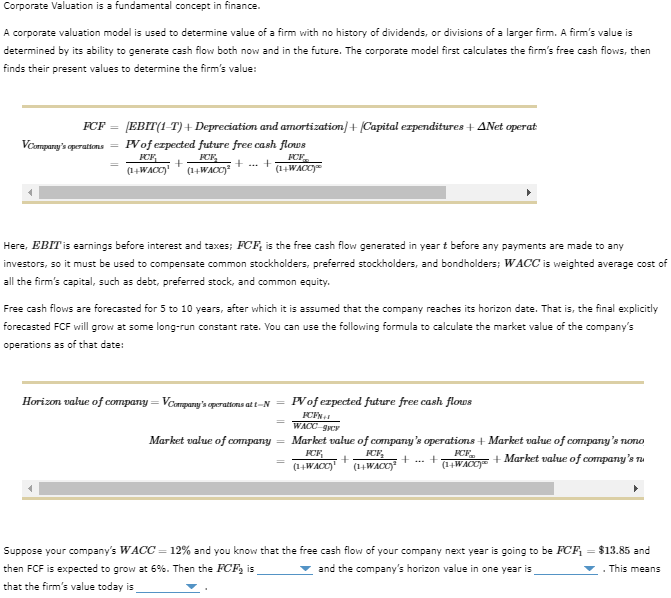

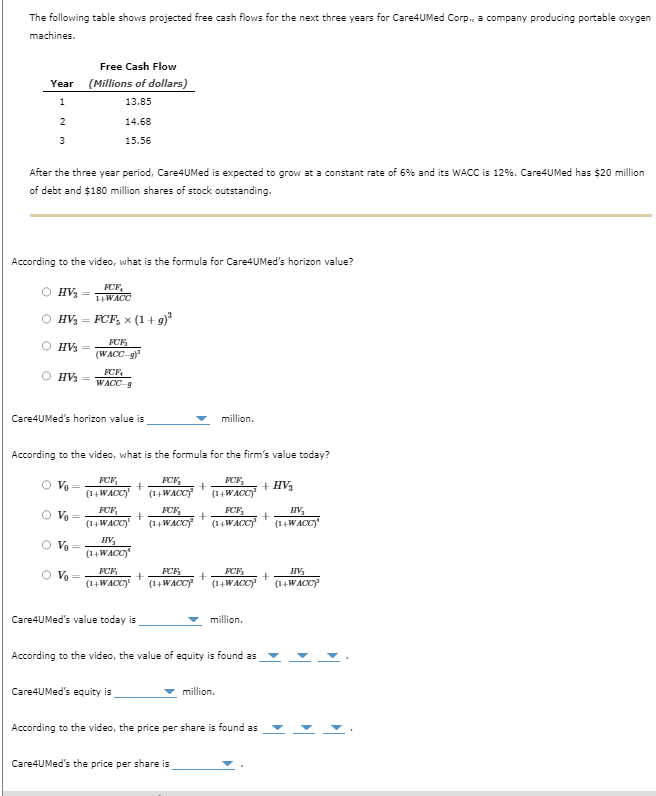

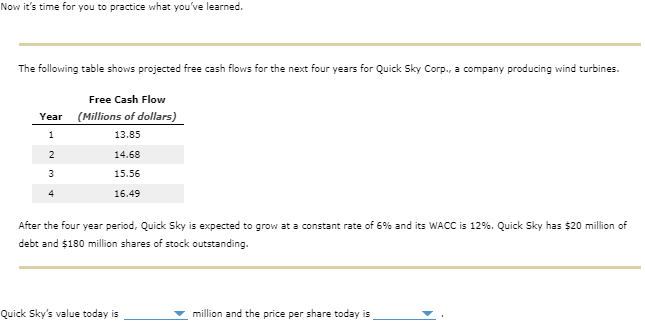

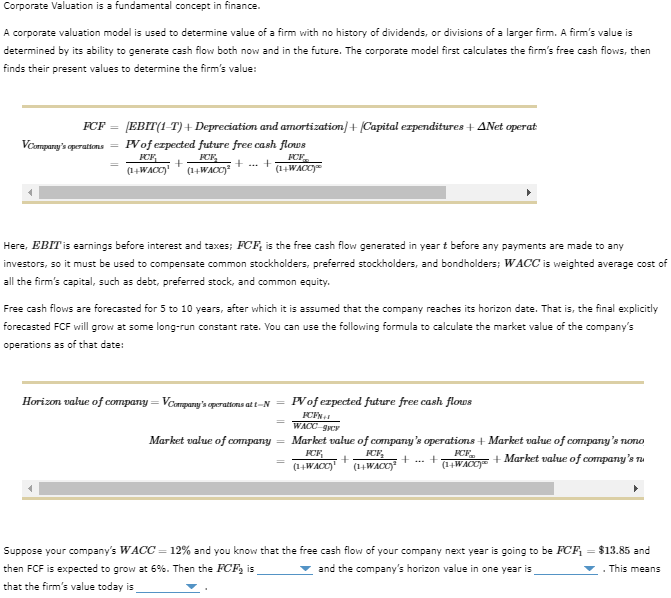

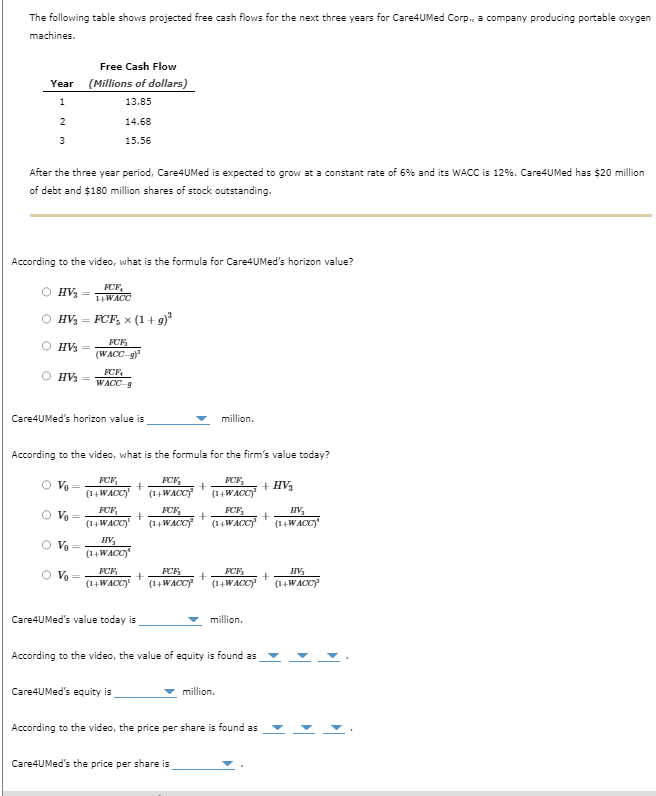

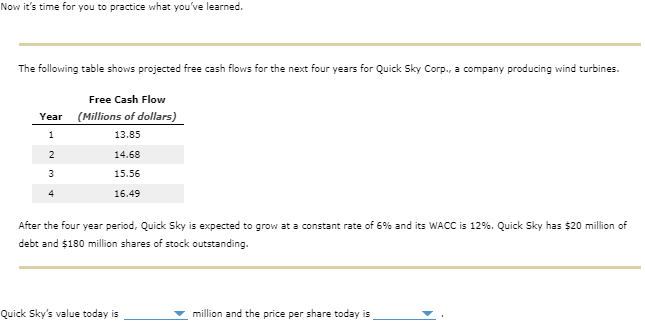

The following table shows projected free cash flows for the next three years for Care4UMed Corp., a company producing portable oxygen machines. After the three year period, Care4UMed is expected to grow at a constant rate of 6% and its WACC is 12%. Care4UMed has $20 million of debt and $180 million shares of stock outstanding. According to the video, what is the formula for Care4uMed's horizon value? HV3HV3HV3HV3=1+WACCFCF4=FCF5(1+g)3=(WACC)3FCF3=WACCgFCF4 Care4UMed's horizon value is million. According to the video, what is the formula for the firm's value today? V0V0V0V0Medsvaluetodayis=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+HV3=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+(1+WACC)4HV3=(1+WACC)4HV3=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+(1+WACC)3HV3million. Care4UMed's value today is million. According to the video, the value of equity is found as Care4uMed's equity is million. According to the video, the price per share is found as Care4UMed's the price per share is Now it's time for you to practice what you've learned. The following table shows projected free cash flows for the next four years for Quick Sky Corp., a company producing wind turbines. After the four year period, Quick Sky is expected to grow at a constant rate of 6% and its WACC is 12\%. Quick Sky has $20 million of debt and $180 million shares of stock outstanding. Quick Sky's value today is million and the price per share today is Corporate Valuation is a fundamental concept in finance. A corporate valuation model is used to determine value of a firm with no history of dividends, or divisions of a larger firm. A firm's value is determined by its ability to generate cash flow both now and in the future. The corporate model first calculates the firm's free cash flows, then finds their present values to determine the firm's value: FCF=[ EBTT (1T)+ Depreciation and amortization /+[ Capital expenditures + Net operat VCompanyscoprations= PV of expected future free cash flows =(1+WACC)1PCF1+(1+WACC)2FCF3++(1+WACC)xFCF00 Here, EBIT is earnings before interest and taxes; FCFt is the free cash flow generated in year t before any payments are made to any investors, so it must be used to compensate common stockholders, preferred stockholders, and bondholders; WACC is weighted average cost of all the firm's capital, such as debt, preferred stock, and common equity. Free cash flows are forecasted for 5 to 10 years, after which it is assumed that the company reaches its horizon date. That is, the final explicitly forecasted FCF will grow at some long-run constant rate. You can use the following formula to calculate the market value of the company's operations as of that date: Horizon value of company =VCompanysaporationsattN= PV of expected future free cash flows =WACCgMCYPCFN+I Market value of company = Market value of company's operations + Market value of company's nono =(1+WACC)1FCF1+(1+WACC)2FCF2++(1+WACC)xPCF+ Market value of company's nu Suppose your company's WACC =12% and you know that the free cash flow of your company next year is going to be FCF1=$13.85 and then FCF is expected to grow at 6%. Then the FCF2 is and the company's horizon value in one year is - This means that the firm's value today is