Answered step by step

Verified Expert Solution

Question

1 Approved Answer

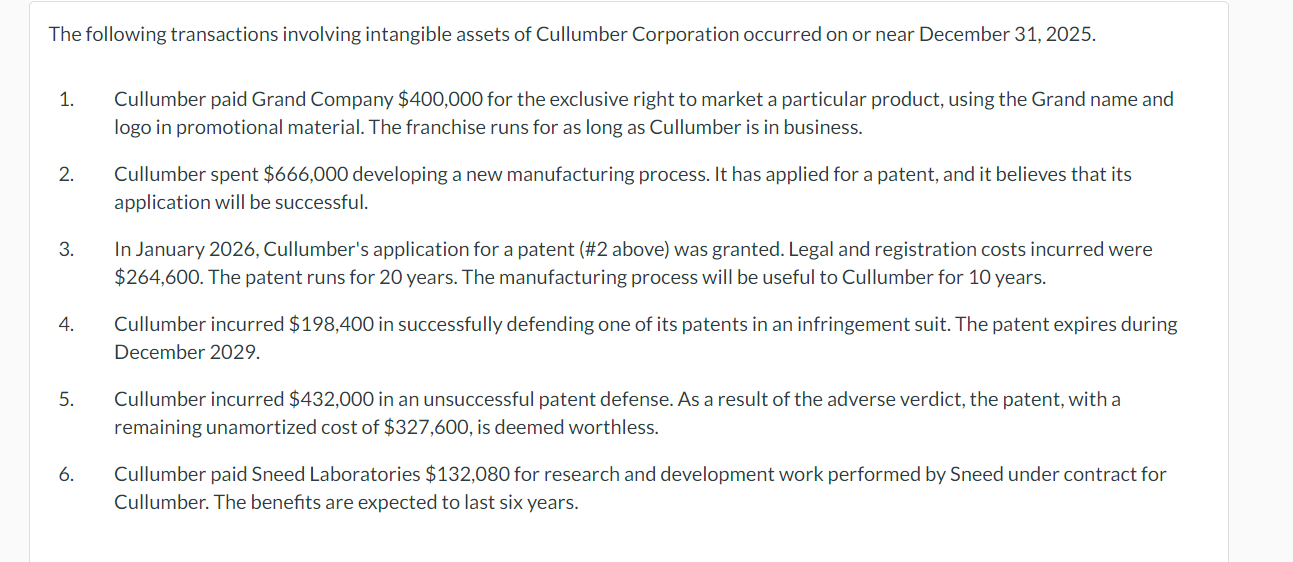

The following transactions involving intangible assets of Cullumber Corporation occurred on or near December 31, 2025. 1. Cullumber paid Grand Company $400,000 for the exclusive

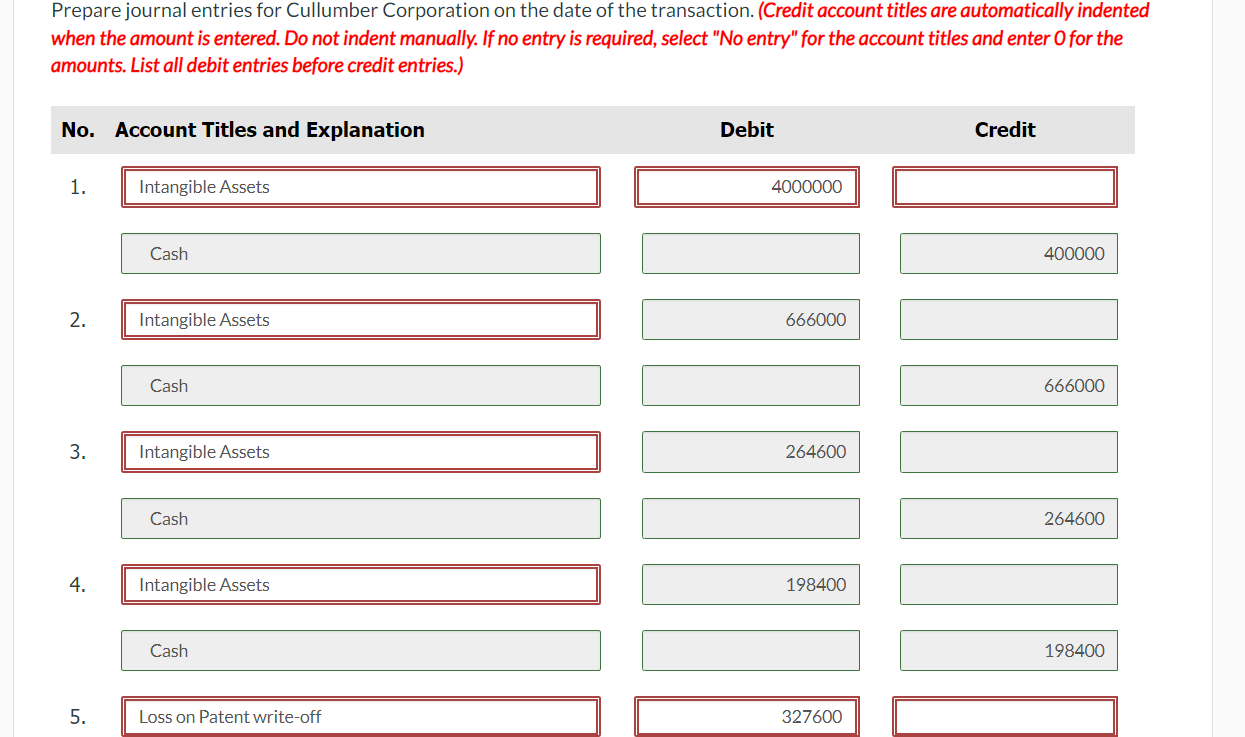

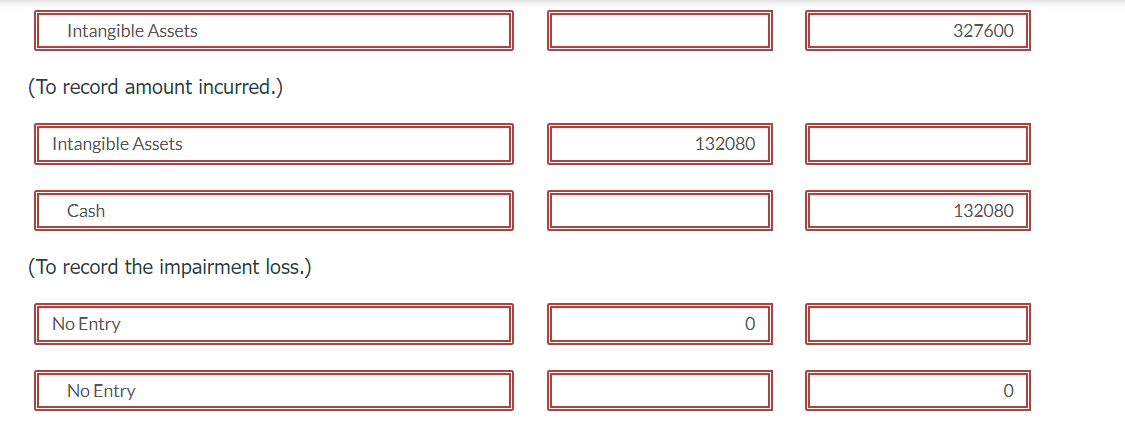

The following transactions involving intangible assets of Cullumber Corporation occurred on or near December 31, 2025. 1. Cullumber paid Grand Company $400,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Cullumber is in business. 2. Cullumber spent $666,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3. In January 2026, Cullumber's application for a patent (\#2 above) was granted. Legal and registration costs incurred were $264,600. The patent runs for 20 years. The manufacturing process will be useful to Cullumber for 10 years. 4. Cullumber incurred $198,400 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. 5. Cullumber incurred $432,000 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of $327,600, is deemed worthless. 6. Cullumber paid Sneed Laboratories $132,080 for research and development work performed by Sneed under contract for Cullumber. The benefits are expected to last six years. Prepare journal entries for Cullumber Corporation on the date of the transaction. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Intangible Assets (To record amount incurred.) Intangible Assets (To record the impairment loss.) No Entry No Entry Prepare journal entry (ies) on December 31, 2026 to record any resulting amortization. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started