Answered step by step

Verified Expert Solution

Question

1 Approved Answer

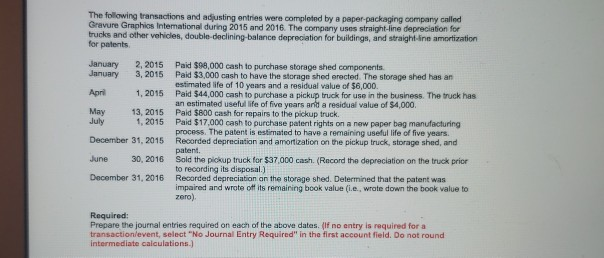

The following transactions and adjusting entries were comploted by a paper-packaging company called Gravure Graphios International during 2015 and 2016. The company uses straight-ine depreciation

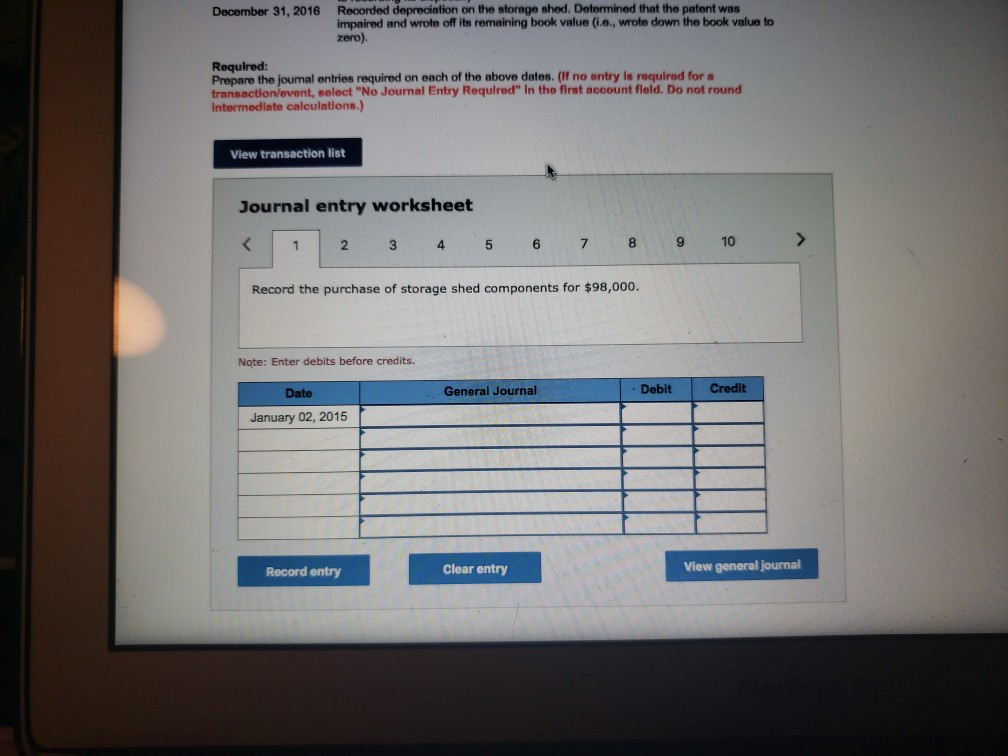

The following transactions and adjusting entries were comploted by a paper-packaging company called Gravure Graphios International during 2015 and 2016. The company uses straight-ine depreciation for trucks and other vehicles, double-declining-balance depreciation for buildings, and straight-ine amortization for patents January 2,2015 Paid $98,000 cash to purchase storage shed components January 3, 2015 Paid $3,000 cash to have the storage shed erected. The storage shed has an estimated life of 10 years and a residual value of $6,000. Apri 1, 2015 Paid $44,000 cash to purchase a pickup truck for use in the business. The truck has an estimated useful life of five years and a residual value of $4,000. Paid $800 cash for repairs to the pickup truck. Paid $17,000 cash to purchase patent rights on a new paper bag manufacturing process. The patent is estimated to have a remaining useful life of five years. Recorded depreciation and amortization on the pickup truck, storage shed, and patent. Sold the pickup truck for $37,000 cash. (Record the depreciation on the truck pricr to recording its disposal.) Recorded depreciation an the storage shed. Determined that the patent was impaired and wrote off its remaining book value (i.e, wrote down the book value to zero). May July 13, 2015 1, 2015 December 31, 2015 June 30, 2016 December 31, 2016 Required: Prepare the journal entries required on each of the above dates. (If no entry is required for a transactionlevent, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) Recorded deprecintion on the storage shed. Determined that the patent was impaired and wrote off its remaining book value (i.e., wrote down the book value to zero). December 31, 2016 Required: Prepare the joumal entries required on each of the above dates. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account fleld. Do not round Intermediate calculations.) View transaction list Journal entry worksheet 10 Record the purchase of storage shed components for $98,000 Note: Enter debits before credits. Date General Journal Debit Credit January 02, 2015 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started