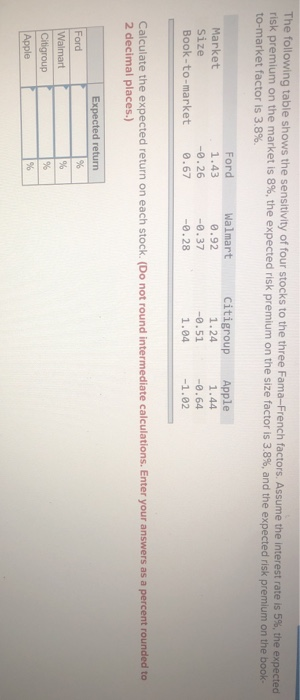

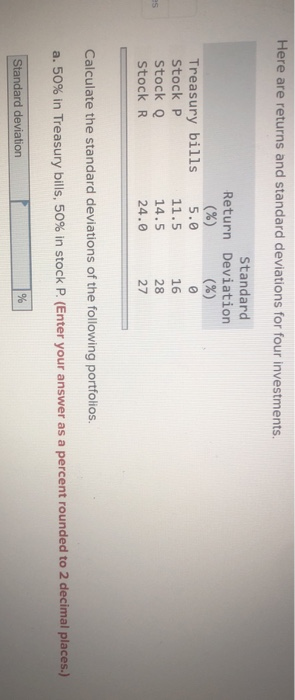

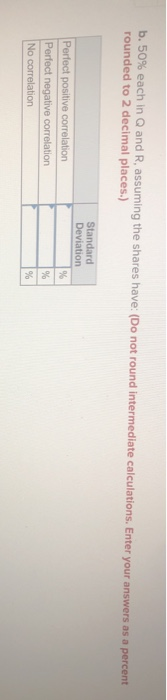

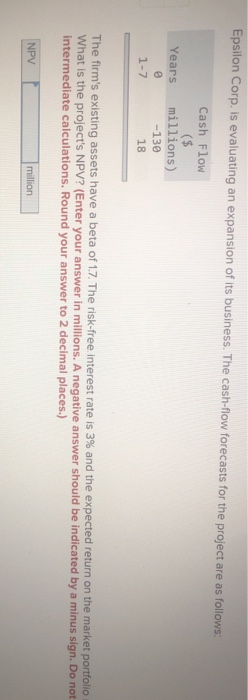

The following table shows the sensitivity of four stocks to the three Fama-French factors. Assume the interest rate is 5%, the expected risk premium on the market is 8%, the expected risk premium on the size factor is 3.8%, and the expected risk premium on the book- to-market factor is 3.8% Market Size Book-to-market Ford 1.43 -0.26 0.67 Walmart 0.92 -0.37 -0.28 Citigroup 1.24 -0.51 1.04 Apple 1.44 -0.64 -1.02 Calculate the expected return on each stock. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Ford Walmart Citigroup Apple Expected return % % % % Here are returns and standard deviations for four investments. Treasury bills Stock P Stock Q Stock R Standard Return Deviation (%) (%) 5.0 11.5 16 14.5 28 24.0 27 es Calculate the standard deviations of the following portfolios. a. 50% in Treasury bills, 50% in stock P. (Enter your answer as a percent rounded to 2 decimal places.) Standard deviation % b. 50% each in Q and R, assuming the shares have: (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Standard Deviation Perfect positive correlation Perfect negative correlation No correlation % % % Epsilon Corp. is evaluating an expansion of its business. The cash-flow forecasts for the project are as follows: Years Cash Flow ($ millions) -130 18 1-7 The firm's existing assets have a beta of 1.7. The risk-free interest rate is 3% and the expected return on the market portfolio What is the project's NPV? (Enter your answer in millions. A negative answer should be indicated by a minus sign. Do not intermediate calculations. Round your answer to 2 decimal places.) NPV million The following table shows the sensitivity of four stocks to the three Fama-French factors. Assume the interest rate is 5%, the expected risk premium on the market is 8%, the expected risk premium on the size factor is 3.8%, and the expected risk premium on the book- to-market factor is 3.8% Market Size Book-to-market Ford 1.43 -0.26 0.67 Walmart 0.92 -0.37 -0.28 Citigroup 1.24 -0.51 1.04 Apple 1.44 -0.64 -1.02 Calculate the expected return on each stock. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Ford Walmart Citigroup Apple Expected return % % % % Here are returns and standard deviations for four investments. Treasury bills Stock P Stock Q Stock R Standard Return Deviation (%) (%) 5.0 11.5 16 14.5 28 24.0 27 es Calculate the standard deviations of the following portfolios. a. 50% in Treasury bills, 50% in stock P. (Enter your answer as a percent rounded to 2 decimal places.) Standard deviation % b. 50% each in Q and R, assuming the shares have: (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Standard Deviation Perfect positive correlation Perfect negative correlation No correlation % % % Epsilon Corp. is evaluating an expansion of its business. The cash-flow forecasts for the project are as follows: Years Cash Flow ($ millions) -130 18 1-7 The firm's existing assets have a beta of 1.7. The risk-free interest rate is 3% and the expected return on the market portfolio What is the project's NPV? (Enter your answer in millions. A negative answer should be indicated by a minus sign. Do not intermediate calculations. Round your answer to 2 decimal places.) NPV million