Answered step by step

Verified Expert Solution

Question

1 Approved Answer

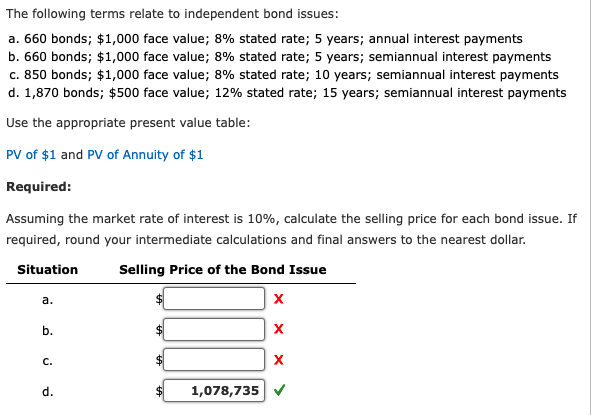

The following terms relate to independent bond issues: a. 660 bonds; $1,000 face value; 8% stated rate; 5 years; annual interest payments b. 660

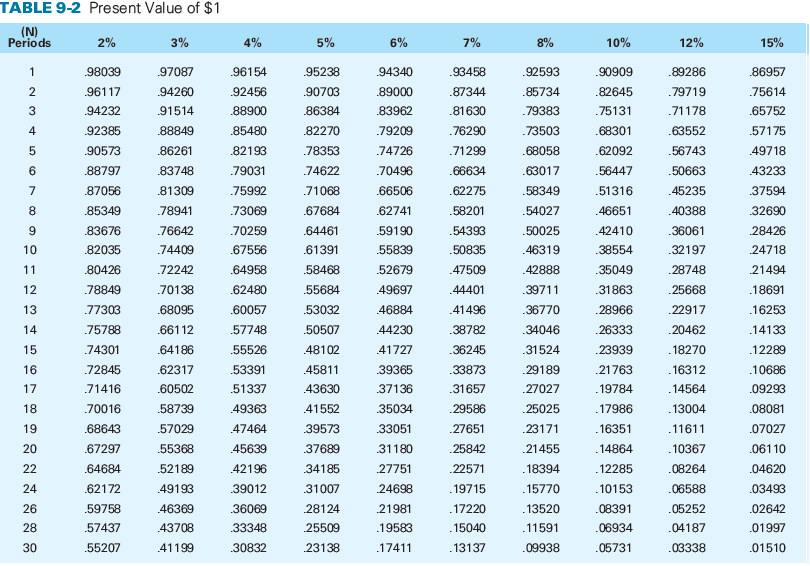

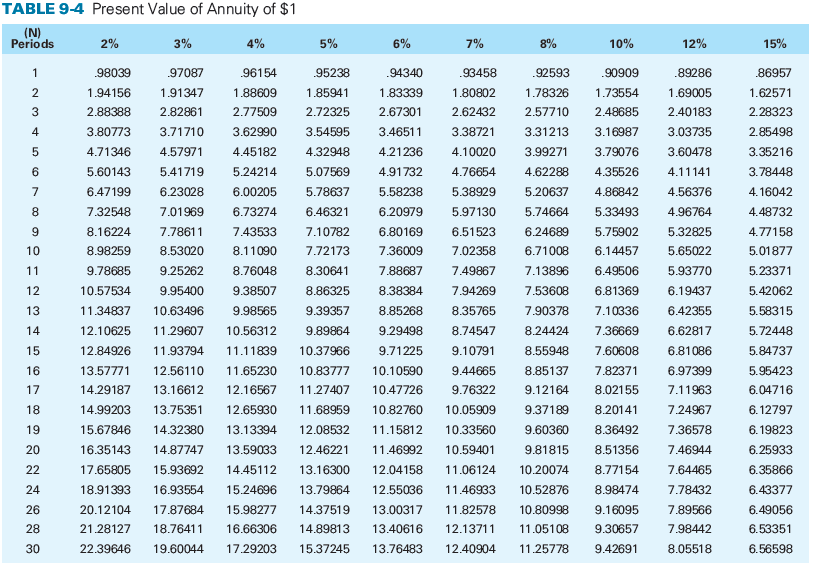

The following terms relate to independent bond issues: a. 660 bonds; $1,000 face value; 8% stated rate; 5 years; annual interest payments b. 660 bonds; $1,000 face value; 8% stated rate; 5 years; semiannual interest payments c. 850 bonds; $1,000 face value; 8% stated rate; 10 years; semiannual interest payments d. 1,870 bonds; $500 face value; 12% stated rate; 15 years; semiannual interest payments Use the appropriate present value table: PV of $1 and PV of Annuity of $1 Required: Assuming the market rate of interest is 10%, calculate the selling price for each bond issue. If required, round your intermediate calculations and final answers to the nearest dollar. Situation a. b. Selling Price of the Bond Issue $ x C. x d. 1,078,735 TABLE 9-2 Present Value of $1 (N) Periods 2% 3% 4% 5% 6% 7% 8% 10% 12% 15% 1 .98039 .97087 .96154 .95238 .94340 .93458 .92593 .90909 .89286 .86957 23 2 .96117 .94260 .92456 .90703 .89000 .87344 .85734 .82645 .79719 .75614 .94232 .91514 .88900 .86384 .83962 .81630 .79383 .75131 .71178 .65752 4 .92385 .88849 .85480 .82270 .79209 .76290 .73503 .68301 .63552 .57175 5 LO .90573 .86261 .82193 .78353 .74726 .71299 .68058 .62092 .56743 .49718 69 .88797 .83748 .79031 .74622 .70496 .66634 .63017 56447 .50663 43233 7 .87056 .81309 .75992 .71068 .66506 .62275 .58349 .51316 .45235 .37594 8 .85349 .78941 .73069 .67684 .62741 .58201 .54027 .46651 .40388 .32690 9 .83676 .76642 .70259 .64461 .59190 .54393 .50025 .42410 .36061 28426 10 .82035 74409 .67556 .61391 .55839 .50835 .46319 .38554 .32197 .24718 11 .80426 .72242 .64958 .58468 .52679 .47509 .42888 .35049 .28748 .21494 12 .78849 .70138 .62480 .55684 .49697 .44401 .39711 .31863 .25668 .18691 13 .77303 .68095 .60057 .53032 .46884 .41496 .36770 .28966 .22917 .16253 14 .75788 .66112 .57748 .50507 .44230 .38782 .34046 .26333 .20462 .14133 15 .74301 .64186 .55526 .48102 .41727 .36245 .31524 .23939 .18270 .12289 16 .72845 .62317 .53391 .45811 .39365 .33873 .29189 .21763 .16312 .10686 17 .71416 .60502 .51337 43630 .37136 .31657 .27027 .19784 .14564 .09293 18 .70016 .58739 .49363 .41552 .35034 .29586 .25025 .17986 .13004 .08081 19 .68643 .57029 .47464 .39573 .33051 .27651 .23171 .16351 .11611 .07027 20 .67297 .55368 45639 .37689 .31180 .25842 .21455 .14864 .10367 .06110 22 .64684 .52189 .42196 .34185 .27751 .22571 .18394 .12285 .08264 .04620 24 .62172 .49193 .39012 .31007 24698 .19715 .15770 .10153 .06588 .03493 26 .59758 .46369 .36069 28124 21981 .17220 .13520 .08391 .05252 .02642 28 .57437 .43708 .33348 .25509 .19583 .15040 .11591 .06934 .04187 .01997 30 .55207 41199 .30832 .23138 .17411 .13137 .09938 .05731 .03338 .01510 TABLE 9-4 Present Value of Annuity of $1 (N) Periods 2% 3% 4% 5% 6% 7% 8% 10% 12% 15% 1 .98039 .97087 .96154 .95238 .94340 .93458 .92593 .90909 .89286 .86957 2 1.94156 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.73554 1.69005 1.62571 3 2.88388 2.82861 2.77509 2.72325 2.67301 2.62432 2.57710 2.48685 2.40183 2.28323 4 3.80773 3.71710 3.62990 3.54595 3.46511 3.38721 3.31213 3.16987 3.03735 2.85498 5 4.71346 4.57971 4.45182 4.32948 4.21236 4.10020 3.99271 3.79076 3.60478 3.35216 6 5.60143 5.41719 5.24214 5.07569 4.91732 4.76654 4.62288 4.35526 4.11141 3.78448 7 6.47199 6.23028 6.00205 5.78637 5.58238 5.38929 5.20637 4.86842 4.56376 4.16042 8 7.32548 7.01969 6.73274 6.46321 6.20979 5.97130 5.74664 5.33493 4.96764 4.48732 9 8.16224 7.78611 7.43533 7.10782 6.80169 6.51523 6.24689 5.75902 5.32825 4.77158 10 8.98259 8.53020 8.11090 7.72173 7.36009 7.02358 6.71008 6.14457 5.65022 5.01877 11 9.78685 9.25262 8.76048 8.30641 7.88687 7.49867 7.13896 6.49506 5.93770 5.23371 12 10.57534 9.95400 9.38507 8.86325 8.38384 7.94269 7.53608 6.81369 6.19437 5.42062 13 11.34837 10.63496 9.98565 9.39357 8.85268 8.35765 7.90378 7.10336 6.42355 5.58315 14 12.10625 11.29607 10.56312 9.89864 9.29498 8.74547 8.24424 7.36669 6.62817 5.72448 15 12.84926 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 7.60608 6.81086 5.84737 16 17 13.57771 14.29187 13.16612 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137 7.82371 6.97399 5.95423 12.16567 11.27407 10.47726 9.76322 9.12164 8.02155 7.11963 6.04716 18 14.99203 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 8.20141 7.24967 6.12797 19 15.67846 20 16.35143 22 24 26 28 21.28127 14.32380 13.13394 14.87747 17.65805 15.93692 14.45112 18.91393 16.93554 15.24696 13.79864 20.12104 17.87684 15.98277 18.76411 16.66306 12.08532 11.15812 10.33560 9.60360 8.36492 7.36578 6.19823 13.59033 12.46221 11.46992 10.59401 9.81815 8.51356 7.46944 6.25933 13.16300 12.04158 11.06124 10.20074 8.77154 7.64465 6.35866 12.55036 11.46933 10.52876 8.98474 7.78432 6.43377 14.37519 13.00317 11.82578 10.80998 9.16095 7.89566 6.49056 14.89813 13.40616 12.13711 11.05108 9.30657 7.98442 6.53351 30 22.39646 19.60044 17.29203 15.37245 13.76483 12.40904 11.25778 9.42691 8.05518 6.56598

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations to determine the selling price of each bond issue a 660 bonds 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663eaf07c3254_953302.pdf

180 KBs PDF File

663eaf07c3254_953302.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started