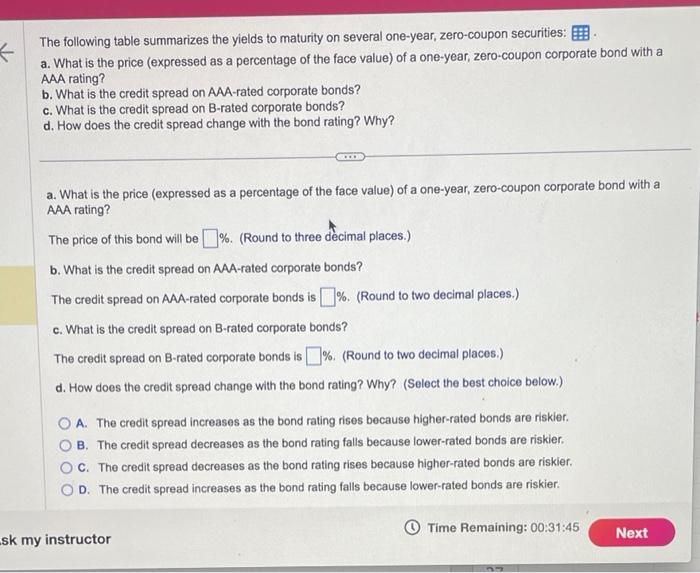

The following table summarizes the yields to maturity on several one-year, zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? b. What is the credit spread on AAA-rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? The price of this bond will be %. (Round to three decimal places.) b. What is the credit spread on AAA-rated corporate bonds? The credit spread on AAA-rated corporate bonds is \%. (Round to two decimal places.) c. What is the credit spread on B-rated corporate bonds? The credit spread on B-rated corporate bonds is \%. (Round to two decimal places.) d. How does the credit spread change with the bond rating? Why? (Select the best choice below.) A. The credit spread increases as the bond rating rises because higher-rated bonds are riskier. B. The credit spread decreases as the bond rating falls because lower-rated bonds are riskier. C. The credit spread decreases as the bond rating rises because higher-rated bonds are riskier. D. The credit spread increases as the bond rating falls because lower-rated bonds are riskier. sk my instructor (D) Time Remaining: 00:31:45 The following table summarizes the yields to maturity on several one-year, zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? b. What is the credit spread on AAA-rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? The price of this bond will be %. (Round to three decimal places.) b. What is the credit spread on AAA-rated corporate bonds? The credit spread on AAA-rated corporate bonds is \%. (Round to two decimal places.) c. What is the credit spread on B-rated corporate bonds? The credit spread on B-rated corporate bonds is \%. (Round to two decimal places.) d. How does the credit spread change with the bond rating? Why? (Select the best choice below.) A. The credit spread increases as the bond rating rises because higher-rated bonds are riskier. B. The credit spread decreases as the bond rating falls because lower-rated bonds are riskier. C. The credit spread decreases as the bond rating rises because higher-rated bonds are riskier. D. The credit spread increases as the bond rating falls because lower-rated bonds are riskier. sk my instructor (D) Time Remaining: 00:31:45