Answered step by step

Verified Expert Solution

Question

1 Approved Answer

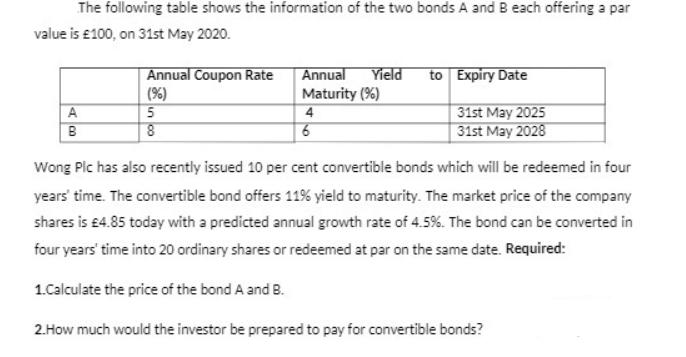

The following table shows the information of the two bonds A and B each offering a par value is 100, on 31st May 2020.

The following table shows the information of the two bonds A and B each offering a par value is 100, on 31st May 2020. A B Annual Coupon Rate (96) 5 8 Annual Yield Maturity (%) 4 6 to Expiry Date 31st May 2025 31st May 2028 Wong Pic has also recently issued 10 per cent convertible bonds which will be redeemed in four years' time. The convertible bond offers 11% yield to maturity. The market price of the company shares is 4.85 today with a predicted annual growth rate of 4.5%. The bond can be converted in four years' time into 20 ordinary shares or redeemed at par on the same date. Required: 1.Calculate the price of the bond A and B. 2.How much would the investor be prepared to pay for convertible bonds?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of bond prices a Bond A Annual Coupon Rate 5 Annual Maturity 4 Yield to Expiry Date 8 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started