current assets Bank loans due in greater than one year Total net assets 450 (295) (70) 13,450 110 1,140 788 8,200 Ordinary share capital (shares of 1 each) Profit and loss reserves Shareholders' equity The premises were bought for 9 million but could now be sold for 11.2 million. 85 (4,300) 3,985 1,000 2,985 3,985

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The financial information provided relates to HDL for the year ended November 30 2019 and its financ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started