Answered step by step

Verified Expert Solution

Question

1 Approved Answer

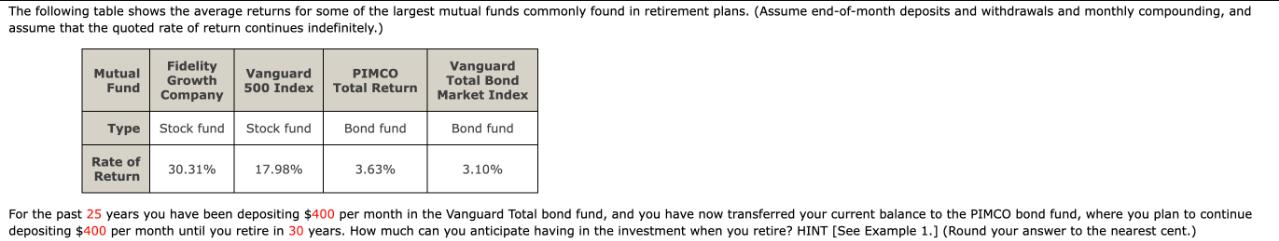

The following table shows the average returns for some of the largest mutual funds commonly found in retirement plans. (Assume end-of-month deposits and withdrawals

The following table shows the average returns for some of the largest mutual funds commonly found in retirement plans. (Assume end-of-month deposits and withdrawals and monthly compounding, and assume that the quoted rate of return continues indefinitely.) Mutual Fund Fidelity Growth Company Vanguard 500 Index PIMCO Total Return Vanguard Total Bond Market Index Type Stock fund Stock fund Bond fund Bond fund Rate of 30.31% 17.98% 3.63% 3.10% Return For the past 25 years you have been depositing $400 per month in the Vanguard Total bond fund, and you have now transferred your current balance to the PIMCO bond fund, where you plan to continue depositing $400 per month until you retire in 30 years. How much can you anticipate having in the investment when you retire? HINT [See Example 1.] (Round your answer to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the anticipated balance in the investment when you retire you ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started