Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following table gives Apple's earnings per share. The common stock, 8.5 million shares outstanding, is now selling for $75.00 per share. The expected

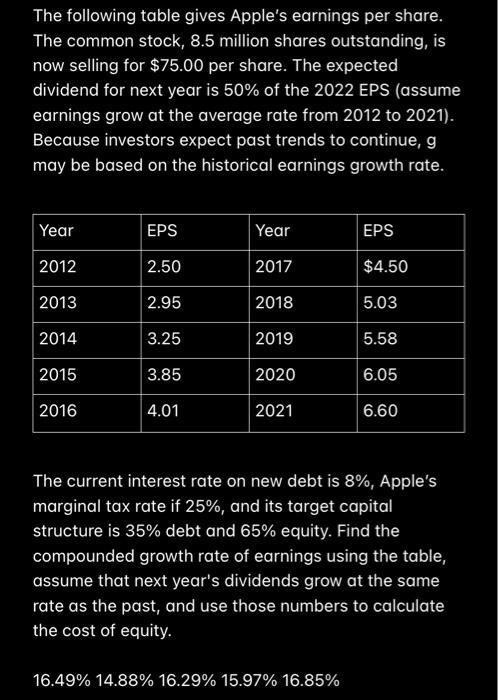

The following table gives Apple's earnings per share. The common stock, 8.5 million shares outstanding, is now selling for $75.00 per share. The expected dividend for next year is 50% of the 2022 EPS (assume earnings grow at the average rate from 2012 to 2021). Because investors expect past trends to continue, g may be based on the historical earnings growth rate. Year EPS Year EPS 2012 2.50 2017 $4.50 2013 2.95 2018 5.03 2014 3.25 2019 5.58 2015 3.85 2020 6.05 2016 4.01 2021 6.60 The current interest rate on new debt is 8%, Apple's marginal tax rate if 25%, and its target capital structure is 35% debt and 65% equity. Find the compounded growth rate of earnings using the table, assume that next year's dividends grow at the same rate as the past, and use those numbers to calculate the cost of equity. 16.49% 14.88% 16.29% 15.97% 16.85%

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Analyzing Accounts Receivable Efficiency Bean Superstore vs Legumes Plus This document analyzes the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started