Answered step by step

Verified Expert Solution

Question

1 Approved Answer

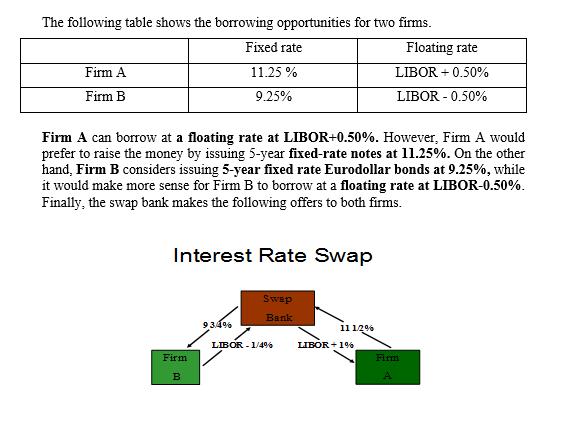

The following table shows the borrowing opportunities for two firms. Fixed rate 11.25% 9.25% Firm A Firm B Firm A can borrow at a

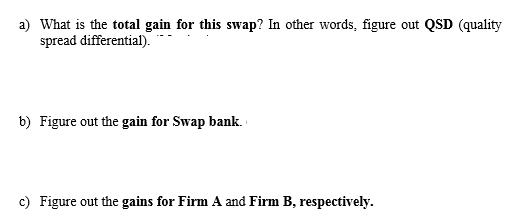

The following table shows the borrowing opportunities for two firms. Fixed rate 11.25% 9.25% Firm A Firm B Firm A can borrow at a floating rate at LIBOR+0.50%. However, Firm A would prefer to raise the money by issuing 5-year fixed-rate notes at 11.25%. On the other hand, Firm B considers issuing 5-year fixed rate Eurodollar bonds at 9.25%, while it would make more sense for Firm B to borrow at a floating rate at LIBOR-0.50%. Finally, the swap bank makes the following offers to both firms. Interest Rate Swap Firm B 93.4% Swap Bank LIBOR - 1/4% 11 1.2% LIBOR + 1% Floating rate LIBOR +0.50% LIBOR - 0.50% A a) What is the total gain for this swap? In other words, figure out QSD (quality spread differential). b) Figure out the gain for Swap bank. c) Figure out the gains for Firm A and Firm B, respectively.

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To solve these questions we need to understand the interest rate swap and how it benefits both firms as well as the swap bank The quality spread differential QSD represents the difference in borrowing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started