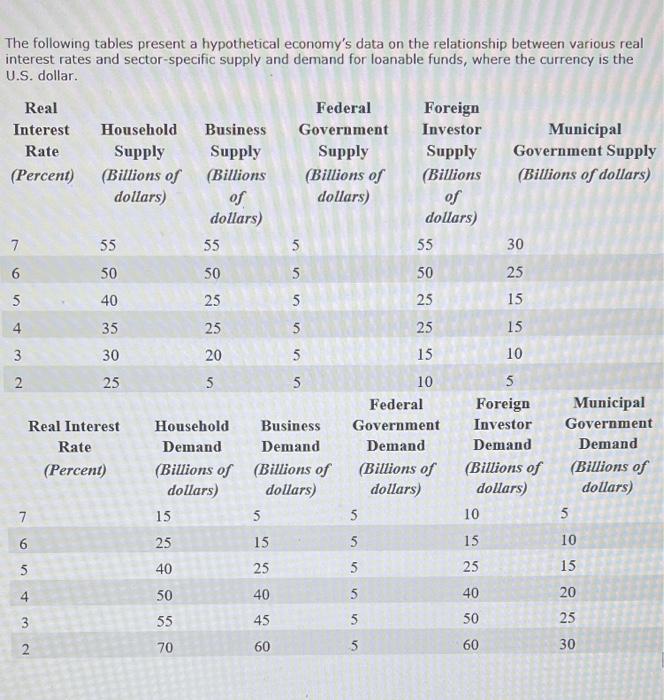

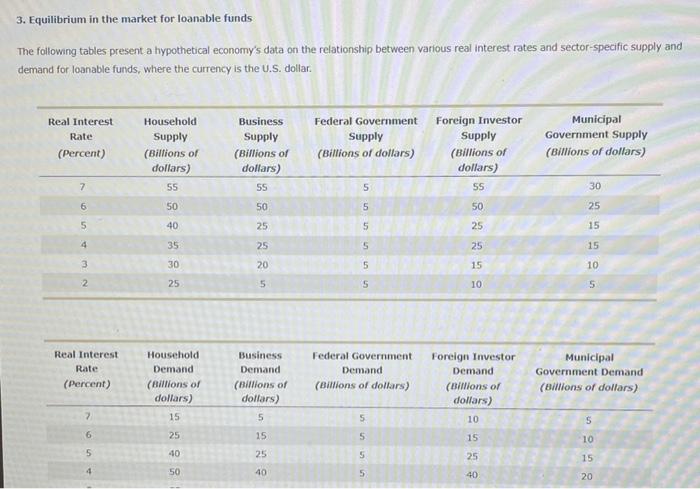

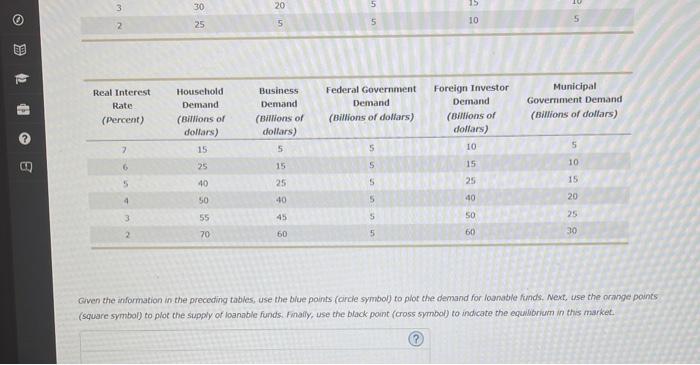

The following tables present a hypothetical economy's data on the relationship between various real interest rates and sector-specific supply and demand for loanable funds, where the currency is the U.S. dollar. Real Federal Foreign Interest Household Business Government Investor Municipal Rate Supply Supply Supply Supply Government Supply (Percent) (Billions of (Billions (Billions of (Billions (Billions of dollars) dollars) of dollars) of dollars) dollars) 7 55 55 5 55 30 6 50 50 50 25 15 5 40 25 5 25 4 35 25 5 5 5 5 5 5 25 15 3 30 5 10 20 5 2 25 5 Real Interest Rate (Percent) Household Business Demand Demand (Billions of (Billions of dollars) dollars) 15 5 15 10 Federal Government Demand (Billions of dollars) 5 5 Foreign Investor Demand (Billions of dollars) 10 15 Municipal Government Demand (Billions of dollars) 5 7 6 25 15 10 5 5 5 40 25 25 15 50 40 5 40 20 3 55 45 5 50 25 2 70 60 60 30 3. Equilibrium in the market for loanable funds The following tables present a hypothetical economy's data on the relationship between various real interest rates and sector-specific supply and demand for loanable funds, where the currency is the U.S. dollar Real Interest Rate (Percent) Household Supply (Billions of dollars) 55 Business Supply (Billions of dollars) 55 Federal Government Foreign Investor Supply Supply (Billions of dollars) (Billions of dollars) 5 SS Municipal Government Supply (Billions of dollars) 7 30 6 50 50 5 50 25 5 40 25 5 25 15 4 35 25 5 25 15 3 30 20 5 15 10 2 25 5 5 10 5 Real Interest Rate (Percent) Household Demand (Billions of dollars) 15 Business Demand (Billions of dollars) 5 Federal Government Demand (Billions of dollars) Foreign Investor Demand (Billions of dollars) Municipal Government Demand (Billions of dollars) 7 5 10 5 6 25 15 5 15 10 5 40 25 5 25 15 4 50 40 5 40 20 30 20 5 15 2 25 5 10 5 09 Real Interest Rate (Percent) Household Demand (Billions of dollars) EP Business Demand (Billions of dollars) 5 Federal Government Demand (Billions of dollars) Foreign Investor Demand (Billions of dollars) 10 Municipal Government Demand (Billions of dollars) 2 15 5 5 10 B 6 25 15 5 5 40 25 15 5 25 40 50 4 40 5 20 25 3 5 45 55 70 60 5 60 30 Given the information in the preceding tables, use the blue points (orcie symbol) to plor the demand for loanable funds. Next, use the orange points (square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market. The following tables present a hypothetical economy's data on the relationship between various real interest rates and sector-specific supply and demand for loanable funds, where the currency is the U.S. dollar. Real Federal Foreign Interest Household Business Government Investor Municipal Rate Supply Supply Supply Supply Government Supply (Percent) (Billions of (Billions (Billions of (Billions (Billions of dollars) dollars) of dollars) of dollars) dollars) 7 55 55 5 55 30 6 50 50 50 25 15 5 40 25 5 25 4 35 25 5 5 5 5 5 5 25 15 3 30 5 10 20 5 2 25 5 Real Interest Rate (Percent) Household Business Demand Demand (Billions of (Billions of dollars) dollars) 15 5 15 10 Federal Government Demand (Billions of dollars) 5 5 Foreign Investor Demand (Billions of dollars) 10 15 Municipal Government Demand (Billions of dollars) 5 7 6 25 15 10 5 5 5 40 25 25 15 50 40 5 40 20 3 55 45 5 50 25 2 70 60 60 30 3. Equilibrium in the market for loanable funds The following tables present a hypothetical economy's data on the relationship between various real interest rates and sector-specific supply and demand for loanable funds, where the currency is the U.S. dollar Real Interest Rate (Percent) Household Supply (Billions of dollars) 55 Business Supply (Billions of dollars) 55 Federal Government Foreign Investor Supply Supply (Billions of dollars) (Billions of dollars) 5 SS Municipal Government Supply (Billions of dollars) 7 30 6 50 50 5 50 25 5 40 25 5 25 15 4 35 25 5 25 15 3 30 20 5 15 10 2 25 5 5 10 5 Real Interest Rate (Percent) Household Demand (Billions of dollars) 15 Business Demand (Billions of dollars) 5 Federal Government Demand (Billions of dollars) Foreign Investor Demand (Billions of dollars) Municipal Government Demand (Billions of dollars) 7 5 10 5 6 25 15 5 15 10 5 40 25 5 25 15 4 50 40 5 40 20 30 20 5 15 2 25 5 10 5 09 Real Interest Rate (Percent) Household Demand (Billions of dollars) EP Business Demand (Billions of dollars) 5 Federal Government Demand (Billions of dollars) Foreign Investor Demand (Billions of dollars) 10 Municipal Government Demand (Billions of dollars) 2 15 5 5 10 B 6 25 15 5 5 40 25 15 5 25 40 50 4 40 5 20 25 3 5 45 55 70 60 5 60 30 Given the information in the preceding tables, use the blue points (orcie symbol) to plor the demand for loanable funds. Next, use the orange points (square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market