Answered step by step

Verified Expert Solution

Question

1 Approved Answer

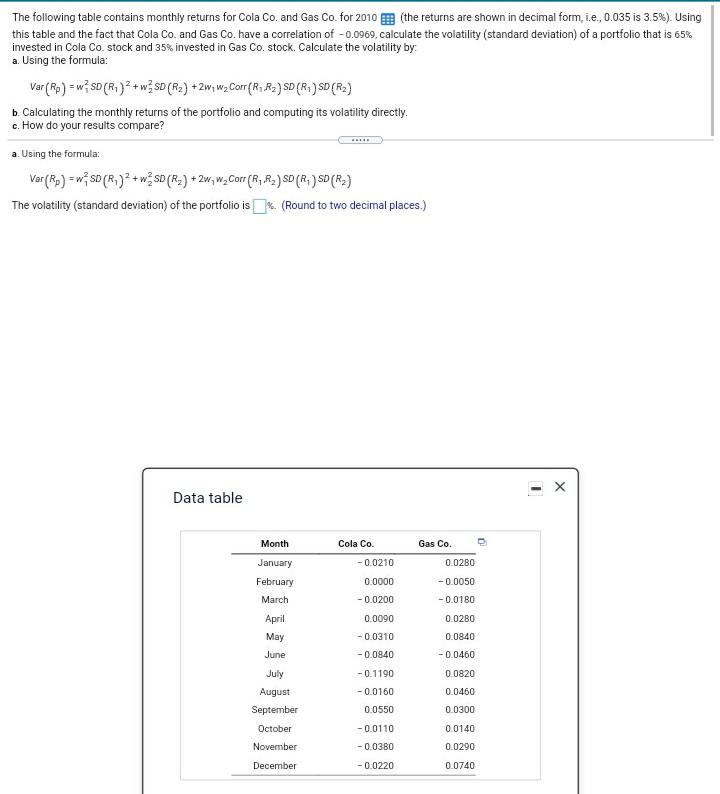

The following table contains monthly returns for Cola Co. and Gas Co. for 2010 (the returns are shown in decimal form, i.e., 0.035 is 3.5%).

The following table contains monthly returns for Cola Co. and Gas Co. for 2010 (the returns are shown in decimal form, i.e., 0.035 is 3.5%). Using this table and the fact that Cola Co. and Gas Co. have a correlation of -0.0969, calculate the volatility (standard deviation) of a portfolio that is 65% invested in Cola Co. stock and 35% invested in Gas Co. stock. Calculate the volatility by: a. Using the formula: Var (Rp) = w;SD (R1) 2 + wSD (R2) +2W, W2 Corr (R, Rz) SD (R4 ) SD (R2) b. Calculating the monthly returns of the portfolio and computing its volatility directly. c. How do your results compare? a. Using the formula: Ver (Ro) = w;SD (R.) 2 + w SD (R3) +2w,w.cort (R, R.) 50 (R, ) SD (R2) The volatility (standard deviation) of the portfolio is %(Round to two decimal places.) -X Data table Month Cola Co. Gas Co. 0 -0.0210 0.0280 0.0000 -0.0050 -0.0180 -0.0200 January February March April May June 0.0280 0.0090 -0.0310 -0.0840 -0.1190 0.0840 -0.0460 0.0820 -0.0160 0.0460 July August September October November 0.0550 0.0300 -0.0110 -0.0380 0.0140 0.0290 December -0.0220 0.0740

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started