Answered step by step

Verified Expert Solution

Question

1 Approved Answer

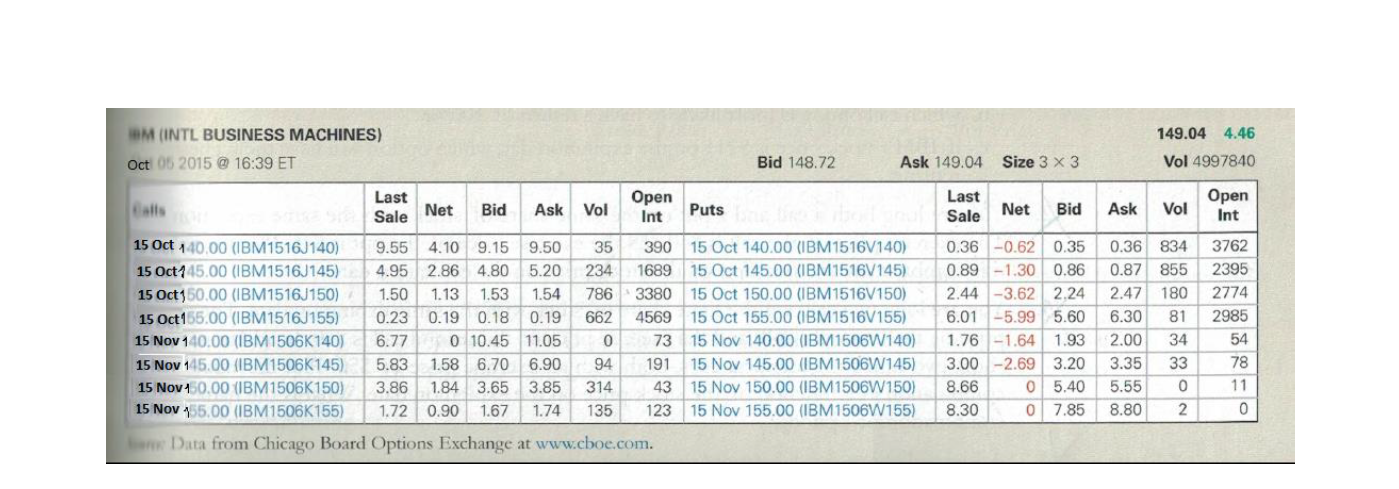

The following table describes the quotes on IBM for options expiring in October and November 2015 : 1) Explain why the last sale price is

The following table describes the quotes on IBM for options expiring in October and November 2015 :

1) Explain why the last sale price is not always between the bid and ask prices.

2)

a. The calls with which strike prices are currently in-the-money? b. Which puts are in-the-money ?

IM (INTL BUSINESS MACHINES) 149.04 4.46 Oct 05 2015 @ 16:39 ET Bid 148.72 Ask 149.04 Size 3 X 3 Vol 4997840 Last Sale Net Bid Ask Vol Open Int + Last Open Balls Sale Net Bid Ask Vol Int Puts 15 Oct 140.00 (BM1516J140) 9.55 4.10 9.15 9.50 35 390 15 Oct 140.00 (IBM1516V140) 15 Oct145.00 (BM1516J145) 4.95 2.86 4.80 5.20 234 1689 15 Oct 145.00 (BM1516V145) 15 Oct150.00 (IBM1516J150) 1.50 1.13 1.53 1.54 786 3380 15 Oct 150.00 (IBM1516V150) 15 Oct155.00 (IBM1516J155) 0.23 0.19 0.18 0.19 662 4569 15 Oct 155.00 (IBM1516V155) 15 Nov 140.00 (IBM1506K140) 6.77 0 10.45 11.05 0 73 15 Nov 140.00 (IBM1506W140) 15 Nov 145.00 (IBM1506K145) 5.83 1.58 6.70 6.90 94 191 15 Nov 145.00 (BM1506W145) 15 Nov 150.00 (BM1506K150) 3.86 1.84 3.65 3.85 314 43 15 Nov 150.00 (BM1506W150) 15 Nov 155.00 (BM1506K155) 1.72 0.90 1.67 1.74 135 123 15 Nov 155.00 (IBM1506W155) Data from Chicago Board Options Exchange at www.cboe.com. 0.36 -0.62 0.35 0.89 -1.30 0.86 2.44 -3.62 2.24 6.01 -5.99 5.60 1.76 -1.64 1.93 3.00 -2.69 3.20 8.66 0 5.40 8.30 0 7.85 0.36 834 0.87 855 2.47 180 6.30 81 2.00 34 3.35 33 5.55 0 8.80 2 3762 2395 2774 2985 54 78 11 0 IM (INTL BUSINESS MACHINES) 149.04 4.46 Oct 05 2015 @ 16:39 ET Bid 148.72 Ask 149.04 Size 3 X 3 Vol 4997840 Last Sale Net Bid Ask Vol Open Int + Last Open Balls Sale Net Bid Ask Vol Int Puts 15 Oct 140.00 (BM1516J140) 9.55 4.10 9.15 9.50 35 390 15 Oct 140.00 (IBM1516V140) 15 Oct145.00 (BM1516J145) 4.95 2.86 4.80 5.20 234 1689 15 Oct 145.00 (BM1516V145) 15 Oct150.00 (IBM1516J150) 1.50 1.13 1.53 1.54 786 3380 15 Oct 150.00 (IBM1516V150) 15 Oct155.00 (IBM1516J155) 0.23 0.19 0.18 0.19 662 4569 15 Oct 155.00 (IBM1516V155) 15 Nov 140.00 (IBM1506K140) 6.77 0 10.45 11.05 0 73 15 Nov 140.00 (IBM1506W140) 15 Nov 145.00 (IBM1506K145) 5.83 1.58 6.70 6.90 94 191 15 Nov 145.00 (BM1506W145) 15 Nov 150.00 (BM1506K150) 3.86 1.84 3.65 3.85 314 43 15 Nov 150.00 (BM1506W150) 15 Nov 155.00 (BM1506K155) 1.72 0.90 1.67 1.74 135 123 15 Nov 155.00 (IBM1506W155) Data from Chicago Board Options Exchange at www.cboe.com. 0.36 -0.62 0.35 0.89 -1.30 0.86 2.44 -3.62 2.24 6.01 -5.99 5.60 1.76 -1.64 1.93 3.00 -2.69 3.20 8.66 0 5.40 8.30 0 7.85 0.36 834 0.87 855 2.47 180 6.30 81 2.00 34 3.35 33 5.55 0 8.80 2 3762 2395 2774 2985 54 78 11 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started