Answered step by step

Verified Expert Solution

Question

1 Approved Answer

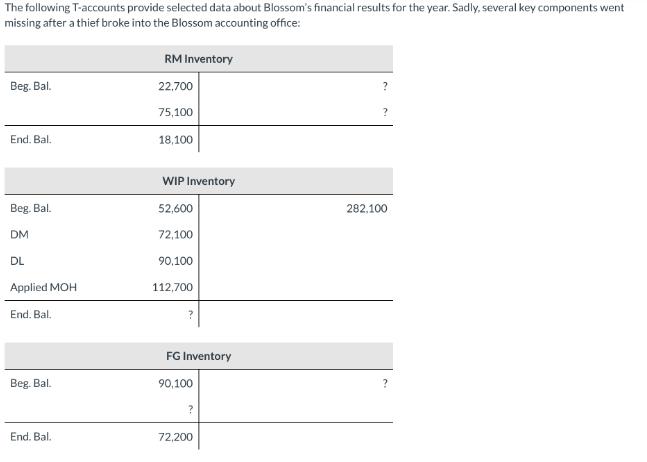

The following T-accounts provide selected data about Blossom's financial results for the year. Sadly, several key components went missing after a thief broke into

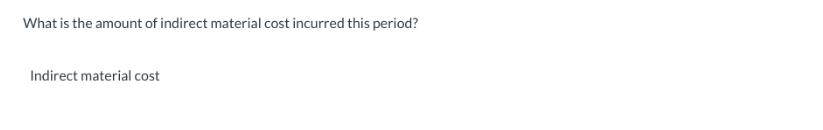

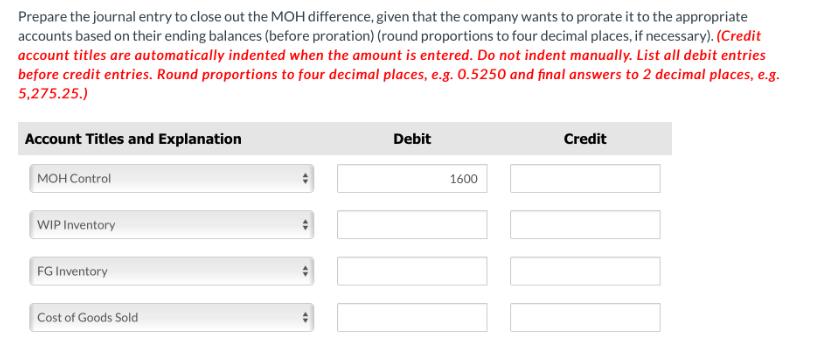

The following T-accounts provide selected data about Blossom's financial results for the year. Sadly, several key components went missing after a thief broke into the Blossom accounting office: Beg. Bal. End. Bal. Beg. Bal. DM DL Applied MOH End. Bal. Beg. Bal. End. Bal. RM Inventory 22,700 75,100 18,100 WIP Inventory 52,600 72,100 90,100 112,700 FG Inventory 90,100 ? 72,200 ? 282.100 What is the amount of indirect material cost incurred this period? Indirect material cost Specify whether MOH for the period was under- or overapplied, and by how much. MOH for the period was overapplied by $ Determine the COGS amount for this period (before any MOH difference would have been closed out). COGS $ Prepare the journal entry to close out the MOH difference, given that the company wants to prorate it to the appropriate accounts based on their ending balances (before proration) (round proportions to four decimal places, if necessary). (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Round proportions to four decimal places, e.g. 0.5250 and final answers to 2 decimal places, e.g. 5,275.25.) Account Titles and Explanation MOH Control WIP Inventory FG Inventory Cost of Goods Sold 4 Debit 1600 Credit

Step by Step Solution

★★★★★

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount of indirect material cost incurred this period we can calculate it by finding the difference in the Work in Process WIP Inventory account for direct materials Given that the be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started