Answered step by step

Verified Expert Solution

Question

1 Approved Answer

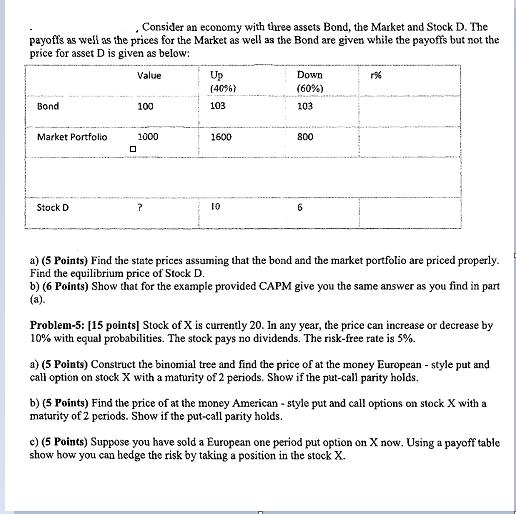

Consider an economy with three assets Bond, the Market and Stock D. The payoffs as well as the prices for the Market as well

Consider an economy with three assets Bond, the Market and Stock D. The payoffs as well as the prices for the Market as well as the Bond are given while the payoffs but not the price for asset D is given as below: Value Bond Market Portfolio Stock D 100 1000 ? Up (40%) 103 1600 10 Down (60%) 103 800 6 a) (5 Points) Find the state prices assuming that the bond and the market portfolio are priced properly. Find the equilibrium price of Stock D. b) (6 Points) Show that for the example provided CAPM give you the same answer as you find in part (a). Problem-5: [15 points] Stock of X is currently 20. In any year, the price can increase or decrease by 10% with equal probabilities. The stock pays no dividends. The risk-free rate is 5%. a) (5 Points) Construct the binomial tree and find the price of at the money European-style put and call option on stock X with a maturity of 2 periods. Show if the put-call parity holds. b) (5 Points) Find the price of at the money American - style put and call options on stock X with a maturity of 2 periods. Show if the put-call parity holds. c) (5 Points) Suppose you have sold a European one period put option on X now. Using a payoff table show how you can hedge the risk by taking a position in the stock X.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a To find the state prices we can use the riskneutral pricing approach We assume that the bond and market portfolio are priced properly meaning their ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started