Question

The following total cost data are for Ralston Manufacturing Company, which has a normal capacity per period of 400,000 units of product that sell for

The following total cost data are for Ralston Manufacturing Company,

which has a normal capacity per period of 400,000 units of product that sell for $18 each. For the

foreseeable future, regular sales volume should continue at normal capacity of production

Solution 6.1

y-intercept 5 Total fixed costs of $5.000

Slope 5 Variable cost per unit of approximately $0.50 per water bottle cage

Total cost 5 ($0.50 3 # of water bottle cages) 1 $5,000

$25,000 5 $0.50 3 40,000 1 $5,000

Direct materials. . . . . . . . . . . . . . . . . . . . . . . . . $1,720,000

Direct labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,120,000

Variable overhead . . . . . . . . . . . . . . . . . . . . . . 560,000

Fixed overhead (Note 1). . . . . . . . . . . . . . . . . . 880,000

Selling expense (Note 2) . . . . . . . . . . . . . . . . . 720,000

Administrative expense (fixed) 200,000

$5,200,000

Notes:

1. Beyond normal capacity, fixed overhead cost increases $30,000 for each 20,000 units or fraction

thereof until a maximum capacity of 640,000 units is reached.

2. Selling expenses are a 10% sales commission. Ralston pays only one-half of the regular sales

commission rates on any sale of 20,000 or more units.

Ralstons sales manager has received a special order for 48,000 units from a large discount chain at a

special price of $16 each, F.O.B. factory. The controllers office has furnished the following additional

cost data related to the special order:

1. Changes in the products construction will reduce direct materials $1.80 per unit.

2. Special processing will add 25% to the per-unit direct labor costs.

3. Variable overhead will continue at the same proportion of direct labor costs.

4. Other costs should not be affected.

Required

a. Present an analysis supporting a decision to accept or reject the special order. Assume Ralstons

regular sales are not affected by this special order.

b. What is the lowest unit sales price Ralston could receive and still make a before-tax profit of

$39,600 on the special order?

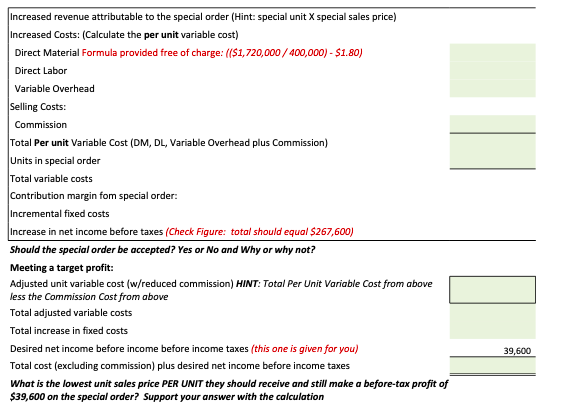

Increased revenue attributable to the special order (Hint: special unit X special sales price) Increased Costs: (Calculate the per unit variable cost) Direct Material Formula provided free of charge: ((1,720,000 / 400,000) - $1.80) Direct Labor Variable Overhead Selling Costs: Commission Total Per unit Variable Cost (DM, DL, Variable Overhead plus Commission) Units in special order Total variable costs Contribution margin fom special order: Incremental fixed costs Increase in net income before taxes (Check Figure: total should equal $267,600) Should the special order be accepted? Yes or No and Why or why not? Meeting a target profit: Adjusted unit variable cost (w/reduced commission) HINT: Total Per Unit Variable Cost from above less the Commission Cost from above Total adjusted variable costs Total increase in fixed costs Desired net income before income before income taxes (this one is given for you) Total cost (excluding commission) plus desired net income before income taxes What is the lowest unit sales price PER UNIT they should receive and still make a before-tax profit of $39,600 on the special order? Support your answer with the calculation 39,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started