the following table List trades for restaurants that different from each other with respect to their quality and speed of delivery draw efficient frontier graph and indicate which one of these restaurants are on the efficient frontier and which are not

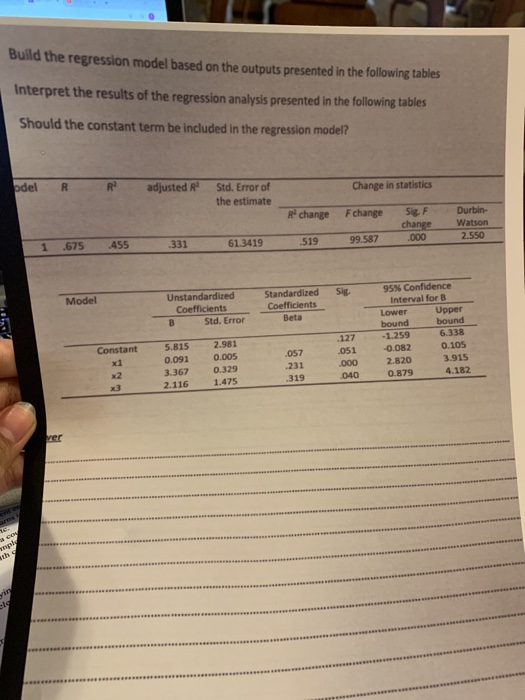

Build the regression model based on the outputs presented in the following tables Interpret the results of the regression analysis presented in the following tables Should the constant term be included in the regression model? adjusted Std. Error of the estimate Change in statistics Rchange Fchange 1.675 Sig. F change .000 455 33161.3419 51999.587 Durbin Watson 2.550 Model sig Unstandardized Coefficients B Std. Error Standardized Coefficients Beta 95% Confidence Interval for B Lower Upper bound bound -1.259 6.338 -0.082 0.105 2.820 3.915 0.879 4.182 Constant 127 .051 5.815 0.091 3.367 2.116 2.981 0.005 0.329 1.475 .057 .231 319 040 IR 9 MANAGEMENT OF ECONOMIC EXPOSURE 243 c. If the U.S. firm hedges against this exposure using a forward contract, what is the variance of the dollar value of the hedged position? 3. Suppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $1,000,000, and the exchange rate will be $1.40/. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $500,000, and the exchange rate will be $1.60/. You assess that the American economy will experience a boom with a 70 percent probability and a recession with a 30 percent probability. a. Estimate your exposure to the exchange risk. b. Compute the variance of the pound value of your American equity position that is attributable to the exchange rate uncertainty. c. How would you hedge this exposure? If you hedge, what is the variance of the pound value of the hedged position? Build the regression model based on the outputs presented in the following tables Interpret the results of the regression analysis presented in the following tables Should the constant term be included in the regression model? adjusted Std. Error of the estimate Change in statistics Rchange Fchange 1.675 Sig. F change .000 455 33161.3419 51999.587 Durbin Watson 2.550 Model sig Unstandardized Coefficients B Std. Error Standardized Coefficients Beta 95% Confidence Interval for B Lower Upper bound bound -1.259 6.338 -0.082 0.105 2.820 3.915 0.879 4.182 Constant 127 .051 5.815 0.091 3.367 2.116 2.981 0.005 0.329 1.475 .057 .231 319 040 IR 9 MANAGEMENT OF ECONOMIC EXPOSURE 243 c. If the U.S. firm hedges against this exposure using a forward contract, what is the variance of the dollar value of the hedged position? 3. Suppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $1,000,000, and the exchange rate will be $1.40/. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $500,000, and the exchange rate will be $1.60/. You assess that the American economy will experience a boom with a 70 percent probability and a recession with a 30 percent probability. a. Estimate your exposure to the exchange risk. b. Compute the variance of the pound value of your American equity position that is attributable to the exchange rate uncertainty. c. How would you hedge this exposure? If you hedge, what is the variance of the pound value of the hedged position