Answered step by step

Verified Expert Solution

Question

1 Approved Answer

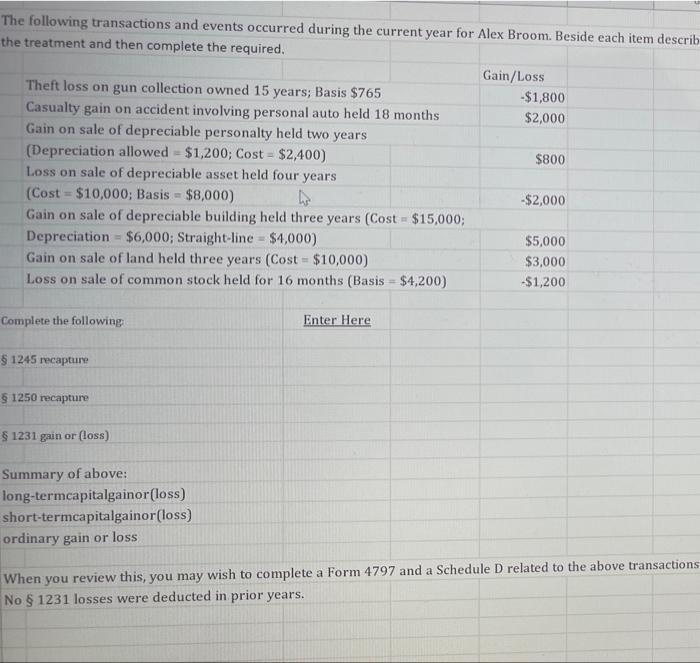

The following transactions and events occurred during the current year for Alex Broom. Beside each item describ the treatment and then complete the required.

The following transactions and events occurred during the current year for Alex Broom. Beside each item describ the treatment and then complete the required. Theft loss on gun collection owned 15 years; Basis $765 Casualty gain on accident involving personal auto held 18 months Gain on sale of depreciable personalty held two years (Depreciation allowed = $1,200; Cost = $2,400) Loss on sale of depreciable asset held four years (Cost = $10,000; Basis $8,000) Gain on sale of depreciable building held three years (Cost = $15,000; Depreciation = $6,000; Straight-line - $4,000) Gain on sale of land held three years (Cost = $10,000) Loss on sale of common stock held for 16 months (Basis = $4,200) Complete the following: 1245 recapture 1250 recapture 1231 gain or (loss) Summary of above: long-termcapitalgainor (loss) short-termcapitalgainor (loss) ordinary gain or loss Enter Here Gain/Loss -$1,800 $2,000 $800 -$2,000 $5,000 $3,000 -$1,200 When you review this, you may wish to complete a Form 4797 and a Schedule D related to the above transactions No 1231 losses were deducted in prior years.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Theft loss on gun collection owned 15 years Basis 765 Casualty gain on accident involvi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started