Question

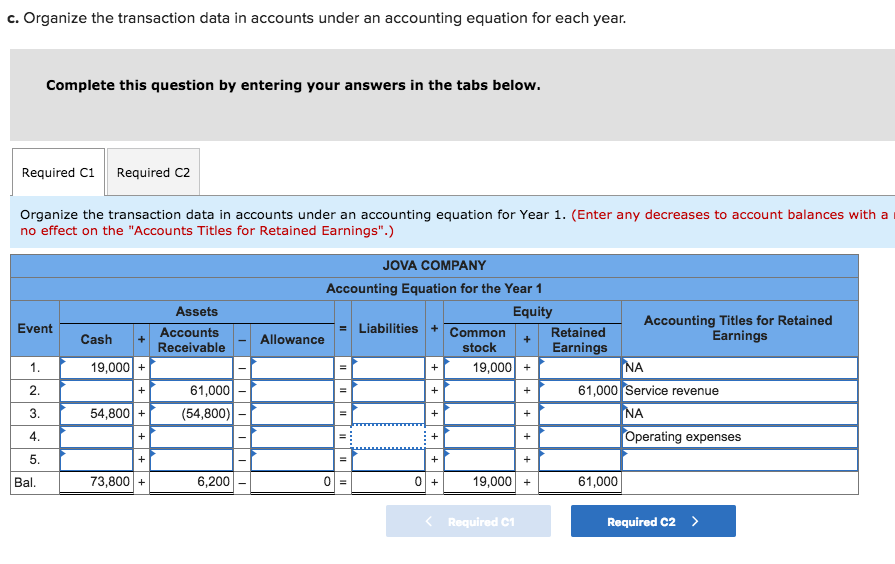

The following transactions apply to Jova Company for Year 1, the first year of operation: Issued $19,000 of common stock for cash. Recognized $61,000 of

The following transactions apply to Jova Company for Year 1, the first year of operation:

Issued $19,000 of common stock for cash.

Recognized $61,000 of service revenue earned on account.

Collected $54,800 from accounts receivable.

Paid operating expenses of $37,400.

Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account.

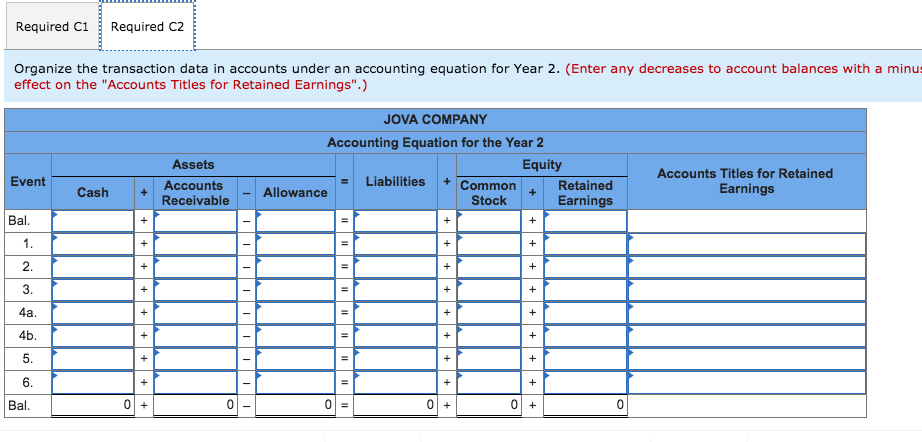

The following transactions apply to Jova for Year 2:

Recognized $68,500 of service revenue on account.

Collected $62,800 from accounts receivable.

Determined that $820 of the accounts receivable were uncollectible and wrote them off.

Collected $100 of an account that had previously been written off.

Paid $47,700 cash for operating expenses.

Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1 percent of sales on account.

Required Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started