Answered step by step

Verified Expert Solution

Question

1 Approved Answer

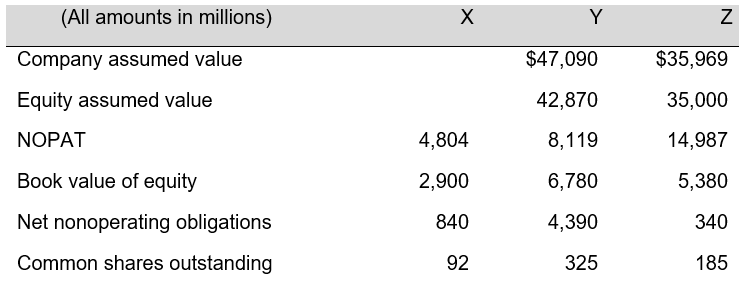

The following table provides summary information for X and its competitors Y, Inc. and Z Corp. a) Compute the BV multiple (PB ratios) for Y

The following table provides summary information for X and its competitors Y, Inc. and Z Corp.

a) Compute the BV multiple (PB ratios) for Y and Z and apply the BV multiple to estimate Xs equity intrinsic value per share. (6 pts) b) Compute the NOPAT multiple for Y and Z and apply the NOPAT multiple to estimate Xs equity intrinsic value per share. (7 pts) (Please show your calculations)

(All amounts in millions) Y Z Company assumed value $47,090 $35,969 Equity assumed value 42,870 35,000 NOPAT 4,804 8,119 14,987 Book value of equity 2,900 6,780 5,380 Net nonoperating obligations 840 4,390 340 Common shares outstanding 92 325 185 (All amounts in millions) Y Z Company assumed value $47,090 $35,969 Equity assumed value 42,870 35,000 NOPAT 4,804 8,119 14,987 Book value of equity 2,900 6,780 5,380 Net nonoperating obligations 840 4,390 340 Common shares outstanding 92 325 185Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started