Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following table contains monthly returns for Cola Co. and Gas Co. for 2013 (the returns are shown in decimal form, i.e., 0.035 is

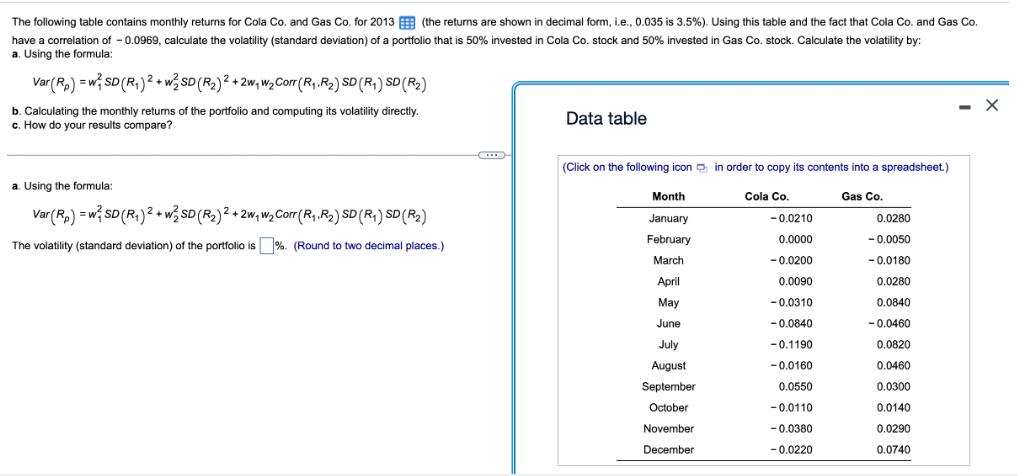

The following table contains monthly returns for Cola Co. and Gas Co. for 2013 (the returns are shown in decimal form, i.e., 0.035 is 3.5%). Using this table and the fact that Cola Co. and Gas Co. have a correlation of -0.0969, calculate the volatility (standard deviation) of a portfolio that is 50% invested in Cola Co. stock and 50% invested in Gas Co. stock. Calculate the volatility by: a. Using the formula: Var (Rp) = w SD (R)+w2 SD (R2) + 2w w Corr (R.R) SD (R) SD (R2) b. Calculating the monthly returns of the portfolio and computing its volatility directly. c. How do your results compare? Data table - X a. Using the formula: Var()()}, SD (M) + 2w, wy Car (R, A) SD (R) SD (R) The volatility (standard deviation) of the portfolio is %. (Round to two decimal places.) (Click on the following icon in order to copy its contents into a spreadsheet.) Cola Co. -0.0210 Month Gas Co. January 0.0280 February 0.0000 -0.0050 March -0.0200 -0.0180 April 0.0090 0.0280 May -0.0310 0.0840 June -0.0840 -0.0460 July -0.1190 0.0820 August -0.0160 0.0460 September 0.0550 0.0300 October -0.0110 0.0140 November -0.0380 0.0290 December -0.0220 0.0740

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started