Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following table presents sample data for Bluewater (BW), a hedge fund. (Abstract from potential biases in the data.) Month 1 Month 2 0.95% -0.4%

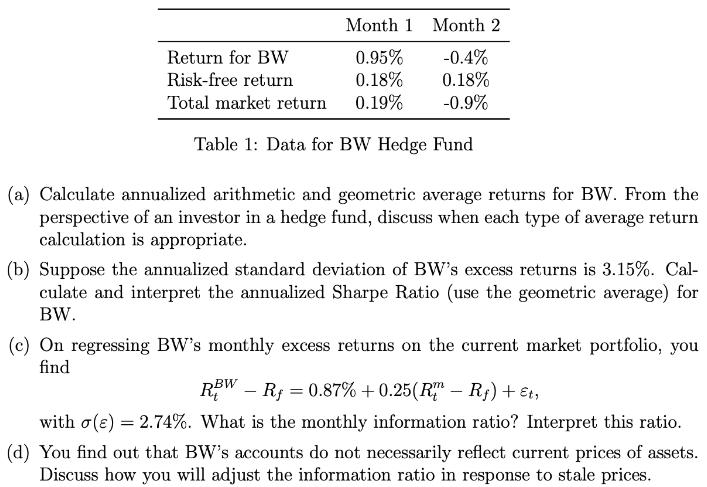

The following table presents sample data for Bluewater (BW), a hedge fund. (Abstract from potential biases in the data.)

Month 1 Month 2 0.95% -0.4% 0.18% 0.18% 0.19% -0.9% Return for BW Risk-free return Total market return Table 1: Data for BW Hedge Fund (a) Calculate annualized arithmetic and geometric average returns for BW. From the perspective of an investor in a hedge fund, discuss when each type of average return calculation is appropriate. (b) Suppose the annualized standard deviation of BW's excess returns is 3.15%. Cal- culate and interpret the annualized Sharpe Ratio (use the geometric average) for BW. (c) On regressing BW's monthly excess returns on the current market portfolio, you find RBWR=0.87% +0.25 (RM-Rf) + Et, with (e) = 2.74%. What is the monthly information ratio? Interpret this ratio. (d) You find out that BW's accounts do not necessarily reflect current prices of assets. Discuss how you will adjust the information ratio in response to stale prices.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

I Computation of Annualized arithmetic average Returns TOLEX S Ist Month 1 Return for Bul Risk Force ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started