Question

The following table lists the data from the budget of Wood Products, Inc. 40% the companys sales are for cash on the nail; the other

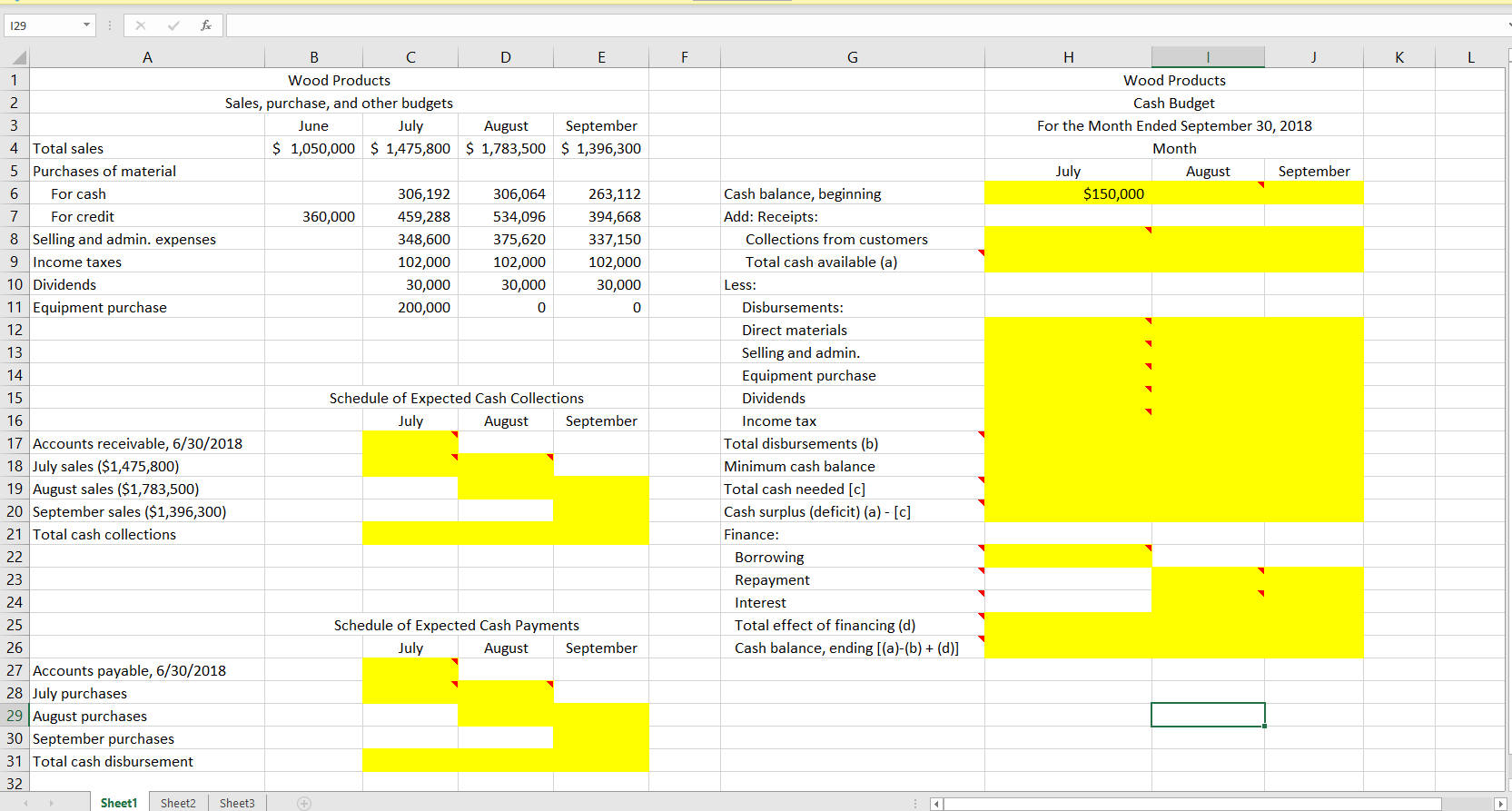

The following table lists the data from the budget of Wood Products, Inc. 40% the companys sales are for cash on the nail; the other 60% are paid for with a one-month delay. The company pays all its credit purchase with a one-month delay. Credit purchases in June were $360,000, and total sales in June were $1,050,000.

Wood products

Sales, purchase, and other budgets

| June | July | Aug | Sept | |

| Total sales | $1,050,000 | $1,475,800 | $1,783,500 | $1,396,300 |

| Purchases of material | ||||

| - for cash | 306,192 | 306,064 | 263,112 | |

| - for credit | 360,000 | 459,288 | 534,096 | 394,668 |

| Selling and admin. expenses | 348,600 | 375,620 | 337,150 | |

| Income taxes | 102,000 | 102,000 | 102,000 | |

| Dividends | 30,000 | 30,000 | 30,000 | |

| Equipment purchase | 200,000 | 0 | 0 |

We make these assumptions to simplify the analysis:

* Wood Products has an open line of credit with its bank, which can be used as needed to bolster the cash position.

* The company desires to maintain a $120,000 minimum cash balance at the end of each month. Therefore, borrowing must be sufficient to cover the cash shortfall and to provide for the minimum cash balance of $120,000.

* All borrowings and repayments must be in multiples of $1,000 amounts, and interest is 7 percent per annum.

* Interest is computed and paid on the principal during the borrowing period.

* All borrowings take place at the beginning of a month, and all repayments are made at the end of a month. The company will take a loan at the beginning of July, and should be able to pay off the loan at the end of August with its cash surplus. You have to figure out the amount of loan taken at the beginning of July.

* The company pays the selling and administrative expenses, income taxes, dividends, and pays for equipment purchase at the end of a month.

Please complete this cash budget.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started