Question

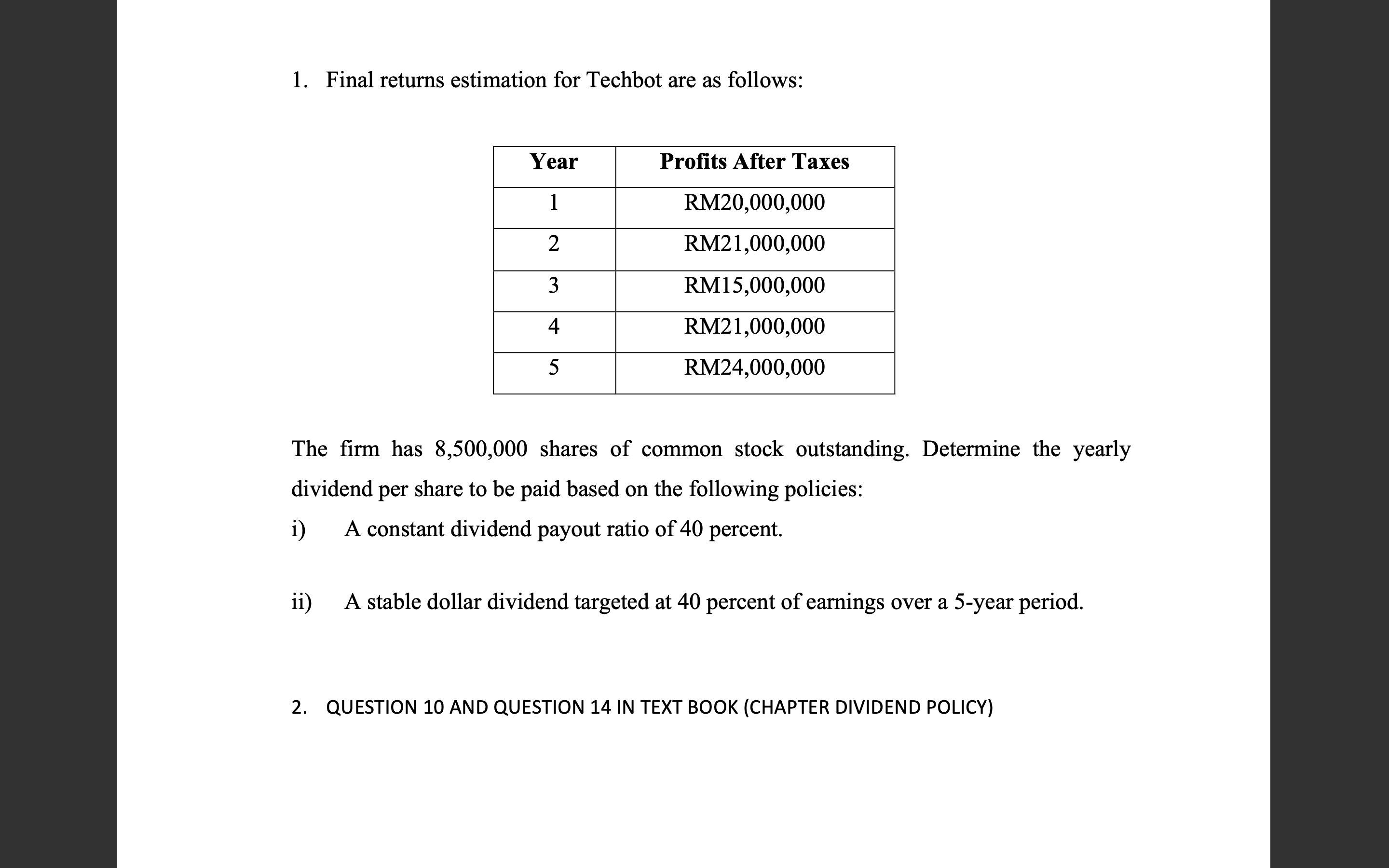

1. Final returns estimation for Techbot are as follows: Year 1 2 3 4 5 Profits After Taxes RM20,000,000 RM21,000,000 RM15,000,000 RM21,000,000 RM24,000,000 The

1. Final returns estimation for Techbot are as follows: Year 1 2 3 4 5 Profits After Taxes RM20,000,000 RM21,000,000 RM15,000,000 RM21,000,000 RM24,000,000 The firm has 8,500,000 shares of common stock outstanding. Determine the yearly dividend per share to be paid based on the following policies: i) A constant dividend payout ratio of 40 percent. ii) A stable dollar dividend targeted at 40 percent of earnings over a 5-year period. 2. QUESTION 10 AND QUESTION 14 IN TEXT BOOK (CHAPTER DIVIDEND POLICY)

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Constant dividend payout ratio of 40 Year 1 Profit after tax RM20000000 Payout ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Elementary Statistics

Authors: Robert R. Johnson, Patricia J. Kuby

11th Edition

978-053873350, 9781133169321, 538733500, 1133169325, 978-0538733502

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App