Question

The following transactions apply to Ozark Sales for 2018: 1.The business was started when the company received $48,500 from the issue of common stock. 2.Purchased

The following transactions apply to Ozark Sales for 2018: 1.The business was started when the company received $48,500 from the issue of common stock. 2.Purchased equipment inventory of $174,000 on account. 3.Sold equipment for $206,000 cash (not including sales tax). Sales tax of 7 percent is collected when the merchandise is sold. The merchandise had a cost of $131,000. 4.Provided a six-month warranty on the equipment sold. Based on industry estimates, the warranty claims would amount to 4 percent of sales. 5.Paid the sales tax to the state agency on $156,000 of the sales. 6.On September 1, 2018, borrowed $20,500 from the local bank. The note had a 5 percent interest rate and matured on March 1, 2019. 7.Paid $5,600 for warranty repairs during the year. 8.Paid operating expenses of $54,500 for the year. 9.Paid $125,600 of accounts payable. 10.Recorded accrued interest on the note issued in transaction no. 6.

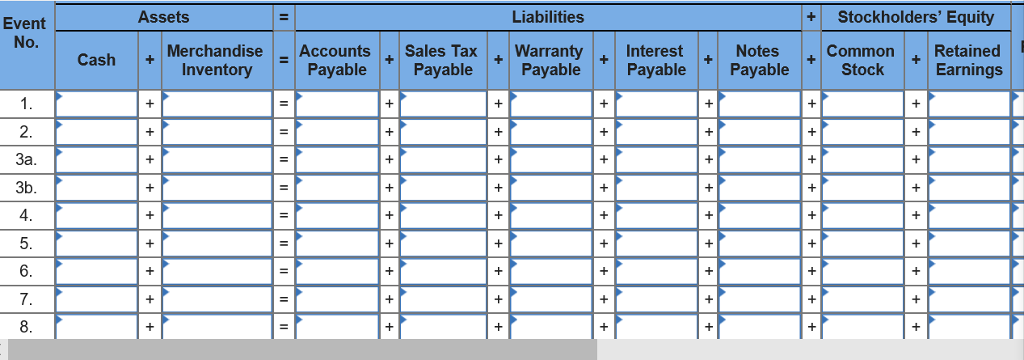

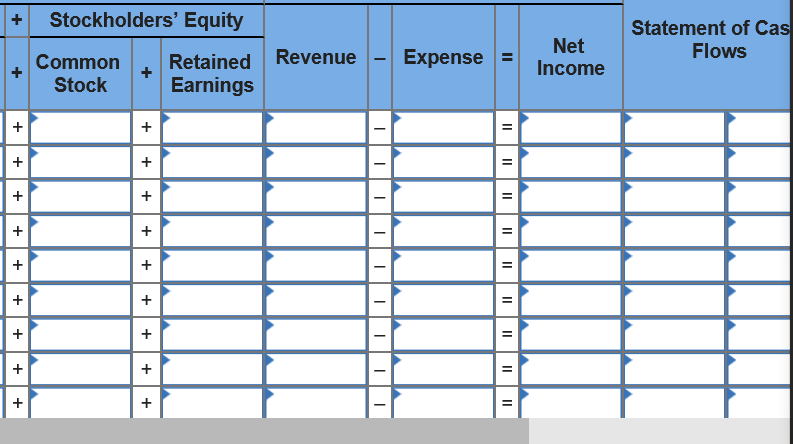

A. Record the given transactions in a horizontal statements model like the following one. (Enter any decreases to account balances and cash outflows with a minus sign. "In the Cash Flow column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA) and NA for not affected. Do not round intermediate calculations and round your answers to the nearest whole dollar amount.)

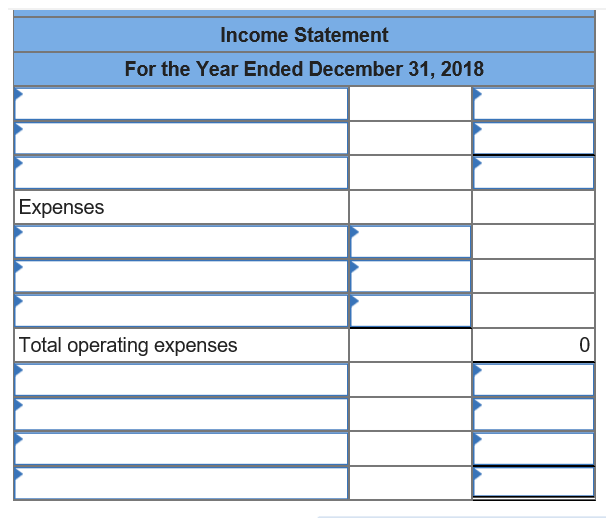

B1.Prepare the income statement for 2018. (Do not round intermediate calculations and round your answers to the nearest whole dollar amount.)

B2. Prepare the balance sheet for 2018. (Do not round intermediate calculations and round your answers to the nearest whole dollar amount.)

B3. Prepare the statement of cash flows for 2018. (Do not round intermediate calculations and round your answers to the nearest whole dollar amount. Amounts to be deducted should be indicated with a minus sign.)

C. What is the total amount of current liabilities at December 31, 2018? (Do not round intermediate calculations and round your answer to the nearest whole dollar amount.)

Event Assets Liabilities +Stockholders' Equity 0 MerchandiseAccounts Sales Tax. Warranty Interest Retained Earnings Inventory Payable Payable Payable ayable +Common ayable Notes 2 3b 4 7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started