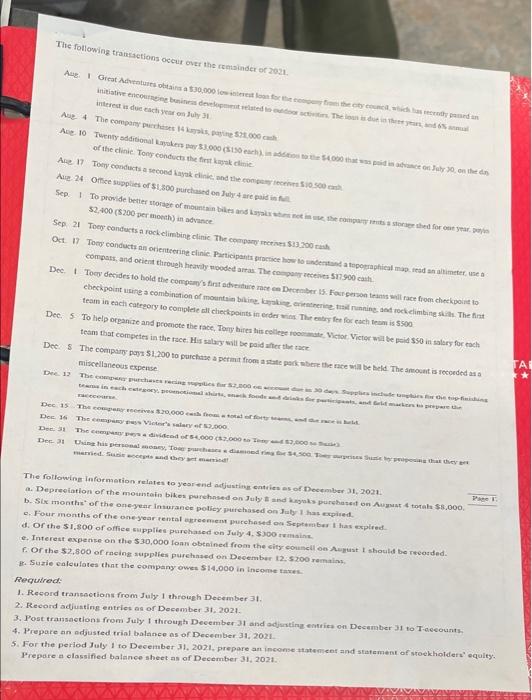

The following transactions occur over the side of 2001 A Great Adventures obtain 10,000 low for the city centre live corren in de scheine est du schon July 31 Aue + The company pues, 57.000 Ace 10 Twenty odditional Layer 1.000 150.000 per on the of the clinic Tons conducts the first A 17 Tory conducts a seconda e con 10.500 ch Aug 24 Office supplies of $1.300 puchon day are paid in Sep To provide better storage of mountain bikes and becomes to shed for one year $2,400 (5200 per month) in advance Sep 21 Tour contacts a rock climbing clinic The com 5:3 200 Oct 17 Tous conducts on orienteering clinic Participants recent porphical map.read an altimeterea composandorint through heavily wooded areas. The company es $17.900 Dee Tomy decides to hold the company's first destuene December is. Forestilace from checkport to checkpoint una combination of mountain bikinking criterin tietoimings. The trom in each category to complete all checkpoints in order with my fee for each team is $500 Dee. 5 To help organize and promote the race, Tonybines his college roommate Victor Victor will be paid sso in story for each team that competes in the race. His will be paid that Dees The companys 51,200 to purchase a permit from a state park where the race will be held. The amount is recorded as a miscellaneous expert Dec 12 The coming 2.000 Dec 15 The 120.000 Dec 16 The Vic.000 De 39 The coded 4.000 12.000 De 3 Une his seal, Tommy The following information relates to year and adjusting entries as of December 31, 2021. a. Depreciation of the mountain bike purchased on July and go purchased on a totale $5,000 Se month of the one year Insurance policy purchased on aty has expired. e. Four months of the one year rental greement purchased on September has expired d. Or the $1.800 of office supplies purchased on July 4.S100 min e. Interest expanse on the $30,000 loan obtained from the city council on August I should be recorded. for the $2.800 of racing supplies purchased on December 12. 5200 ms Suzie calculates that the company ows $14.000 in income awes Required: 1. Record transactions from July 1 through December 31. 2. Record adjusting entries as of December 31, 2021. 3. Post transactions from July 1 through December and adjusting entries on December 31 to Taccounts 4. Prepare an adjusted trial balance as of December 31, 2021 5. For the period July 1 to December 31, 2021. prepare an income statement and statement of stockholders' equity. Prepare a classified balance sheet as of December 31, 2021 The following transactions occur over the side of 2001 A Great Adventures obtain 10,000 low for the city centre live corren in de scheine est du schon July 31 Aue + The company pues, 57.000 Ace 10 Twenty odditional Layer 1.000 150.000 per on the of the clinic Tons conducts the first A 17 Tory conducts a seconda e con 10.500 ch Aug 24 Office supplies of $1.300 puchon day are paid in Sep To provide better storage of mountain bikes and becomes to shed for one year $2,400 (5200 per month) in advance Sep 21 Tour contacts a rock climbing clinic The com 5:3 200 Oct 17 Tous conducts on orienteering clinic Participants recent porphical map.read an altimeterea composandorint through heavily wooded areas. The company es $17.900 Dee Tomy decides to hold the company's first destuene December is. Forestilace from checkport to checkpoint una combination of mountain bikinking criterin tietoimings. The trom in each category to complete all checkpoints in order with my fee for each team is $500 Dee. 5 To help organize and promote the race, Tonybines his college roommate Victor Victor will be paid sso in story for each team that competes in the race. His will be paid that Dees The companys 51,200 to purchase a permit from a state park where the race will be held. The amount is recorded as a miscellaneous expert Dec 12 The coming 2.000 Dec 15 The 120.000 Dec 16 The Vic.000 De 39 The coded 4.000 12.000 De 3 Une his seal, Tommy The following information relates to year and adjusting entries as of December 31, 2021. a. Depreciation of the mountain bike purchased on July and go purchased on a totale $5,000 Se month of the one year Insurance policy purchased on aty has expired. e. Four months of the one year rental greement purchased on September has expired d. Or the $1.800 of office supplies purchased on July 4.S100 min e. Interest expanse on the $30,000 loan obtained from the city council on August I should be recorded. for the $2.800 of racing supplies purchased on December 12. 5200 ms Suzie calculates that the company ows $14.000 in income awes Required: 1. Record transactions from July 1 through December 31. 2. Record adjusting entries as of December 31, 2021. 3. Post transactions from July 1 through December and adjusting entries on December 31 to Taccounts 4. Prepare an adjusted trial balance as of December 31, 2021 5. For the period July 1 to December 31, 2021. prepare an income statement and statement of stockholders' equity. Prepare a classified balance sheet as of December 31, 2021