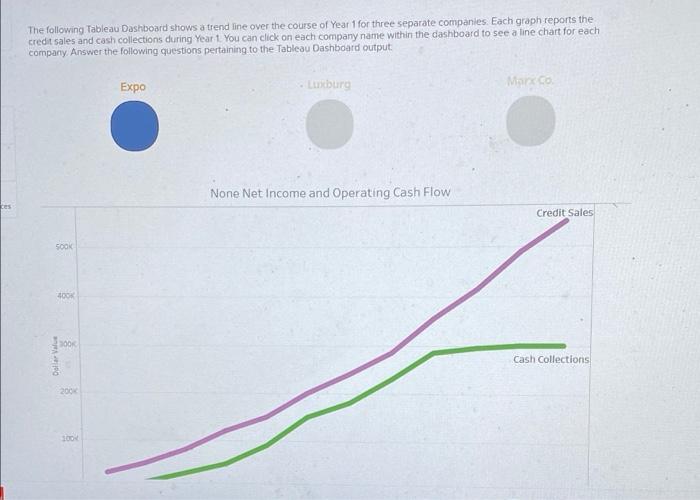

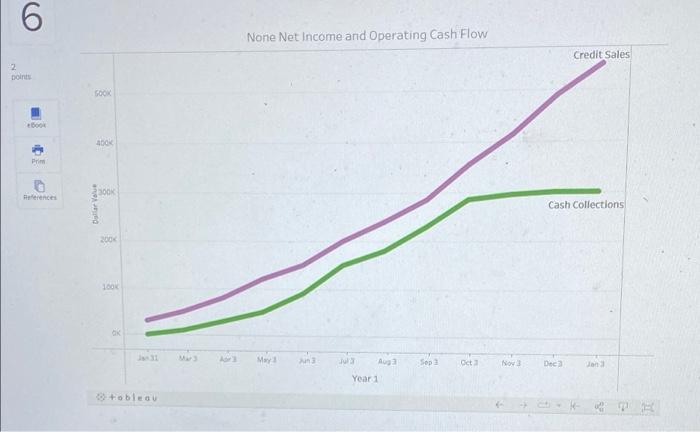

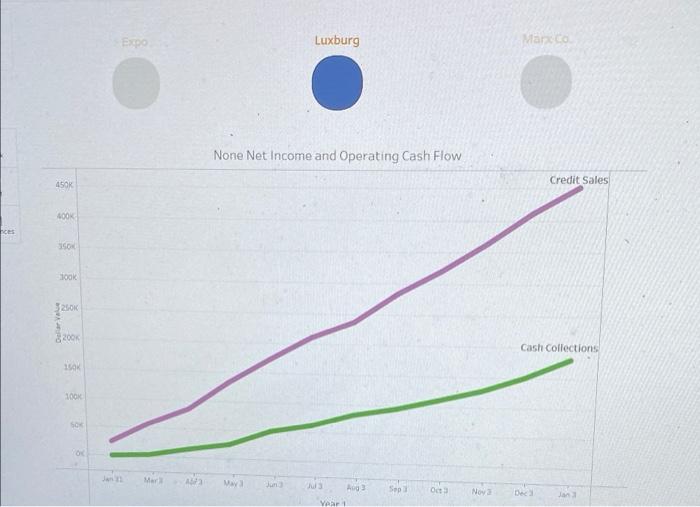

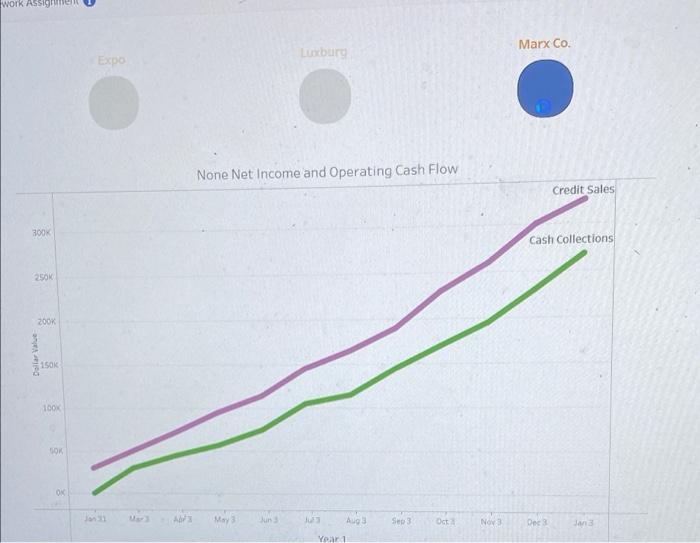

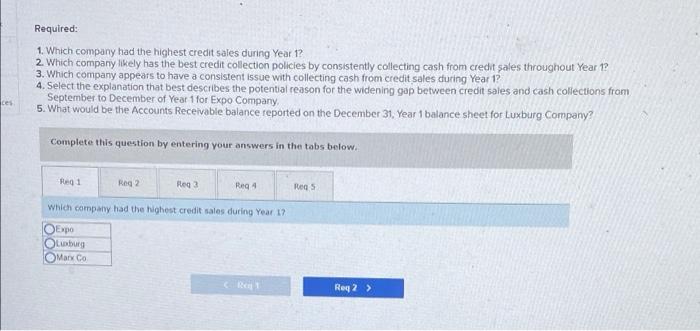

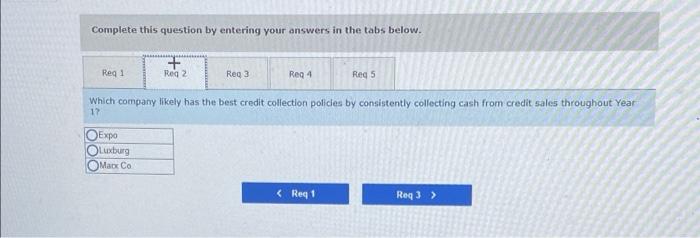

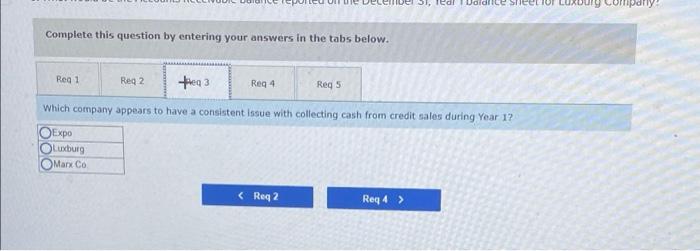

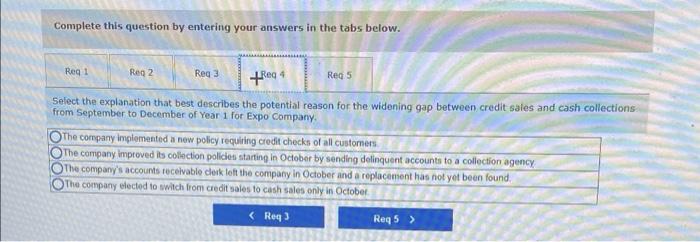

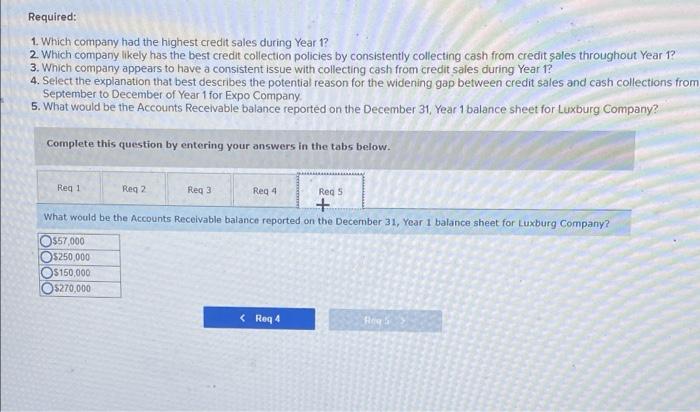

The following Tableau Dashboard shows a trend fine over the course of Year 1 for three separate companies. Each graph reports the credit sales and cash collections during Year 1 You can click on each company name within the dashboard to see a line chart for each a company. Answer the following questions pertaining to the Tableau Dashboard Output Expo tryburg Moro None Net Income and Operating Cash Flow Credit Sales SOOK 2008 1001 Cash Collections 200 6 None Net Income and Operating Cash Flow Credit Sales points SOO 600 60 Prim 3002 Blue Cash Collections 2004 May Sep Oct Now Deca an Jul Aug Year 1 +obleau Expo Luxburg Marco None Net Income and Operating Cash Flow 450K Credit Sales 400K TES 30 BOOK $2606 8200 Cash Collections 100% 50 Ag Spa Oct Nova VAR work Assigne Marx Co. Expo Luxburg None Net Income and Operating Cash Flow Credit Sales 300K Cash Collections 250 ZOOK 150k 100% OK ON AW May3 un Aus Se Oct No Dec Jan Year 1 Required: 1. Which company had the highest credit sales during Year 12 2. Which company likely has the best credit collection policies by consistently collecting cash from credit sales throughout Year 1? 3. Which company appears to have a consistent issue with collecting cash from credit sales during Year 12 4. Select the explanation that best describes the potential reason for the widening gap between credit sales and cash collections from September to December of Year 1 for Expo Company 5. What would be the Accounts Receivable balance reported on the December 31. Year 1 balance sheet for Luxburg Company? Complete this question by entering your answers in the tobs below. R1 Reg 2 Rega Rega Regs which company had the highest credit sales during Year 1? Expo Oborg Mary Co Re Req2 > Complete this question by entering your answers in the tabs below. + Reg2 Reg 1 Reg 3 Reg 4 Reg 5 Which company likely has the best credit collection policies by consistently collecting cash from credit sales throughout Year 17 OExpo Luxburg Max Co Si, Ted Waidrice shee Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 tega Reg 4 Reg 5 Which company appears to have a consistent issue with collecting cash from credit sales during Year 1? OExpo Luxburg Marx Co Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3 treg 4 Regs Select the explanation that best describes the potential reason for the widening gap between credit sales and cash collections from September to December of Year 1 for Expo Company The company implemented a new policy requiring credit checks of all customers The company improved its collection policies starting in October by sending delinquent accounts to a collection agency The company's accounts receivable clerk telt the company in October and a replacement has not yet been found. The company elected to switch from credit sales to cash sales only in October Required: 1. Which company had the highest credit sales during Year 1? 2. Which company likely has the best credit collection policies by consistently collecting cash from credit sales throughout Year 1? 3. Wnich company appears to have a consistent issue with collecting cash from credit sales during Year 1? 4. Select the explanation that best describes the potential reason for the widening gap between credit sales and cash collections from September to December of Year 1 for Expo Company 5. What would be the Accounts Receivable balance reported on the December 31, Year 1 balance sheet for Luxburg Company? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3 Reg 4 Reqs + What would be the Accounts Receivable balance reported on the December 31, Year 1 balance sheet for Luxburg Company? O$57,000 OS250,000 O$150,000 5270,000 & Req4 Hogs