Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The common stocks of XYZ Company are currently trading (beginning of 2017) at $ 20 on the market. The company has just distributed an

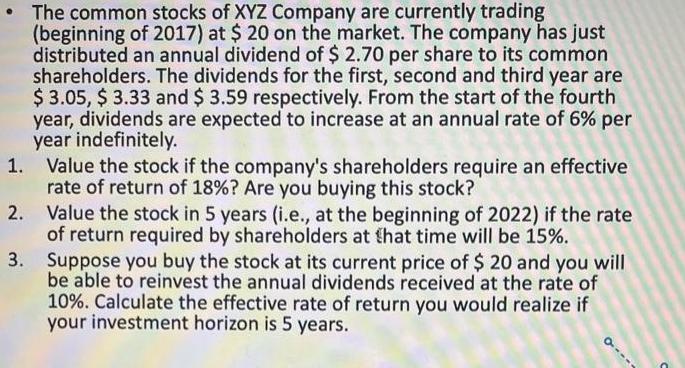

The common stocks of XYZ Company are currently trading (beginning of 2017) at $ 20 on the market. The company has just distributed an annual dividend of $ 2.70 per share to its common shareholders. The dividends for the first, second and third year are $ 3.05, $ 3.33 and $ 3.59 respectively. From the start of the fourth year, dividends are expected to increase at an annual rate of 6% per year indefinitely. 1. 2. Value the stock in 5 years (i.e., at the beginning of 2022) if the rate of return required by shareholders at that time will be 15%. Suppose you buy the stock at its current price of $ 20 and you will be able to reinvest the annual dividends received at the rate of 10%. Calculate the effective rate of return you would realize if your investment horizon is 5 years. 3. Value the stock if the company's shareholders require an effective rate of return of 18% ? Are you buying this stock?

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 The stocks value can be estimated using the dividend discount model which values a stock based on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started