Question

The following table lists the data from the budget of Ritewell Publishers. 55% the companys sales are for cash on the nail; the other 45%

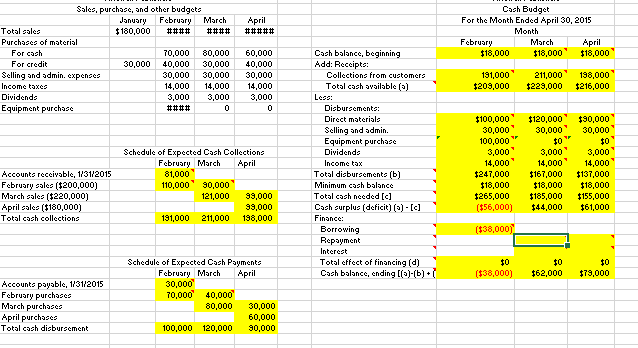

The following table lists the data from the budget of Ritewell Publishers. 55% the companys sales are for cash on the nail; the other 45% are paid for with a one-month delay. The company pays all its credit purchase with a one-month delay. Credit purchases in January were $30,000, and total sales in January were $180,000. Ritewell Publishers Sales, purchase, and other budgets January February March April Total sales $ 180,000 $200,000 $ 220,000 $ 180,000 Purchases of material For cash 70,000 80,000 60,000 For credit 30,000 40,000 30,000 40,000 Selling and admin. expenses 30,000 30,000 30,000 Income taxes 14,000 14,000 14,000 Dividends 3,000 3,000 3,000 Equipment purchase 100,000 0 0 We make these assumptions to simplify the analysis: * Ritewell Publishers has an open line of credit with its bank, which can be used as needed to bolster the cash position. * The company desires to maintain a $18,000 minimum cash balance at the end of each month. Therefore, borrowing must be sufficient to cover the cash shortfall and to provide for the minimum cash balance of $18,000. * All borrowings and repayments must be in multiples of $1,000 amounts, and interest is 6 percent per annum. * Interest is computed and paid on the principal during the borrowing period. * All borrowings take place at the beginning of a month, and all repayments are made at the end of a month. The company will take a loan at the beginning of February, repaying part of the loan at the end of March and the remaining balance at the end of April. At the end of March, the company will repay the loan as much as possible but also keeps the minimum cash balance of $18,000. Repayment in March is based on available cash from operating activities. You have to figure out the loan amount and repayment amounts. * The company pays the selling and administrative expenses, income taxes, dividends, and pays for equipment purchase at the end of a month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started