Question

The following table summarizes the stock-based compensation expenses included on our Consolidated Statements of Income (in millions): We capitalized stock-based compensation costs to inventory totaling

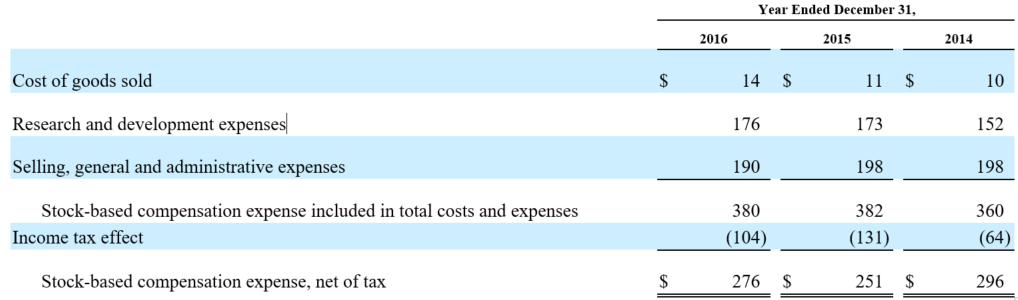

The following table summarizes the stock-based compensation expenses included on our Consolidated Statements of Income (in millions):

We capitalized stock-based compensation costs to inventory totaling $15 million in 2016, $13 million in 2015 and $12 million in 2014. The capitalized stock-based compensation costs remaining in inventory were $9 million as of December 31, 2016, $8 million as of December 31, 2015 and $6 million as of December 31, 2014.

Stock-based compensation is recognized as expense over the requisite service periods on our Consolidated Statements of Income using the straight-line expense attribution approach, reduced for estimated forfeitures. We estimate forfeitures based on our historical experience.

What is the journal entry for the stock compensation expense in 2016?

a. Debit compensation expense for 360 and credit equity for 360

b. Debit compensation expense for 276 and credit equity for 276

c. Debit compensation expense for 360 and credit due to employees for 360

d. No entry required

Year Ended December 31, 2016 2015 2014 14 S 176 190 380 (104) 276 $ 11 S 173 198 382 10 152 198 360 Cost of goods sold Research and development expense Selling, general and administrative expenses Stock-based compensation expense included in total costs and expenses Income tax effect (131) (64) 251 S 296 Stock-based compensation expense, net of tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started