Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following transactions and events affecting Canning Country General Fund took place during the fiscal year ended June 30, 2006: The following annual budget was

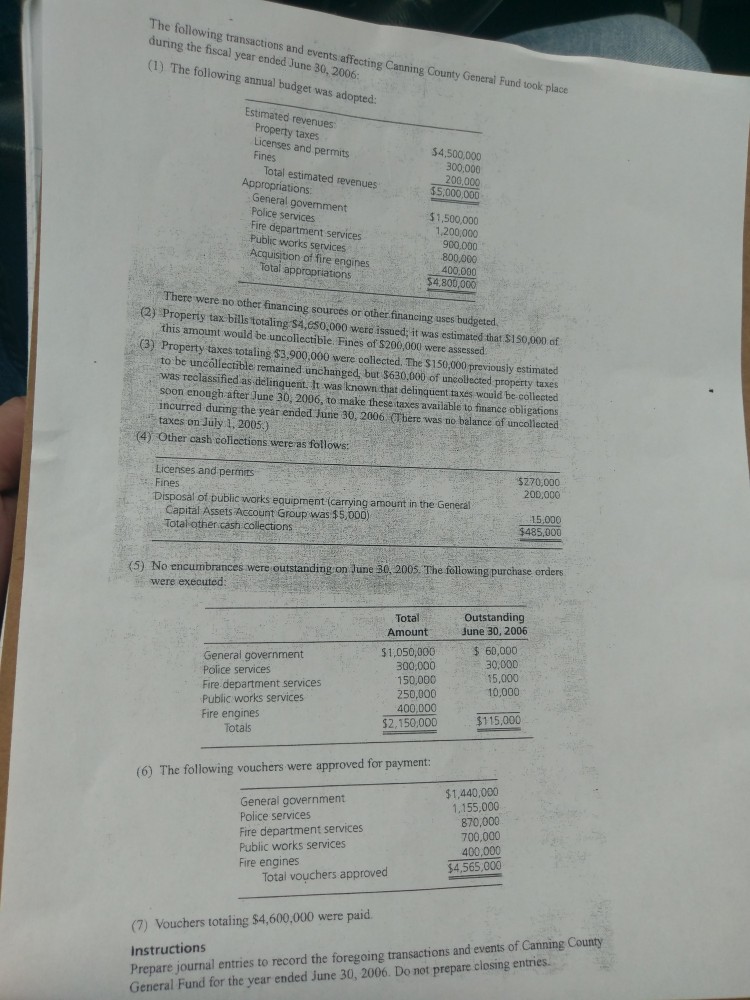

The following transactions and events affecting Canning Country General Fund took place during the fiscal year ended June 30, 2006: The following annual budget was adopted: There were no other financing sources or other financing uses budgeted. Property tax bills totaling $4, 050,000 were issued; it was estimated that $150,000 of this amount would be uncollectible. Fines of $200,000 were assessed. Property taxes totaling $3, 900,000 were collected. The $150,000 previously estimated to be uncollectible remained unchanged, but $630,000 of uncollected property taxes was reclassified as delinquent. It was known that delinquent taxes would be collected soon enough after June 30, 2006, to make these taxes available to finance obligations incurred during the year ended June 30, 2006. (There was no balance of uncollected taxes on July 1, 2005.) Other cash collections were as follows: No encumbrances were outstanding on June 30, 2005. The following purchase orders weer executed: The following vouchers were approved for payment: Vouchers totaling $4, 600,000 were paid

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started