Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following table contains the historic returns from a portfolio consisting of large stocks and a portfolio consisting of long - term Treasury bonds over

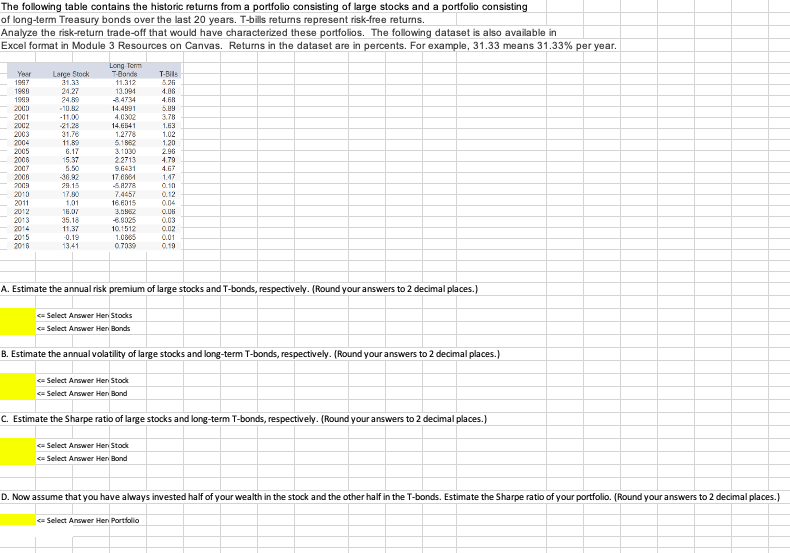

The following table contains the historic returns from a portfolio consisting of large stocks and a portfolio consisting

of longterm Treasury bonds over the last years. Tbills returns represent riskfree returns.

Analyze the riskreturn tradeoff that would have characterized these portfolios. The following dataset is also available in

Excel format in Module Resources on Canvas. Returns in the dataset are in percents. For example, means per year.

A Estimate the annual risk premium of large stocks and Tbonds, respectively. Round your answers to decimal places.

B Estimate the annual volatility of large stocks and longterm Tbonds, respectively. Round your answers to decimal places.

C Estimate the Sharpe ratio of large stocks and longterm Tbonds, respectively. Round your answers to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started