Question

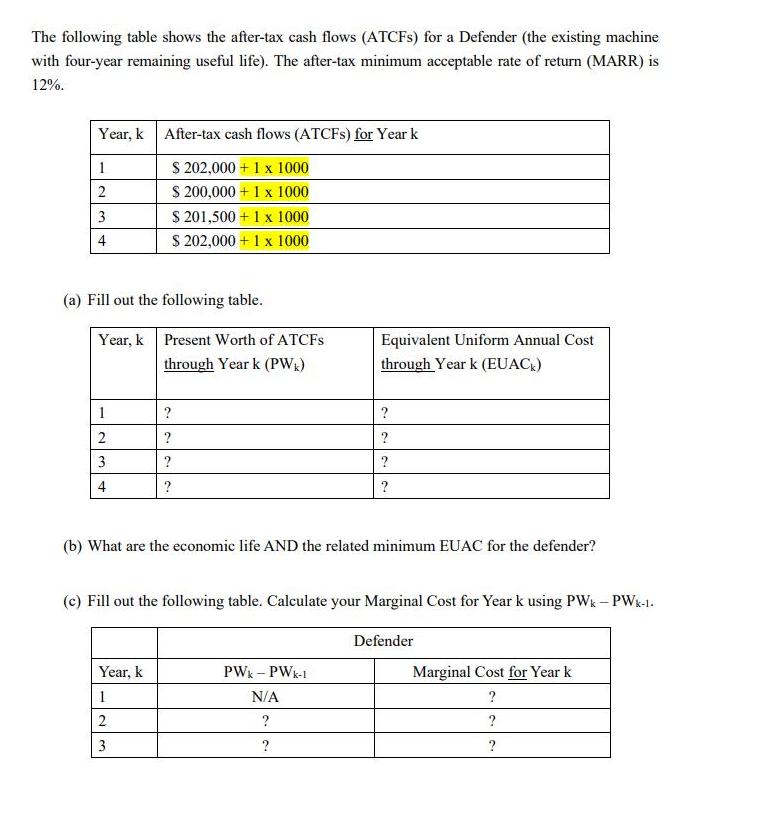

The following table shows the after-tax cash flows (ATCFs) for a Defender (the existing machine with four-year remaining useful life). The after-tax minimum acceptable

The following table shows the after-tax cash flows (ATCFs) for a Defender (the existing machine with four-year remaining useful life). The after-tax minimum acceptable rate of return (MARR) is 12%. Year, k After-tax cash flows (ATCFS) for Year k $ 202,000 + 1 x 1000 $ 200,000 + 1 x 1000 $ 201,500+ 1 x 1000 $ 202,000+ 1 x 1000 1 2 3 4 (a) Fill out the following table. Year, k 1 2 3 4 Present Worth of ATCFS through Year k (PWk) Year, k 1 2 ? ? 3 ? ? (b) What are the economic life AND the related minimum EUAC for the defender? Equivalent Uniform Annual Cost through Year k (EUACK) (c) Fill out the following table. Calculate your Marginal Cost for Year k using PWk - PWk-1. Defender ? ? ? ? PWk - PWK-1 N/A ? ? Marginal Cost for Year k ? ? ?

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial And Managerial Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

14th Edition

1337119202, 978-1337119207

Students also viewed these Programming questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App