Answered step by step

Verified Expert Solution

Question

1 Approved Answer

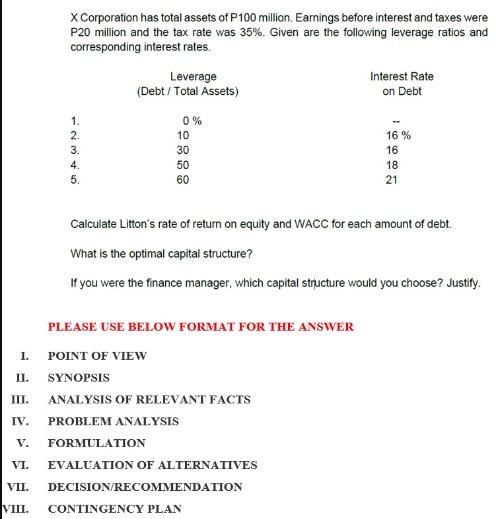

X Corporation has total assets of P100 million. Earnings before interest and taxes were P20 million and the tax rate was 35%. Given are

X Corporation has total assets of P100 million. Earnings before interest and taxes were P20 million and the tax rate was 35%. Given are the following leverage ratios and corresponding interest rates. Leverage (Debt/ Total Assets) 12345 1. 0% 2. 10 3. 30 4. 5. 50 60 Interest Rate on Debt 16% 16 18 21 Calculate Litton's rate of return on equity and WACC for each amount of debt. What is the optimal capital structure? If you were the finance manager, which capital structure would you choose? Justify. PLEASE USE BELOW FORMAT FOR THE ANSWER I. POINT OF VIEW II. SYNOPSIS III. ANALYSIS OF RELEVANT FACTS IV. PROBLEM ANALYSIS V. FORMULATION VI. EVALUATION OF ALTERNATIVES VII. DECISION/RECOMMENDATION VIII. CONTINGENCY PLAN

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

I POINT OF VIEW As the finance manager of X Corporation I am tasked with determining the optimal cap...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started