Question

The following transactions are from Ohlm Company. (Use 360 days a year.) Year 1 December 16 Accepted a(n) $12,900, 60-day, 7% note in granting Danny

The following transactions are from Ohlm Company. (Use 360 days a year.) Year 1

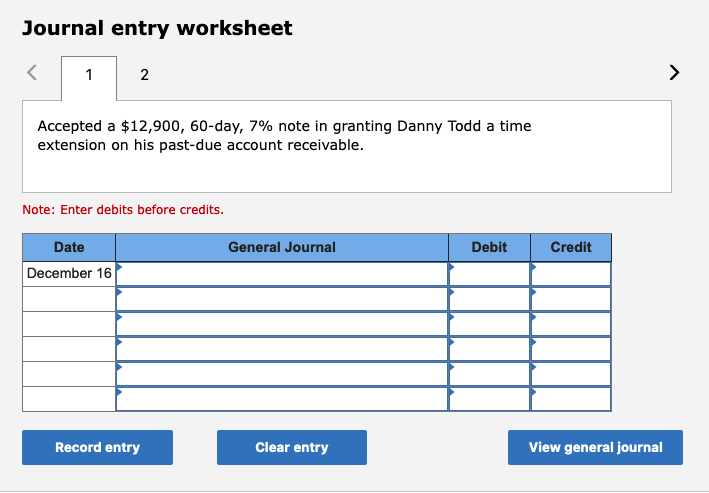

| December 16 | Accepted a(n) $12,900, 60-day, 7% note in granting Danny Todd a time extension on his past-due account receivable. |

|---|---|

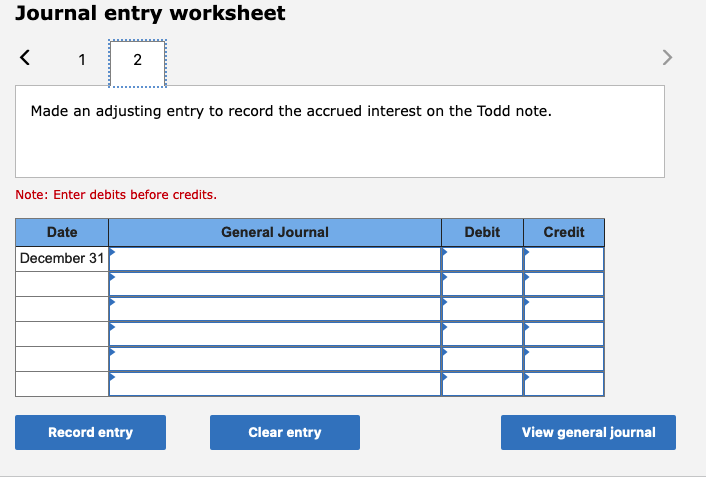

| December 31 | Made an adjusting entry to record the accrued interest on the Todd note. |

Year 2

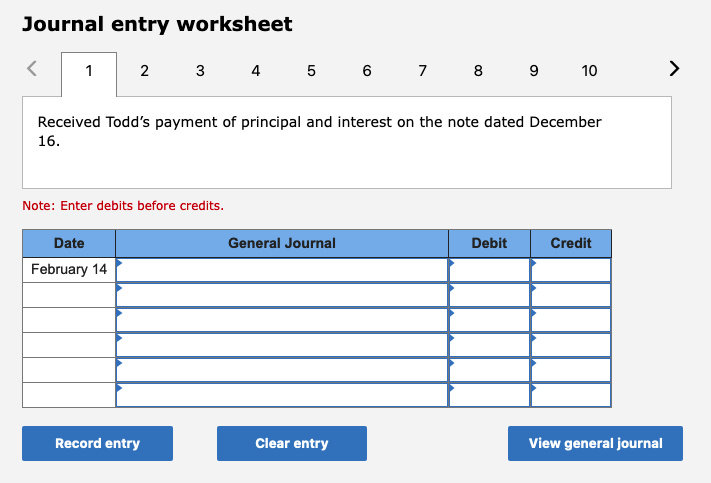

| February 14 | Received Todds payment of principal and interest on the note dated December 16. |

|---|---|

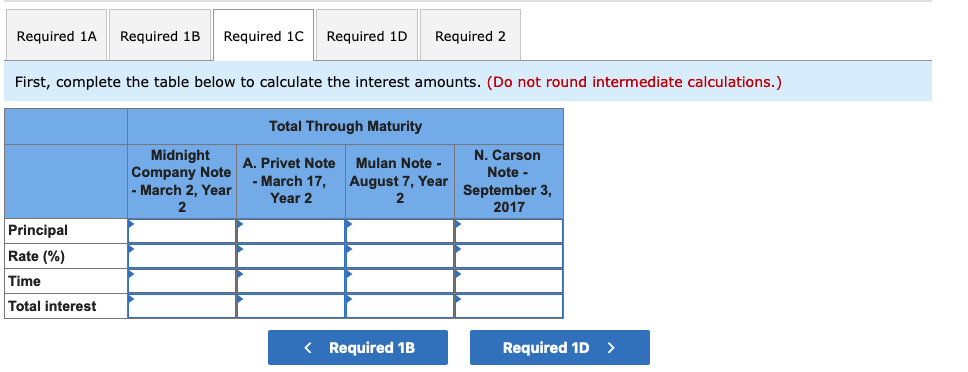

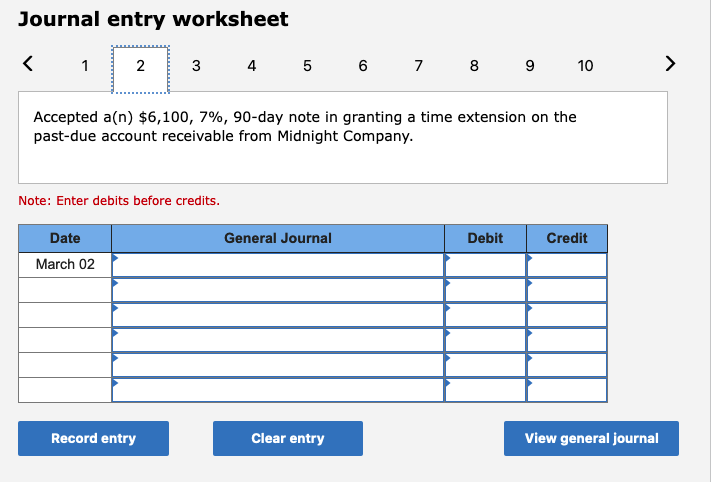

| March 2 | Accepted a(n) $6,100, 7%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. |

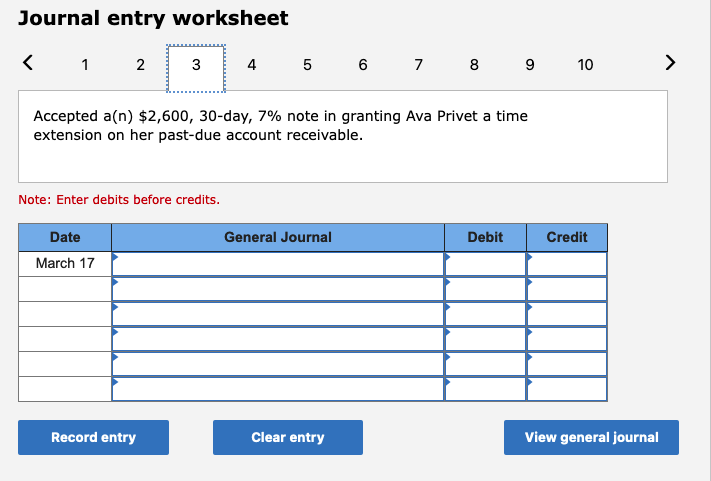

| March 17 | Accepted a $2,600, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. |

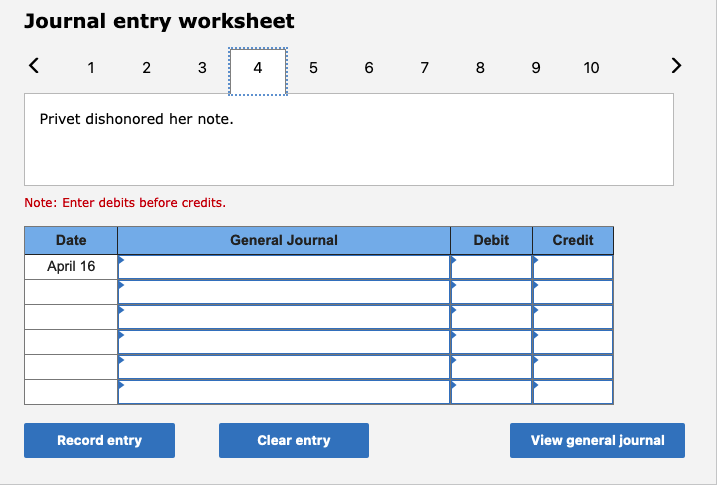

| April 16 | Privet dishonored her note. |

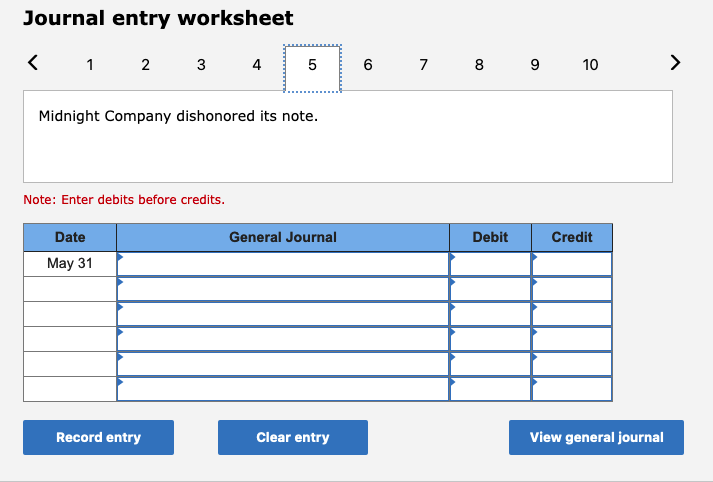

| May 31 | Midnight Company dishonored its note. |

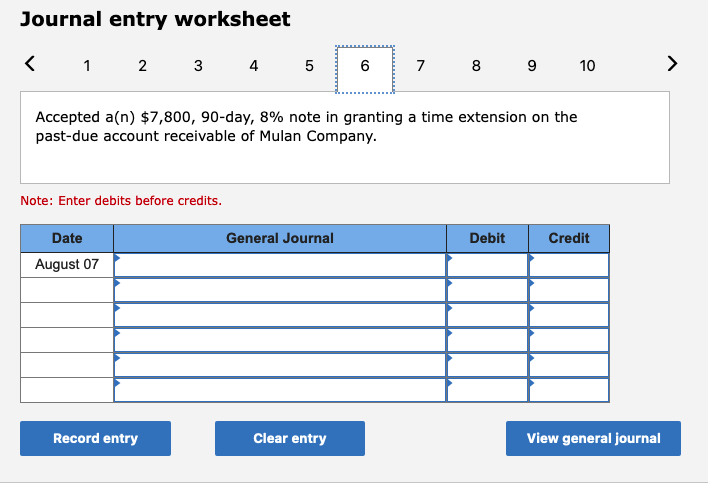

| August 7 | Accepted a(n) $7,800, 90-day, 8% note in granting a time extension on the past-due account receivable of Mulan Company. |

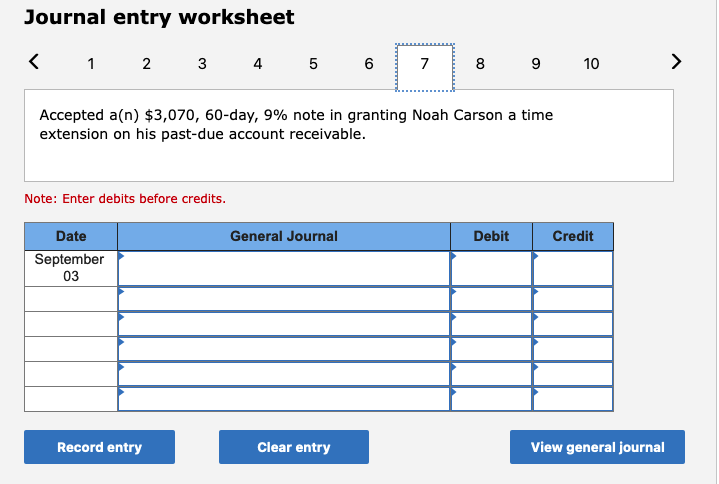

| September 3 | Accepted a $3,070, 60-day, 9% note in granting Noah Carson a time extension on his past-due account receivable. |

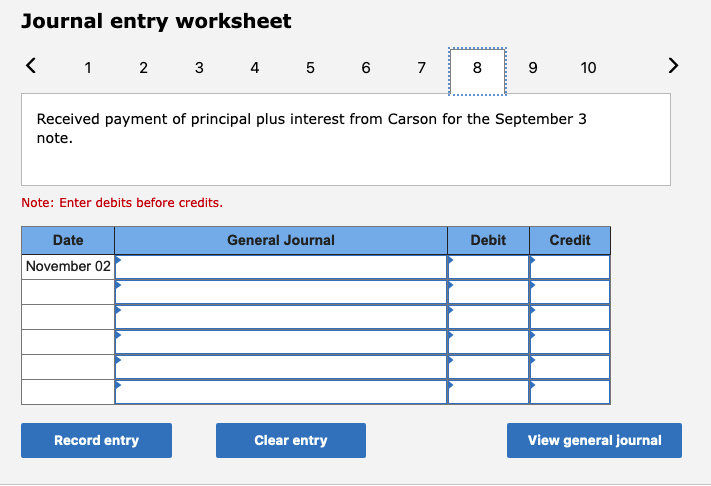

| November 2 | Received payment of principal plus interest from Carson for the September 3 note. |

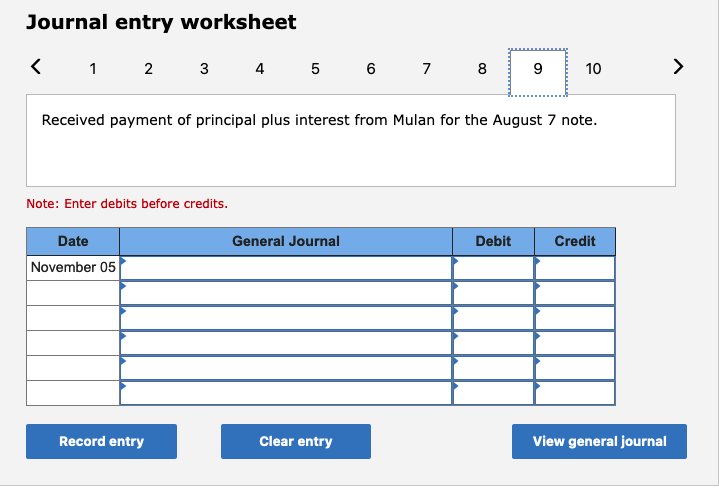

| November 5 | Received payment of principal plus interest from Mulan for the August 7 note. |

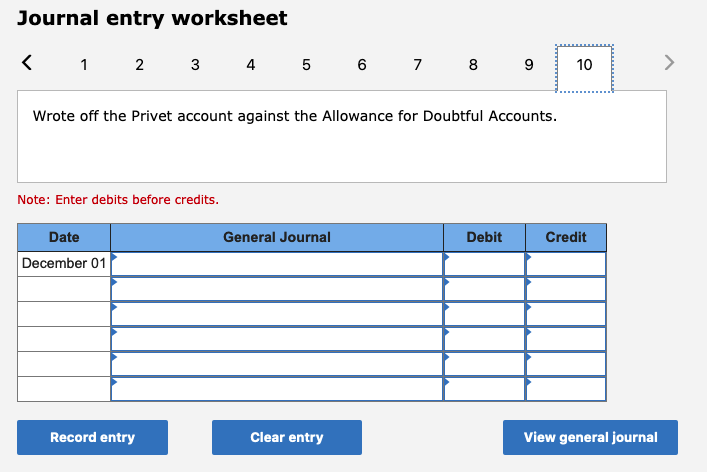

| December 1 | Wrote off the Privet account against the Allowance for Doubtful Accounts. |

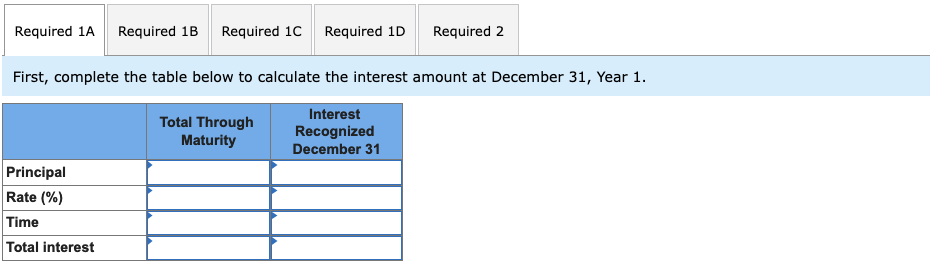

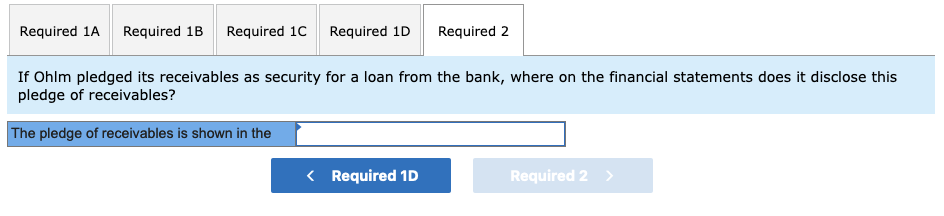

Required: 1-a. First, complete the table below to calculate the interest amount at December 31, Year 1. 1-b. Use the calculated value to prepare your journal entries for Year 1 transactions. 1-c. First, complete the table below to calculate the interest amounts. 1-d. Use those calculated values to make your journal entries for Year 2 transactions. 2. If Ohlm pledged its receivables as security for a loan from the bank, where on the financial statements does it disclose this pledge of receivables?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started