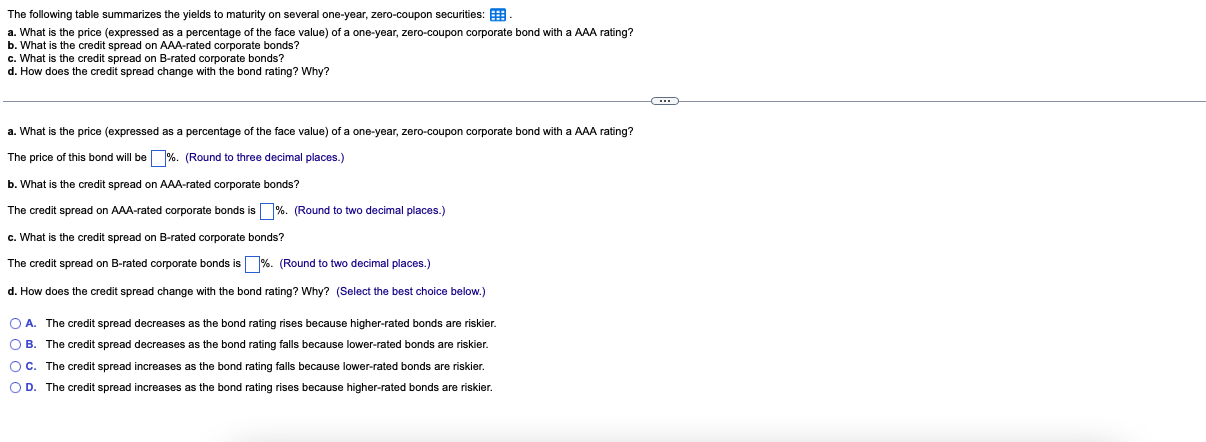

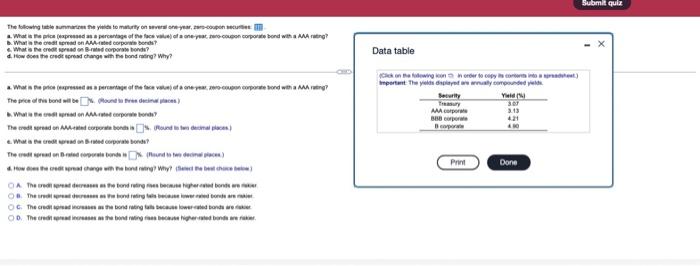

The following table summarizes the yields to maturity on several one-year, zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? b. What is the credit spread on AAA-rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? The price of this bond will be %. (Round to three decimal places.) b. What is the credit spread on AAA-rated corporate bonds? The credit spread on AAA-rated corporate bonds is %. (Round to two decimal places.) c. What is the credit spread on B-rated corporate bonds? The credit spread on B-rated corporate bonds is %. (Round to two decimal places.) d. How does the credit spread change with the bond rating? Why? (Select the best choice below.) O A. The credit spread decreases as the bond rating rises because higher-rated bonds are riskier. OB. The credit spread decreases as the bond rating falls because lower-rated bonds are riskier. OC. The credit spread increases as the bond rating falls because lower-rated bonds are riskier. OD. The credit spread increases as the bond rating rises because higher-rated bonds are riskier. The following table summarizes the yields to maturity on several one-year, zer-coupon cu What is the price expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? b. What is the credit spread on AAA-rated corporate bonds? What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? a. What is the price (expressed as a percentage of the face value of a one-year, zero-coupon corporate bond with a AAA rating? The price of this bond will be ound to free decinal places) What is the credit spread on AAA rated corporate bonds? The credit spread on AAA-rated corporate bonds is. Round to decimal places) What is the credit spread on rated corporate bonds? The credt spread on B-rated corporals bonds is (ound to deace) How does the credt spread change with the hond rating? Why? (eet the best choice b A The credit spread decreases as the bond rating rises because higher rated bonds ar OB. The credit spre decreases as the bond rating is because owered bonds are OC. The credit spread increases as the bond rating falls because lower-cated bod OD. The credit spread increases as the bond rating rises because higher-radbods are Data table on the flowing icon in order to copy its content into a spra important The yields displayed are annually compounded yields Security Yuld AAA corporat 888 corporat Bcorporate Print 3.07 3.13 421 Done Submit quiz