Question

The following table provides summary data for Guess? Inc. and its competitors, Ralph Lauren Corp. and The Gap Inc. In millions Company assumed value..

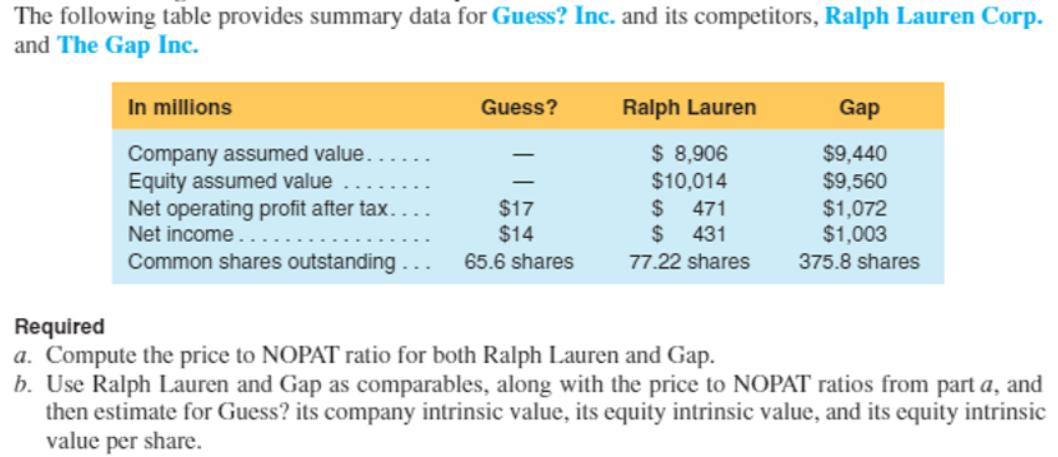

The following table provides summary data for Guess? Inc. and its competitors, Ralph Lauren Corp. and The Gap Inc. In millions Company assumed value.. Equity assumed value Net operating profit after tax.. Net income... Common shares outstanding... Guess? $17 $14 65.6 shares Ralph Lauren $ 8,906 $10,014 $ 471 $ 431 77.22 shares Gap $9,440 $9,560 $1,072 $1,003 375.8 shares Required a. Compute the price to NOPAT ratio for both Ralph Lauren and Gap. b. Use Ralph Lauren and Gap as comparables, along with the price to NOPAT ratios from part a, and then estimate for Guess? its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share.

Step by Step Solution

3.27 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Price to NOPAT ratio for Ralph Lauren and Gap Ralph Lauren Price to NOPAT Comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M Wahlen, Stephen P Baginskl, Mark T Bradshaw

7th Edition

9780324789423, 324789416, 978-0324789416

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App