Question

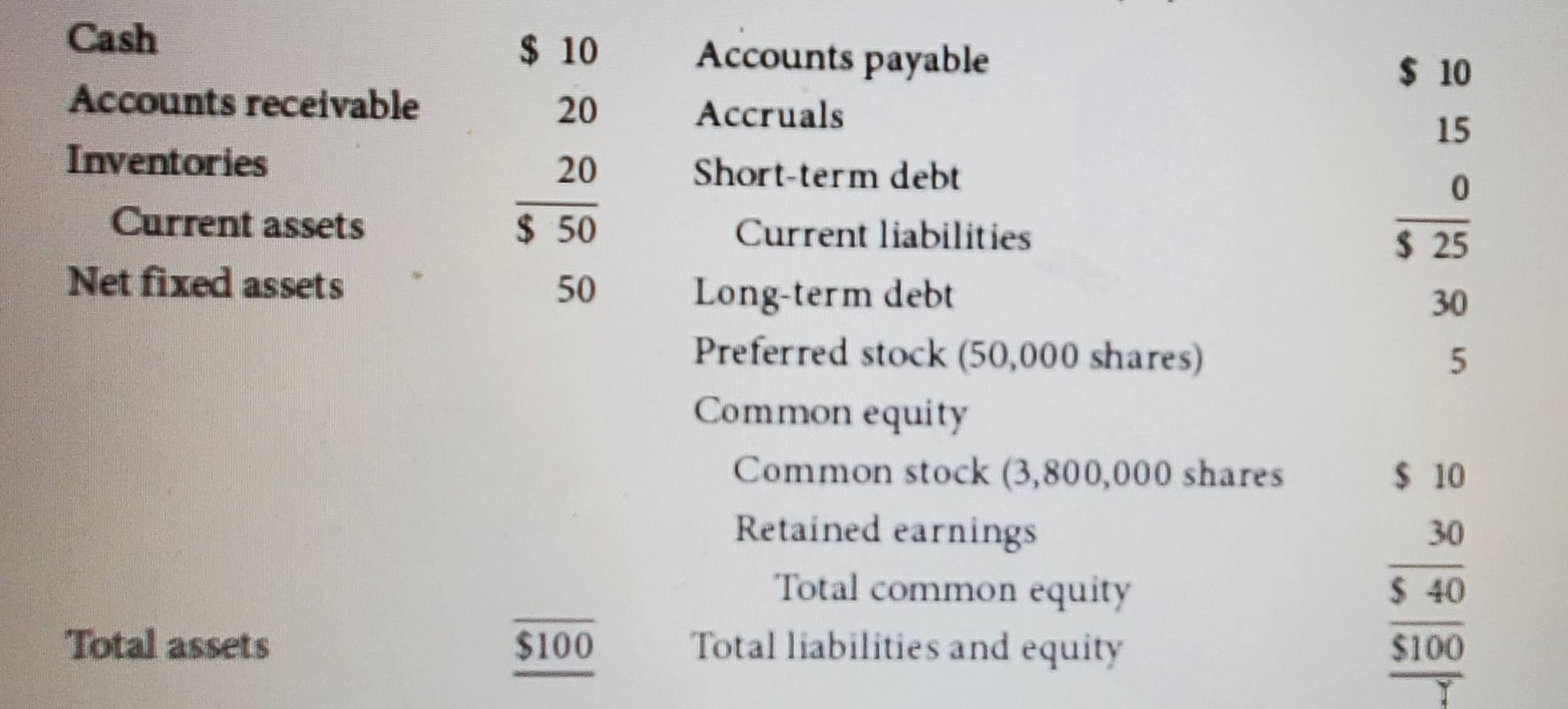

The following table gives the current balance sheet for TravellersInn Inc. (TII), a company that was formed by merging a number of regional motel chains.

The following table gives the current balance sheet for TravellersInn Inc. (TII), a company that was formed by merging a number of regional motel chains. (19)The following facts also apply to TII.

1. The long-term debt consists of 24,000bonds, each having a 20-year maturity, semiannual payments, a coupon rate of 7%(APR),and a face value of $1,000. Currently, these bonds provide investors with a yield to maturity of 6.7% APR. If new bonds were sold, they would have also have a 6.7% yield to maturity.

2. TIIs perpetual preferred stock has a $100 par value, pays a quarterly dividend per share of $2, and has a yield to investors of 8%(APR). New perpetual preferred stock would have to provide the same yield to investors, and the company would incur a 3% flotation cost to sell it.

3. The company has 4million shares of common stock outstanding(ignore the 3,800,000 number in the picture abovein parentheses), aprice per share of $22,a dividend just paid (D0) of $1.50, andan earnings/share just realized (EPS0) of $5. The return on equity (ROE) is expected to be 10%.

4. The stock has a beta of 1.25. The T-bond rate is 3%, andthe risk premium isestimated to be 6%.

5. TIIs financial vice president recently polled some pension fund investment managers who hold TIIs securities regarding what minimum rate of return on TIIs common stock would make them willing to buy common stockrather than TII bonds, given that the bonds yielded 6.7%. The responses suggest a risk premium of TII bonds + 2.8%

6.TII is in the 23% federal-plus-state tax bracket.

Assume that you were recently hired by TII as a financial analyst and that your boss, the treasurer, has asked you to estimate the companys WACC under the assumption that no new equity will be issued. Your cost of capital should be appropriate for use in evaluating projects that are in the same risk class as the assets TII now operates. Based on your analysis, answer the following questions.

What are the current market value weights for debt, preferred stock, and common stock? (Hint:Do your work in dollars, not millions of dollars. When you calculate the market values of debt and preferred stock, be sure to round the market price per bond and the market price per share of preferred to the nearest penny.)

$ 10 $ 10 20 15 Cash Accounts receivable Inventories Current assets Net fixed assets 20 0 $ 50 $ 25 50 30 Accounts payable Accruals Short-term debt Current liabilities Long-term debt Preferred stock (50,000 shares) Common equity Common stock (3,800,000 shares Retained earnings Total common equity Total liabilities and equity 5 $ 10 30 $ 40 Total assets $100 $100 $ 10 $ 10 20 15 Cash Accounts receivable Inventories Current assets Net fixed assets 20 0 $ 50 $ 25 50 30 Accounts payable Accruals Short-term debt Current liabilities Long-term debt Preferred stock (50,000 shares) Common equity Common stock (3,800,000 shares Retained earnings Total common equity Total liabilities and equity 5 $ 10 30 $ 40 Total assets $100 $100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started