Question

The following table describes how Moodys, credit rating agency, adjusts firms financial statements to capitalise operating leases. Assuming that you try to evaluate the effect

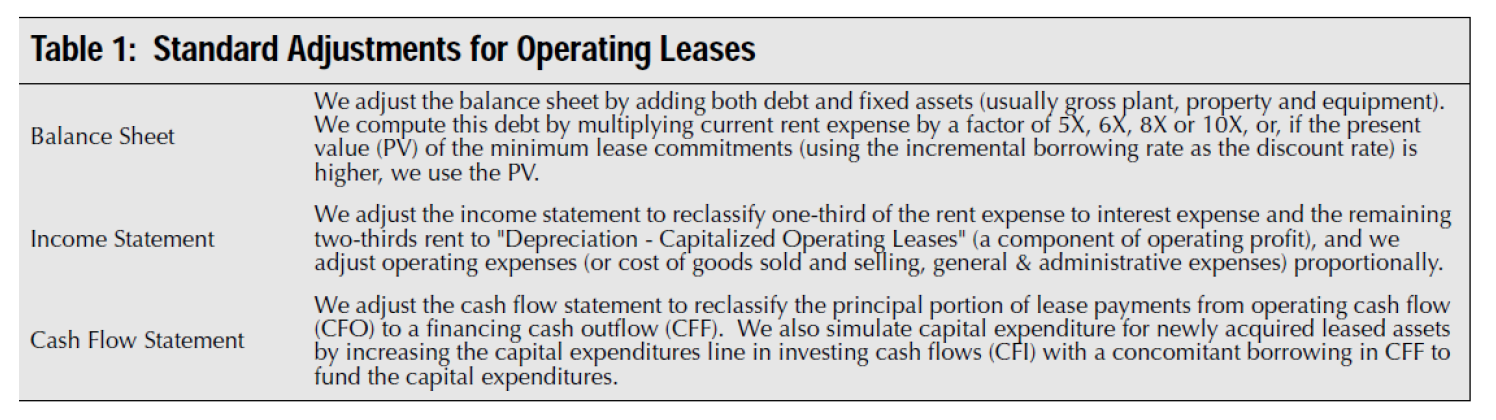

The following table describes how Moodys, credit rating agency, adjusts firms financial statements to capitalise operating leases.

Assuming that you try to evaluate the effect of constructive capitalisation of operating leases on the balance sheets by estimating the present value of operating lease payments (instead of the approach used by Moodys), explain what types of information you can get from firm disclosures and from which parts of financial statements; assumptions that you would need to make; and limitations of such approach to constructive capitalisation.

Table 1: Standard Adjustments for Operating Leases We adjust the balance sheet by adding both debt and fixed assets (usually gross plant, property and equipment). Balance Sheet We compute this debt by multiplying current rent expense by a factor of 5X, 6X, 8X or 10x, or, if the present value (PV) of the minimum lease commitments (using the incremental borrowing rate as the discount rate) is higher, we use the PV. We adjust the income statement to reclassify one-third of the rent expense to interest expense and the remaining Income Statement two-thirds rent to "Depreciation - Capitalized Operating Leases" (a component of operating profit), and we adjust operating expenses (or cost of goods sold and selling, general & administrative expenses) proportionally. We adjust the cash flow statement to reclassify the principal portion of lease payments from operating cash flow Cash Flow Statement (CFO) to a financing cash outflow (CFF). We also simulate capital expenditure for newly acquired leased assets by increasing the capital expenditures line in investing cash flows (CFI) with a concomitant borrowing in CFF to fund the capital expenditures. Table 1: Standard Adjustments for Operating Leases We adjust the balance sheet by adding both debt and fixed assets (usually gross plant, property and equipment). Balance Sheet We compute this debt by multiplying current rent expense by a factor of 5X, 6X, 8X or 10x, or, if the present value (PV) of the minimum lease commitments (using the incremental borrowing rate as the discount rate) is higher, we use the PV. We adjust the income statement to reclassify one-third of the rent expense to interest expense and the remaining Income Statement two-thirds rent to "Depreciation - Capitalized Operating Leases" (a component of operating profit), and we adjust operating expenses (or cost of goods sold and selling, general & administrative expenses) proportionally. We adjust the cash flow statement to reclassify the principal portion of lease payments from operating cash flow Cash Flow Statement (CFO) to a financing cash outflow (CFF). We also simulate capital expenditure for newly acquired leased assets by increasing the capital expenditures line in investing cash flows (CFI) with a concomitant borrowing in CFF to fund the capital expendituresStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started