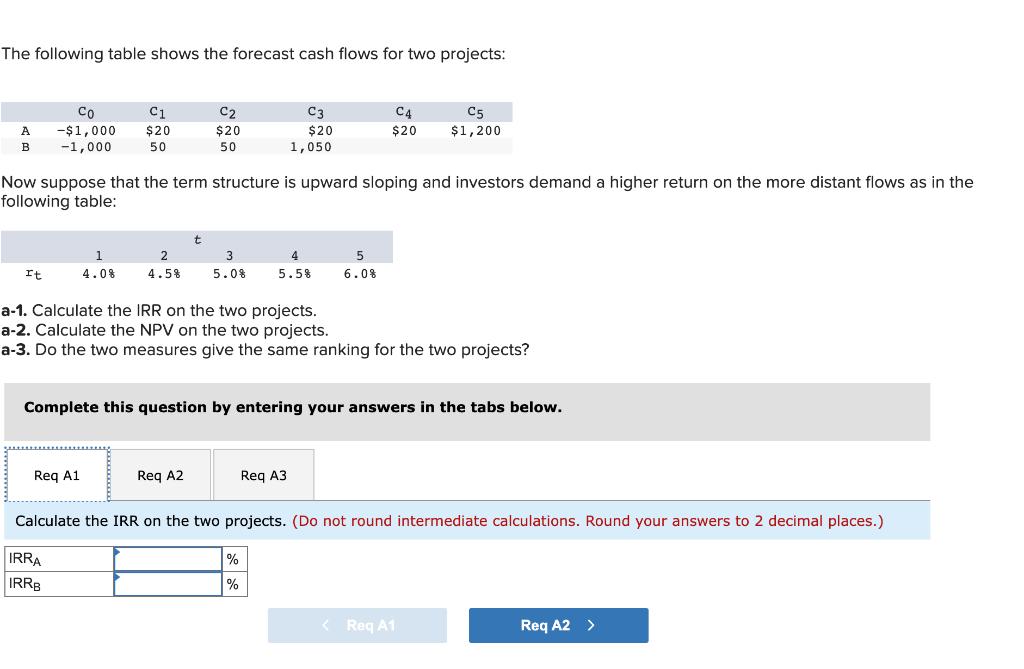

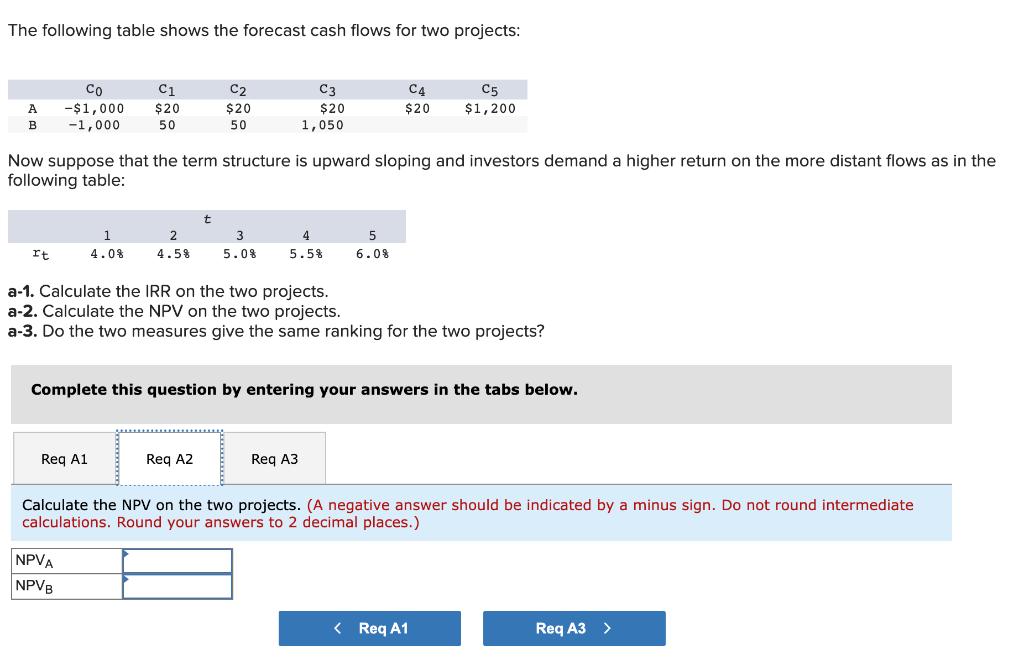

Question: The following table shows the forecast cash flows for two projects: Co A -$1,000 B -1,000 It C1 $20 50 C2 $20 50 Req

The following table shows the forecast cash flows for two projects: Co A -$1,000 B -1,000 It C1 $20 50 C2 $20 50 Req A1 Now suppose that the term structure is upward sloping and investors demand a higher return on the more distant flows as in the following table: 1 2 3 4.0% 4.5% 5.08 Req A2 C3 $20 1,050 4 5.5% a-1. Calculate the IRR on the two projects. a-2. Calculate the NPV on the two projects. a-3. Do the two measures give the same ranking for the two projects? Req A3 C4 $20 5 6.0% Complete this question by entering your answers in the tabs below. % % C5 $1,200 Calculate the IRR on the two projects. (Do not round intermediate calculations. Round your answers to 2 decimal places.) IRRA IRRB < Req A1 Req A2 > The following table shows the forecast cash flows for two projects: A B It. Co -$1,000 -1,000 C1 $20 50 1 4.0% Req A1 Now suppose that the term structure is upward sloping and investors demand a higher return on the more distant flows as in the following table: NPVA NPVB 2 4.58 C2 $20 50 t Req A2 3 5.0% C3 $20 1,050 4 5.5% a-1. Calculate the IRR on the two projects. a-2. Calculate the NPV on the two projects. a-3. Do the two measures give the same ranking for the two projects? C4 $20 5 6.0% Complete this question by entering your answers in the tabs below. Req A3 C5 $1,200 Calculate the NPV on the two projects. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) < Req A1 Req A3 > The following table shows the forecast cash flows for two projects: Co A -$1,000 B -1,000 It C1 $20 50 C2 $20 50 Req A1 Now suppose that the term structure is upward sloping and investors demand a higher return on the more distant flows as in the following table: 1 2 3 4.0% 4.5% 5.08 Req A2 C3 $20 1,050 4 5.5% a-1. Calculate the IRR on the two projects. a-2. Calculate the NPV on the two projects. a-3. Do the two measures give the same ranking for the two projects? Req A3 C4 $20 5 6.0% Complete this question by entering your answers in the tabs below. % % C5 $1,200 Calculate the IRR on the two projects. (Do not round intermediate calculations. Round your answers to 2 decimal places.) IRRA IRRB < Req A1 Req A2 > The following table shows the forecast cash flows for two projects: A B It. Co -$1,000 -1,000 C1 $20 50 1 4.0% Req A1 Now suppose that the term structure is upward sloping and investors demand a higher return on the more distant flows as in the following table: NPVA NPVB 2 4.58 C2 $20 50 t Req A2 3 5.0% C3 $20 1,050 4 5.5% a-1. Calculate the IRR on the two projects. a-2. Calculate the NPV on the two projects. a-3. Do the two measures give the same ranking for the two projects? C4 $20 5 6.0% Complete this question by entering your answers in the tabs below. Req A3 C5 $1,200 Calculate the NPV on the two projects. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) < Req A1 Req A3 >

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

SOLUTION a1 To calculate the IRR on the two projects we need to find the discount rate that makes the net present value NPV of the cash flows equal to ... View full answer

Get step-by-step solutions from verified subject matter experts