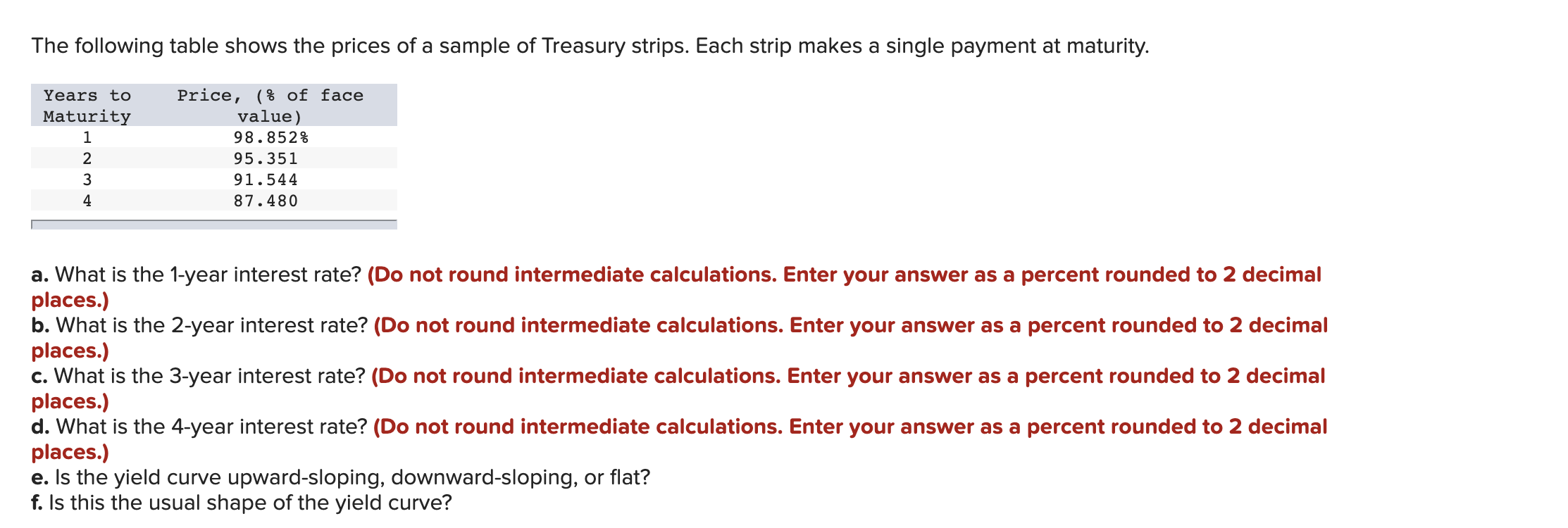

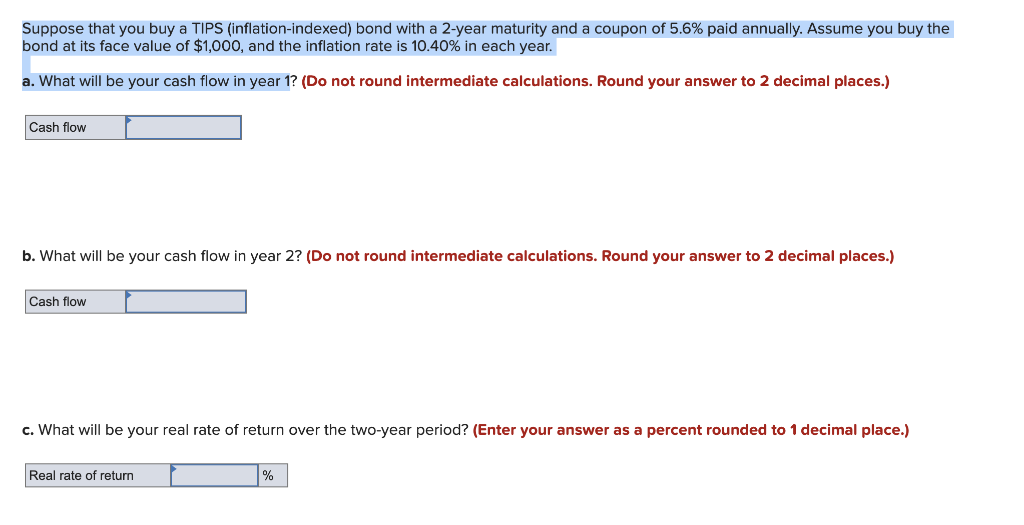

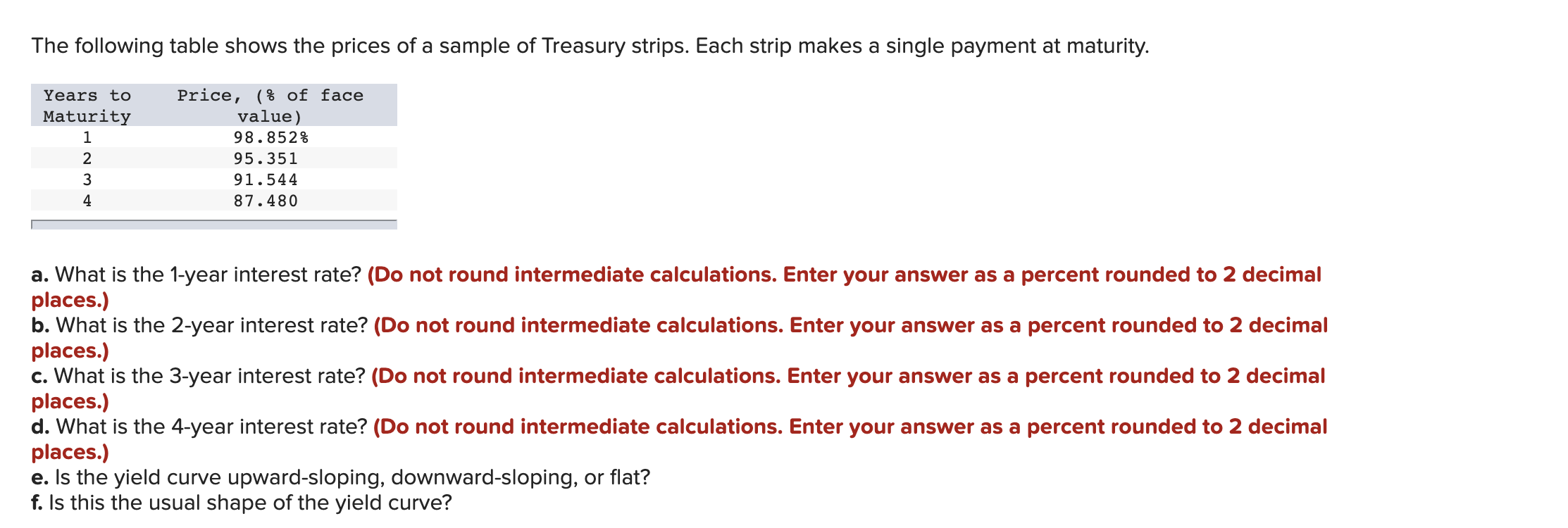

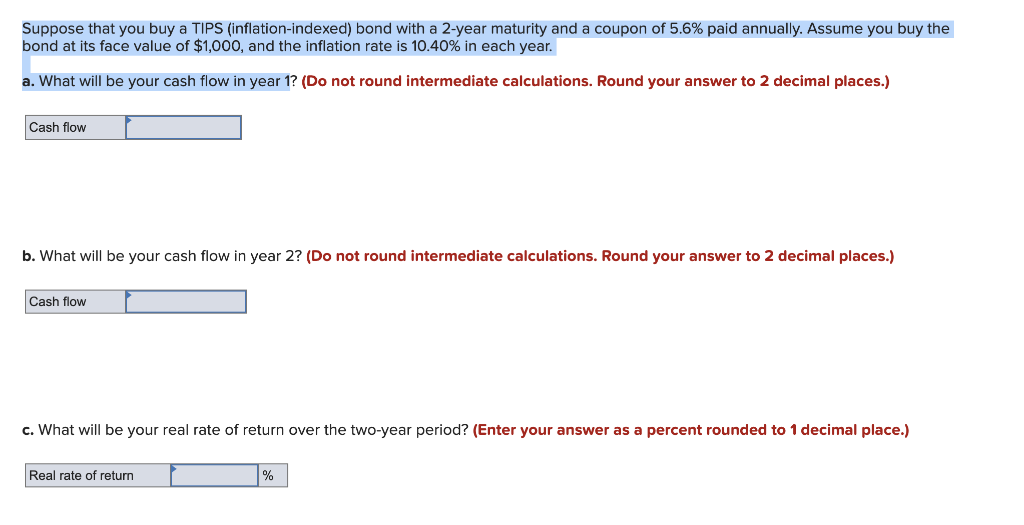

The following table shows the prices of a sample of Treasury strips. Each strip makes a single payment at maturity. Years to Maturity 1 2 3 Price, (% of face value) 98.852% 95.351 91.544 87.480 4 a. What is the 1-year interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) b. What is the 2-year interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is the 3-year interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) d. What is the 4-year interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) e. Is the yield curve upward-sloping, downward-sloping, or flat? f. Is this the usual shape of the yield curve? Suppose that you buy a TIPS (inflation-indexed) bond with a 2-year maturity and a coupon of 5.6% paid annually. Assume you buy the bond at its face value of $1,000, and the inflation rate is 10.40% in each year. a. What will be your cash flow in year 1? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Cash flow b. What will be your cash flow in year 2? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Cash flow c. What will be your real rate of return over the two-year period? (Enter your answer as a percent rounded to 1 decimal place.) Real rate of return % The following table shows the prices of a sample of Treasury strips. Each strip makes a single payment at maturity. Years to Maturity 1 2 3 Price, (% of face value) 98.852% 95.351 91.544 87.480 4 a. What is the 1-year interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) b. What is the 2-year interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is the 3-year interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) d. What is the 4-year interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) e. Is the yield curve upward-sloping, downward-sloping, or flat? f. Is this the usual shape of the yield curve? Suppose that you buy a TIPS (inflation-indexed) bond with a 2-year maturity and a coupon of 5.6% paid annually. Assume you buy the bond at its face value of $1,000, and the inflation rate is 10.40% in each year. a. What will be your cash flow in year 1? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Cash flow b. What will be your cash flow in year 2? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Cash flow c. What will be your real rate of return over the two-year period? (Enter your answer as a percent rounded to 1 decimal place.) Real rate of return %