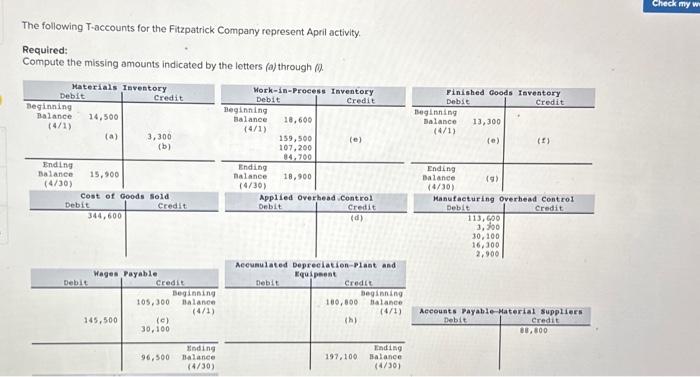

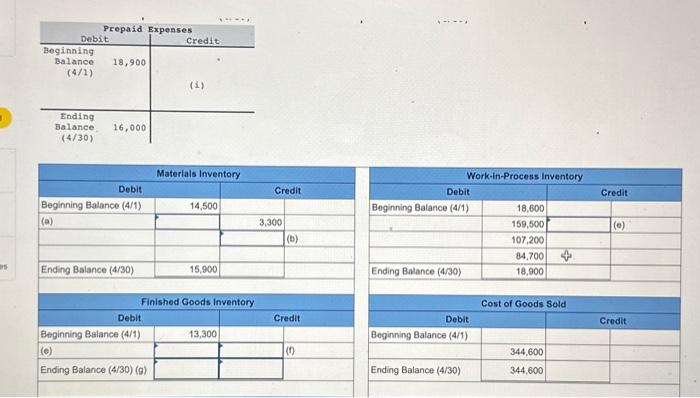

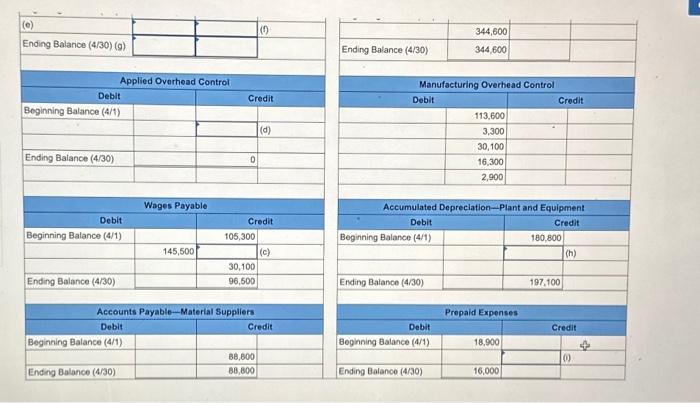

The following T-accounts for the Fitzpatrick Company represent April activity. Required: Compute the missing amounts indicated by the letters (a) through (0) \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Applied Ovarhead Control } \\ \hline \multicolumn{2}{|c|}{ Debit } & & \\ \hline Beginning Balance (4/1) & & & Credit \\ \hline & & & \\ \hline & & 0 & \\ \hline Ending Baiance (4/30) & & \\ \hline & & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline \multicolumn{3}{|c|}{ Wages Payable } \\ \hline \multicolumn{2}{|c|}{ Debit } & & \multicolumn{2}{|c|}{ Credit } \\ \hline Beginning Balance (4/1) & & 105,300 & \\ \hline & 145,500 & & (c) \\ \hline & & 30,100 & \\ \hline Ending Balance (4/30) & & 96,500 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c|}{ Accounts Payable-Materlal Suppliers } \\ \hline \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{|c|}{ Credit } \\ \hline Beginning Balance (4/1) & & \\ \hline & & 68,600 \\ \hline Ending Bolance (4/30) & & 88,800 \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \hline & 344,600 & \\ \hline Ending Balance (4/30) & 344,600 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline \multicolumn{3}{|c|}{ Manufacturing Overhead Control } \\ \hline \multicolumn{2}{|c|}{ Debit } & & \multicolumn{1}{|c|}{ Credit } \\ \hline & 113,600 & \\ \hline & 3,300 & & \\ \hline & 30,100 & & \\ \hline & 16,300 & & \\ \hline & 2,900 & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline \multicolumn{3}{|c|}{ Accumulated Depreciation-Plant and Equipment } \\ \hline \multicolumn{1}{|c|}{ Debit } & Credit \\ \hline Beginning Balance (4/1) & & 180,800 \\ \hline & & (h) \\ \hline & & 197,100 \\ \hline Ending Balance (4/30) & & \\ \hline & \\ \hline \end{tabular} The following T-accounts for the Fitzpatrick Company represent April activity. Required: Compute the missing amounts indicated by the letters (a) through (0) \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Applied Ovarhead Control } \\ \hline \multicolumn{2}{|c|}{ Debit } & & \\ \hline Beginning Balance (4/1) & & & Credit \\ \hline & & & \\ \hline & & 0 & \\ \hline Ending Baiance (4/30) & & \\ \hline & & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline \multicolumn{3}{|c|}{ Wages Payable } \\ \hline \multicolumn{2}{|c|}{ Debit } & & \multicolumn{2}{|c|}{ Credit } \\ \hline Beginning Balance (4/1) & & 105,300 & \\ \hline & 145,500 & & (c) \\ \hline & & 30,100 & \\ \hline Ending Balance (4/30) & & 96,500 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c|}{ Accounts Payable-Materlal Suppliers } \\ \hline \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{|c|}{ Credit } \\ \hline Beginning Balance (4/1) & & \\ \hline & & 68,600 \\ \hline Ending Bolance (4/30) & & 88,800 \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \hline & 344,600 & \\ \hline Ending Balance (4/30) & 344,600 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline \multicolumn{3}{|c|}{ Manufacturing Overhead Control } \\ \hline \multicolumn{2}{|c|}{ Debit } & & \multicolumn{1}{|c|}{ Credit } \\ \hline & 113,600 & \\ \hline & 3,300 & & \\ \hline & 30,100 & & \\ \hline & 16,300 & & \\ \hline & 2,900 & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline \multicolumn{3}{|c|}{ Accumulated Depreciation-Plant and Equipment } \\ \hline \multicolumn{1}{|c|}{ Debit } & Credit \\ \hline Beginning Balance (4/1) & & 180,800 \\ \hline & & (h) \\ \hline & & 197,100 \\ \hline Ending Balance (4/30) & & \\ \hline & \\ \hline \end{tabular}