Answered step by step

Verified Expert Solution

Question

1 Approved Answer

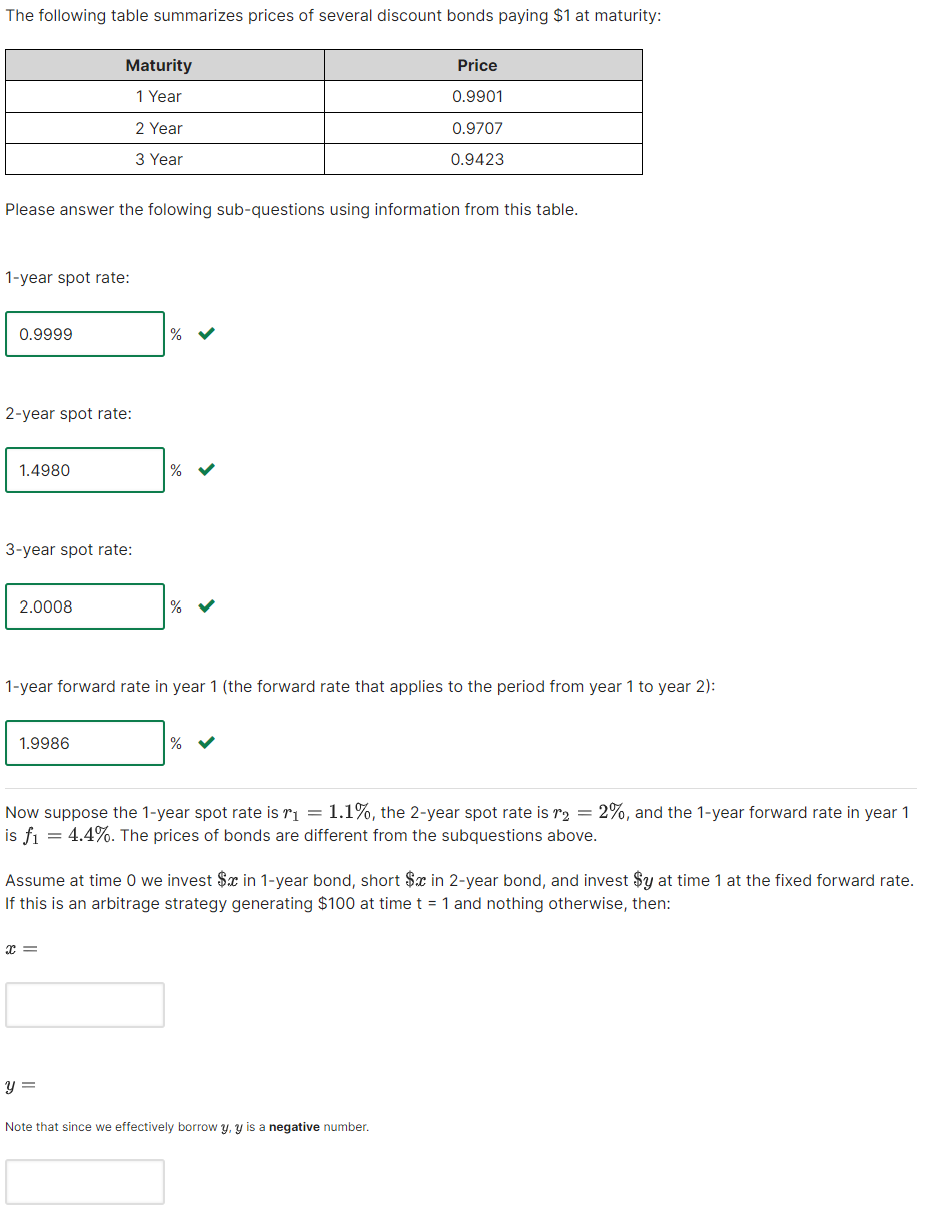

The following table summarizes prices of several discount bonds paying $1 at maturity: Please answer the folowing sub-questions using information from this table. 1-year

The following table summarizes prices of several discount bonds paying $1 at maturity: Please answer the folowing sub-questions using information from this table. 1-year spot rate: 0.9999 2-year spot rate: 1.4980 Maturity 1 Year 2 Year 3 Year 3-year spot rate: 2.0008 1.9986 % x = % 1-year forward rate in year 1 (the forward rate that applies to the period from year 1 to year 2): y = % % Now suppose the 1-year spot rate is r = 1.1%, the 2-year spot rate is r2 = 2%, and the 1-year forward rate in year 1 is f = 4.4%. The prices of bonds are different from the subquestions above. Price 0.9901 0.9707 0.9423 Assume at time 0 we invest $x in 1-year bond, short $x in 2-year bond, and invest $y at time 1 at the fixed forward rate. If this is an arbitrage strategy generating $100 at time t = 1 and nothing otherwise, then: Note that since we effectively borrow y, y is negative number.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The problem is asking for the values of x and y in an arbitrage strategy involving a 1year bond a 2y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started